[ad_1]

With the brand new monetary yr formally upon us, now’s your probability at a recent begin. This implies it’s time to revisit targets, set intentions, and degree up with a purpose to profit from the following 12 months. A superb place to start out? By optimising your programs and processes to create extra seamless workflows and win again time.

That will help you set off on the best foot, we’ve rounded up a listing of the way to work smarter in Xero. Take what you want from the following pointers and tips to remain on high of your numbers, and keep in mind, your monetary advisor is all the time there for extra assist do you have to want it.

1. Automate information entry with Hubdoc

If you happen to’re trying to save time and streamline information entry, Hubdoc might be the device for you. The info seize software program makes it simple to maintain monitor of payments and receipts and automates the method of coming into them in Xero.

You’ll be able to electronic mail, scan or take pictures of paperwork through the Hubdoc cellular app to retailer in Xero. It is going to then extract key information, like a provider’s title, tax charges, bill numbers, quantities, and due dates. You simply want to inform Hubdoc the way you need to publish the knowledge in Xero to simply match it in your financial institution feed. Plus, Hubdoc helps you go paperless by storing payments and receipts digitally, and in a single central place.

2. Pay invoices quicker with batch funds in Xero

On the subject of paying payments, conventional strategies (like handbook financial institution funds) will be gradual and monotonous, particularly when you must make a number of funds. So, why not attempt batch funds in Xero to hurry up the method?

With batch funds, you may bundle a number of payments into one cost file earlier than importing it into your checking account for processing. You’ll be able to schedule cost dates in Xero and customise what particulars you need to seem on each your financial institution assertion and your provider’s. If their checking account particulars are saved of their contact report, this data will carry throughout routinely. If not, merely enter the account particulars manually the place they’ll be saved for the following time you schedule a batch cost, minimising the necessity for handbook information entry. To study extra, take a look at Xero Central.

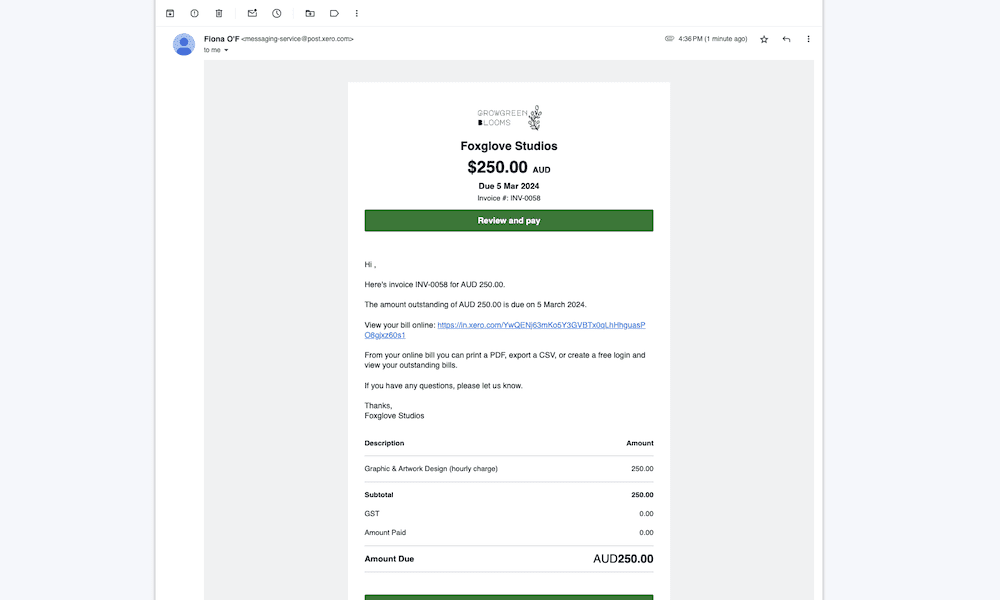

Do you know that as much as 45% of invoices from Kiwi small companies are paid late? A simple technique to minimise this threat in FY25 is by including a ‘Pay now’ button to your on-line invoices. This may give prospects extra methods to pay – be it through credit score or debit card, direct debit, or Apple Pay and Google Pay – as a way to spend much less time chasing funds.

Begin by connecting to your most well-liked cost suppliers. As soon as related, they’ll routinely add to your current Xero branding themes (also referred to as bill templates), or you may handle them straight out of your invoices. One of the best half? On-line bill funds may help you receives a commission as much as twice as quick. Plus, the setup is easy, fast and free.

