[ad_1]

One of the crucial frustratingly troublesome ideas to get throughout to starting merchants is that you simply actually don’t must make the method of technical evaluation messy or complicated, in any respect.

One of the crucial frustratingly troublesome ideas to get throughout to starting merchants is that you simply actually don’t must make the method of technical evaluation messy or complicated, in any respect.

Truthfully, this piece of the buying and selling “puzzle” must be the only and best, however for a lot of merchants, it’s the exact opposite…

They begin off with dozens of indicators on their charts, 20 completely different web sites open on their pc, actually making an attempt to investigate lots of of various variables on the identical time. They do all of this to attempt to discover a buying and selling edge; one thing that can present them with a “clue” of what may occur subsequent out there.

Guess what? This buying and selling edge is sitting there proper in entrance of them, hidden beneath the mountain of pointless distractions on their charts. That edge is, after all, value motion evaluation.

So don’t waste your time pondering there’s some “Holy Grail” buying and selling system primarily based on indicators or software program that can flip your pc into an ATM, as a result of (sadly) there isn’t. I can let you know from 18+ years of reside buying and selling expertise, the one factor it’s good to successfully analyze a value chart is your eyes, a pc, and the uncooked value motion knowledge the market provides you for FREE, oh and possibly a whole lot of caffeine.

Nonetheless, in the event you’re nonetheless not satisfied that value motion is really the one factor it’s good to analyze the markets, then possibly considered one of these factors will assist to “knock” some sense into you:

1. Clear vs. Messy

As I clearly illustrated in my value motion tutorial, one of many principal causes to discover ways to learn value motion is in an effort to declutter your charts and commerce in a easy, “bare” method, devoid of complicated and messy indicators.

The buying and selling world is already stuffed with a myriad of conflicting and complicated recommendation, strategies and approaches, so one of many greatest steps you may very simply take that can put you’ll forward of different merchants, is solely to take away all of the “rubbish” out of your charts. Put merely, you do not want to commerce with indicators, in any respect.

I like to recommend EVERY starting dealer begin by studying to obviously map the charts and be taught to hearken to the market by merely studying to interpret and commerce the value motion. Relating to technical evaluation, simplifying the evaluation portion is vital, but most merchants do the exact opposite; they over-complicate it.

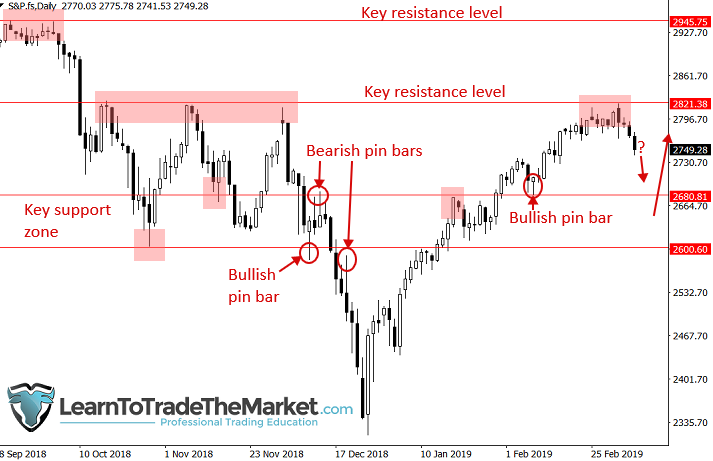

Check out the instance chart beneath, take a look at all of the issues we will see simply from analyzing a BARE indicator-free value chart:

We are able to use the value motion knowledge described above to formulate an anticipatory buying and selling plan, that successfully offers us a “window into the longer term” in order that we will plan our subsequent transfer. Which, as you may see in far proper of the above chart, may contain ready for a pullback to the help zone to search for a value motion purchase sign.

2. No Information is Good Information

One factor that I really feel very strongly about and that’s additionally an enormous good thing about studying to learn value motion, is that by doing so you may ignore the information and all different pointless buying and selling variables. You see, the value motion displays all of the information in addition to all different variables influencing it.

