[ad_1]

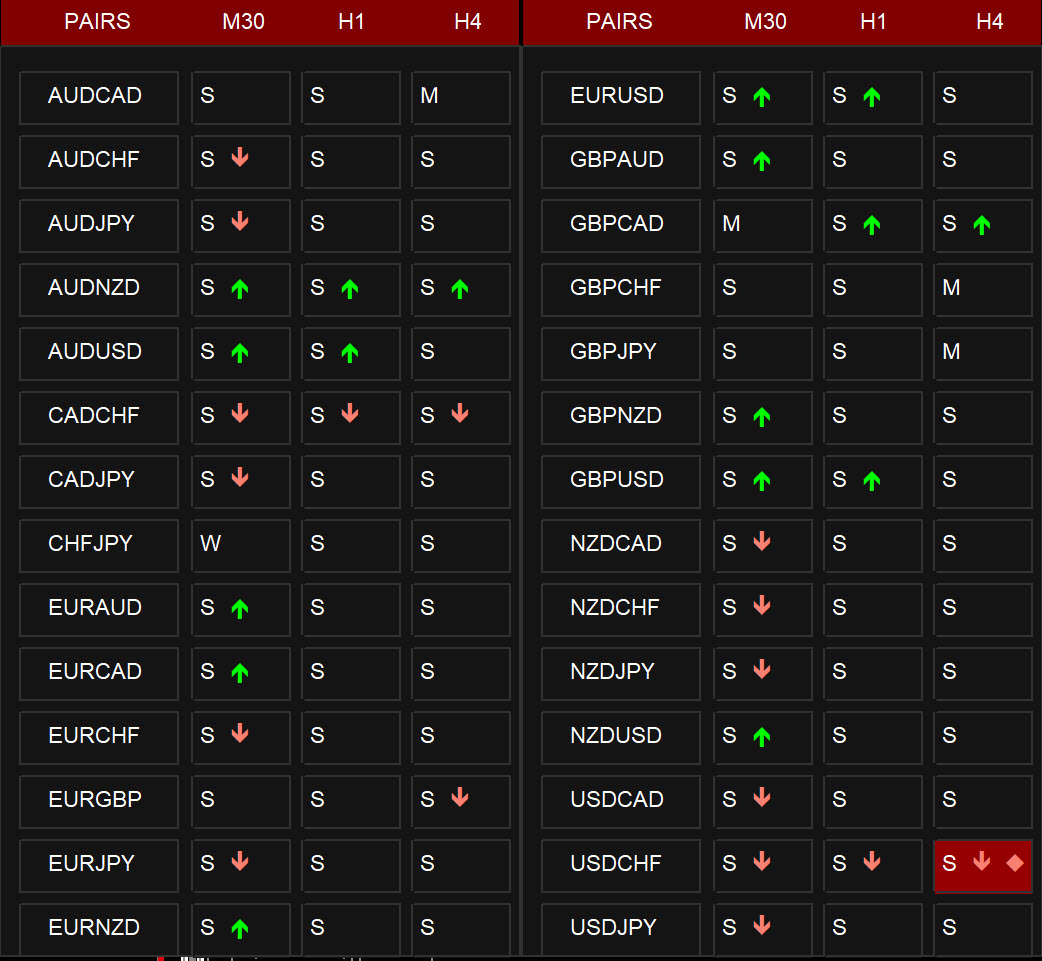

This dashboard reveals you the 3MA Cross Overs present standing for Multi-currency multi-timeframes. Works for Metatrader 4 (MT4) platform.

https://www.mql5.com/en/market/product/124099/

With Development Energy Test:

Further Obtain:

The way it Works:

MA Cross Indicators

It is going to present “S” Inexperienced/Crimson Sturdy Indicators and “M” or “W” Inexperienced/Crimson Medium or Weak indicators.

We have now 3 kinds of MA: Quicker, Medium and Slower MA.

A robust sign is when FasterMA and MediumMA are each above/under SlowerMA.

A medium sign is when solely FasterMA is above/under SlowerMA. MediumMA has nonetheless not crossed it.

A weak sign is when FasterMA has solely crossed MediumMA however not but SlowerMA.

Greater TF Up/Down Arrows:

If increased timeframe align possibility is true, it’s going to examine if given variety of increased timeframes even have MAs aligned giving robust sign.

Development Energy Diamond:

If Development Energy Test is true, it’s going to use trend_power indicator to examine pattern energy and if pattern is powerful, give a purple/inexperienced diamond.