4. Make data-driven choices with Xero Analytics

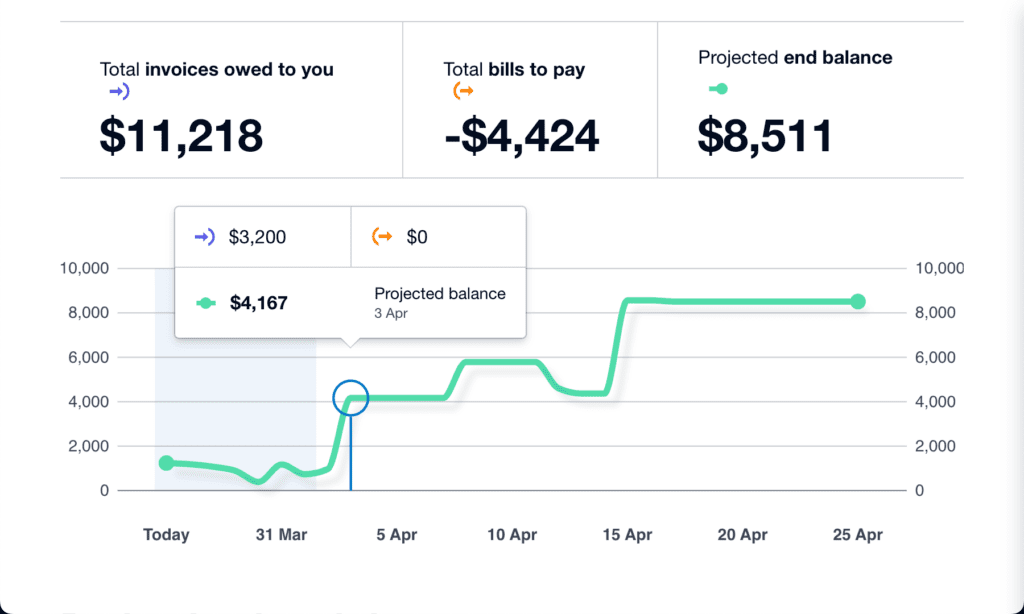

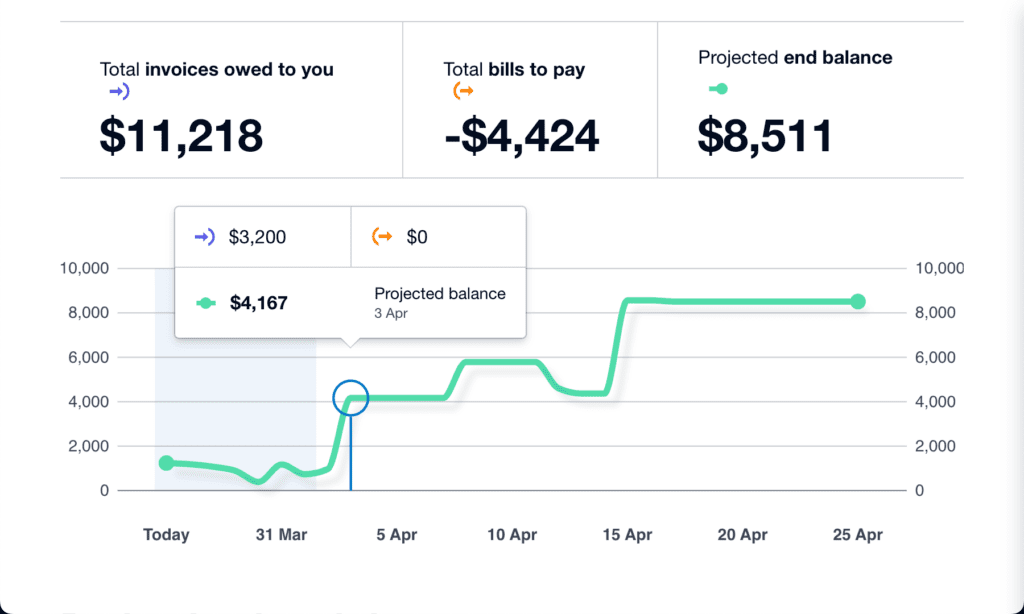

If monitoring money movement wasn’t a precedence final monetary yr, now’s the time to make it a part of your routine. Right here’s the place the Xero Analytics short-term money movement device may help. It attracts on the stability of your chosen financial institution accounts and the upcoming payments and invoices you’ve entered into Xero to generate a money movement projection for the following seven to 30 days. This big-picture view may help you make smarter monetary choices.