Much less variables to investigate means you may keep away from the “evaluation paralysis” that hurts so many merchants by inflicting them to attempt to absorb an excessive amount of and “make sense of it”. When buying and selling with value motion we actually solely want to fret concerning the 3 principal elements: Development, Ranges and Worth Motion Indicators.

As I wrote in different classes wherein I mentioned why I don’t commerce the information, more often than not when buying and selling information is launched, the precise transfer from it has already occurred. This has to do with the “purchase the rumor promote the very fact” impact that occurs within the markets as merchants and particularly the larger gamers anticipate what’s going to occur when XYZ occasion is launched or takes place. The purpose is, typically, what would appear just like the logical value course on account of a sure information occasion, just isn’t the course it strikes in, however typically it’s. So, to attempt to achieve some “edge” by “predicting” a market transfer primarily based on the information, is really futile, particularly when the value motion already possible tipped you off to the subsequent market transfer, earlier than the information or forward of it.

3. Worth Motion is The Language of Cash

Worth motion offers us the perfect perception into the psychology of these buying and selling the market. The truth is, the value motion we see on a chart is absolutely all simply human psychology enjoying out by way of the markets. What one dealer thinks is an efficient place to purchase is what one other thinks is an efficient place to promote, and so forth. and when extra individuals suppose shopping for is the appropriate transfer, value goes up, or down if extra suppose promoting is the appropriate transfer. Regardless of no matter variables went into these selections, the tip end result is identical: value motion mirrored by way of value bars on a chart. So, reduce out the “center man”, so to talk” (the variables aside from value motion) and be taught to learn the “language” of cash that’s proper there staring you within the face on the charts.

So, if value encompasses all beliefs and views of all market members and any explicit second of time, then studying the value bars on the charts permits us to learn what the market members are saying or making an attempt to say. Let’s take a look at an instance:

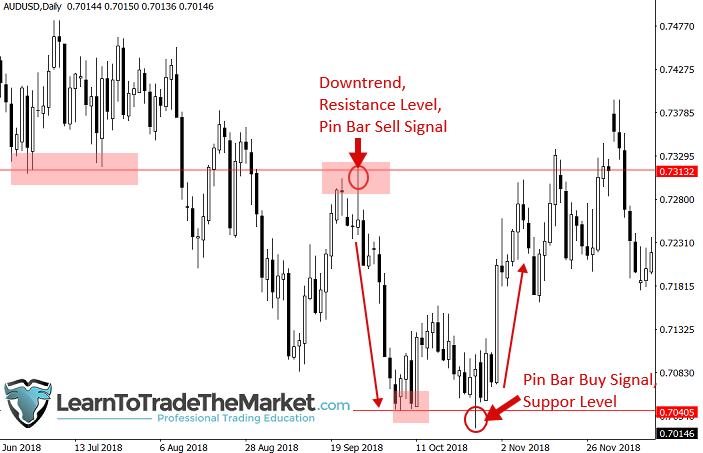

Within the chart beneath, we will see with a bullish pin bar, bears initially pushed value decrease however consumers noticed that as a chance and purchased into that down transfer extra aggressively, leading to a protracted decrease tail or wick, and a bullish pin bar that signifies value might transfer increased quickly. The bearish pin bar exhibits us the other; that sellers gained out and value is now wanting “heavier” or bearish…

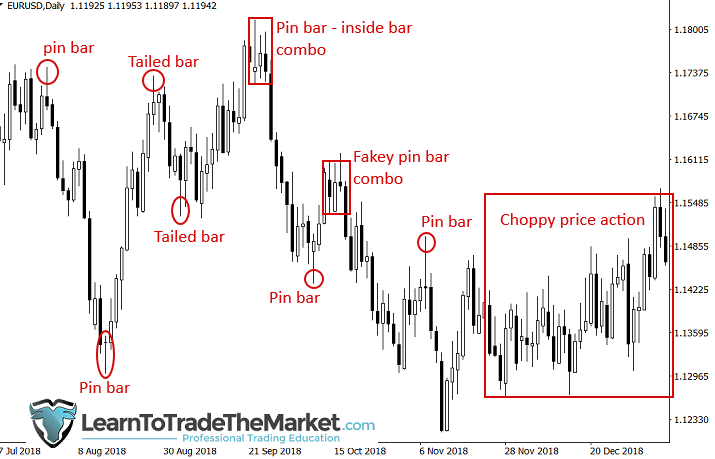

4. Worth Motion Lets Us Establish Clear Buying and selling Indicators and Repeating Patterns

If you know the way to learn the uncooked value motion on the charts you even have a whole buying and selling technique that gives us with an outlined set of entry and threat administration guidelines while offering us with a high-probability edge.