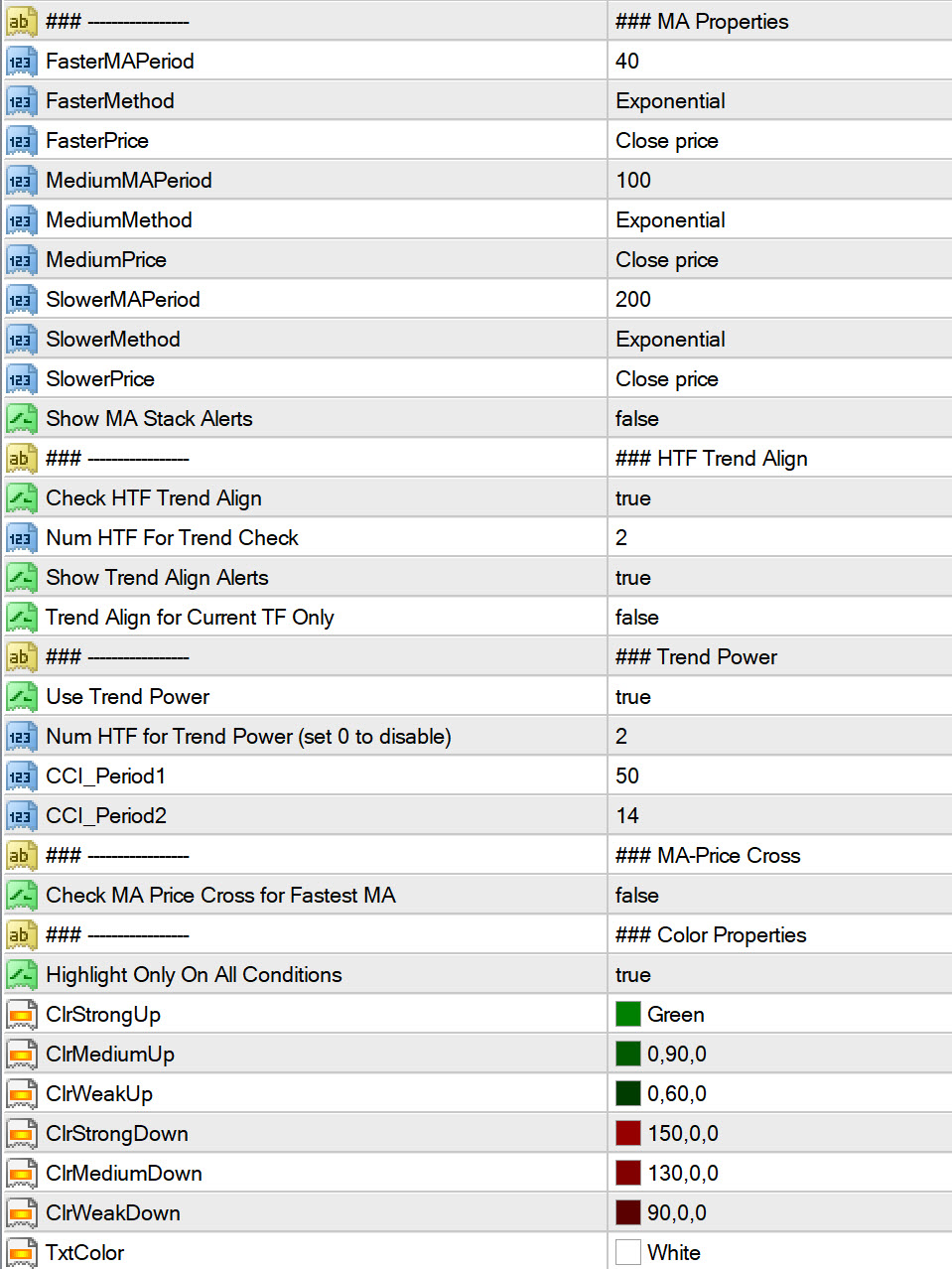

Settings:

You may learn particulars about Dashboard settings right here:

https://www.mql5.com/en/blogs/publish/747456

Listed here are the 3MA Cross Dashboard particular default settings:

Development Align for Present TF Solely:

If true and suppose principal chart is M15, it’s going to solely examine increased timeframes aligned with M15.

If false, it’s going to examine increased timeframe developments aligned with all timeframes you chose within the sprint.

How you can Use:

- When quickest MA crosses medium and sluggish MA.

- And a pair of increased timeframes even have pattern alignment (quickest MA there’s additionally above medium and sluggish MA).

- And Development Energy reveals a excessive pattern

When all situations align, you’ll get a BUY/SELL Sign alert.

Use this Telegram forwarder EA to get screenshot of chart with the template 3MACross.tpl utilized:

https://www.mql5.com/en/blogs/publish/758717

That is the utilized template:

(Observe: All additional indicators and templates are additionally accessible in obtain bundle)

Check out the place the three MAs cross pointed by the Yellow arrow within the determine.

All 3 situations had been met within the dashboard for EURJPY H1. You may specify “3MACross.tpl” in Dashboard “Use Template for New Window”.

Click on on EURJPY H1 and it’ll open up the chart with this template.

Additionally, value has crossed above Pivot stage.

So, now you can place a BUY sign and hold cease loss someplace just a little under the final value low. And Take Revenue about 2-3 instances greater than cease loss.

Additionally, check out a number of the different previous arrows. When Development Energy is low or increased timeframes will not be aligned, then sign won’t be as robust.

So, watch out buying and selling such indicators.

A number of Different Helpful Methods:

3MA Technique could be very helpful to seek out the Sturdy Development path. Nevertheless it must be mixed with different supporting indicators for validation.

Listed here are some helpful 3MA Methods which use 3MA Crossover as base sign and use different indicators as validating indicators.

E.g.: 3MA with Stochastic, with Development Energy, and so forth.

https://www.forexmt4indicators.com/3-simple-moving-average-crossover-forex-trading-strategy/

https://www.netpicks.com/three-moving-average-crossover/

https://www.forexstrategiesresources.com/trend-following-forex-strategies-ii/171-3ma-trend-power/

[ad_2]