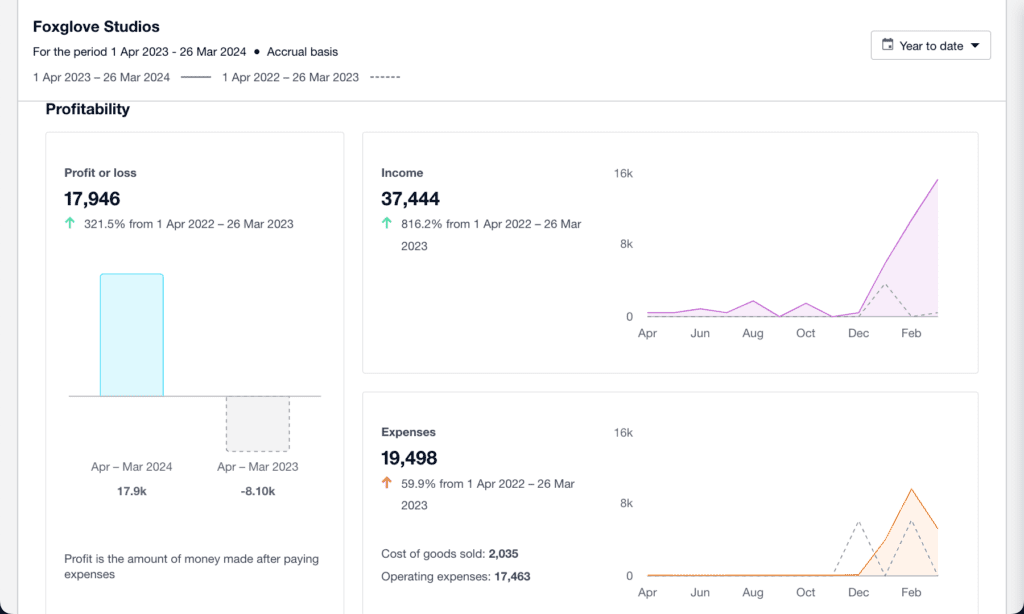

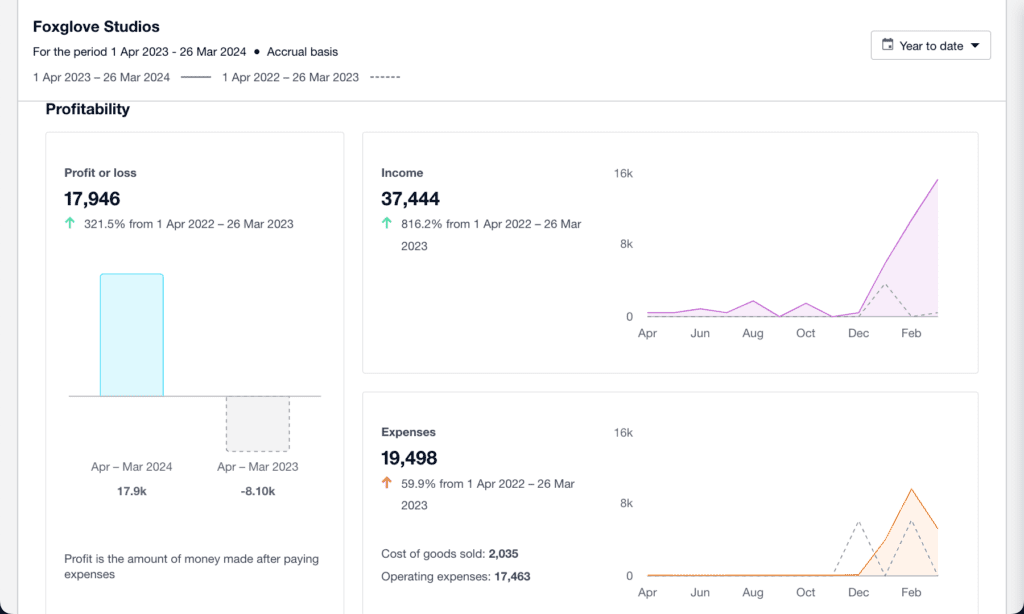

The Enterprise snapshot dashboard is one other device in Xero Analytics for an prompt, one-page overview of your organisation’s monetary wellbeing. It tracks data like profitability, revenue, largest working bills, key monetary metrics, and extra to judge how properly what you are promoting is working as a way to have extra knowledgeable conversations along with your advisor.

If you wish to take your data-driven resolution making to the following degree, there’s additionally Xero Analytics Plus, enabling deeper insights like money movement projections of as much as 90 days, and far more.

5. Streamline reconciliation with financial institution guidelines

To avoid wasting time and minimise errors within the reconciliation course of, contemplate creating financial institution guidelines for recurring money transactions. Whether or not it’s an everyday expense like filling your work automobile with petrol or paying a month-to-month checking account payment, you may create financial institution guidelines which are focused sufficient to determine these transactions, and inform Xero the way you need to code them.

When a transaction comes via your checking account in Xero that matches the financial institution rule’s circumstances, you may reconcile it in only one click on. You too can create financial institution guidelines from current transactions to present you a head begin in setting them up. Helpful, proper?

Try this information for extra methods to win again time this monetary yr. Xero’s EOFY hub additionally has some invaluable sources, webinars and ideas, so be certain to try what’s on supply. Right here’s to creating FY25 your finest yr but!

[ad_2]