For instance, once you get a transparent pin bar sign at a key chart stage and ideally inside a development, you may have the “Large 3” elements of confluence lined up for you: Development, Degree, Sign or T.L.S. This supplies you with not simply an entry but additionally a threat administration technique “in-built”; you’ll base your cease loss placement at the very least partially on the sign bar in addition to surrounding ranges and your place measurement and revenue goal is about from that.

To get a greater thought of how the T.L.S technique works so simply and successfully, check out the chart beneath:

A easy set of parameters: Development, Degree, and Sign can present us with some very high-probability repeating value motion setups:

Via self-study of charts, it turns into obvious that value motion indicators and different value motion patterns are likely to repeat themselves again and again, throughout time. As soon as we be taught to determine these indicators in real-time and begin to develop dealer’s intestine really feel and instinct, and begin trusting ourselves, these indicators and patterns will start to “come out” at you increasingly. Will probably be nearly as if the market is “speaking” on to you…

5. A Minimalist Strategy is Usually Finest

Minimalism is a lifestyle for some individuals, and it’s one thing I’m very drawn to and attempt to mannequin in my very own life in some ways. Having much less, means you may have much less to fret about, much less issues, much less to consider. Most individuals find yourself shopping for stuff they don’t want and that they find yourself realizing they don’t even need. The outcomes are in: “Stuff” doesn’t make you cheerful. Time, freedom, spending time with family members, not having to fret about cash continuously; this stuff make you cheerful.

What does this need to do with buying and selling? Every thing.

I wrote an article on a minimalist information to buying and selling which it is best to undoubtedly learn. The essential thought of it’s that doing much less; pondering much less, analyzing much less and TRADING LESS is what finally ends up because the catalyst for buying and selling success. You actually want to attenuate your interactions with the market, from what number of trades you enter to how typically you verify on them as soon as they’re reside, to what number of occasions you open your charts. Much less is Extra and it’s the best way you earn cash sooner, belief me.

Conclusion

In my early days of studying how one can commerce, I actually felt like I used to be misplaced, maybe a few of you are feeling the identical method proper now. There’s simply a lot info on the market and far of it I’d name “misinformation”, {that a} starting dealer actually has to have the ability to filter the “good from the unhealthy” fairly effectively to know what’s value spending their time on and what isn’t.

After finding out nearly each indicator and buying and selling system underneath the solar, and realizing they didn’t work as marketed, I lastly got here again to plain and easy value motion buying and selling. I rapidly realized that that is what made essentially the most sense and that I didn’t want all that different “crap” on my charts, which was simply obstructing the REAL view of the market; the value motion.

I’ve been buying and selling with value motion for effectively over 15 years now and it has confirmed itself time and time once more. It’s easy but extremely efficient and it eliminates the necessity to take a look at different variables, as a result of every thing actually is mirrored by way of the value motion, you simply need to know how one can learn it.

The buying and selling tutorials I’ve produced for my college students since 2008 are the precise kind of actual world schooling sources I want I had entry to after I began my buying and selling journey all these years in the past. Should you apply your self and follow the core philosophies of studying value motion, bar by bar, and preserving your total buying and selling methodology easy, then your possibilities of making it on the earth {of professional} buying and selling are elevated considerably.

This weblog and the lots of upon lots of of buying and selling classes I’ve authored, in addition to my Skilled Worth Motion Buying and selling Course are right here that will help you dramatically fast-track your information and allow you to obtain buying and selling success sooner.

Cheers to your future buying and selling success, Nial.

Please Go away A Remark Under With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.

[ad_2]