[ad_1]

The fintech world has grown quickly lately, because of new applied sciences and altering client expectations. Conventional monetary establishments aren’t the gatekeepers anymore—fintechs are shifting quicker and providing smarter, customer-focused options.

On the coronary heart of this shift is massive knowledge. The quantity of knowledge generated each second presents fintech corporations with an enormous alternative. With superior analytics, they will acquire deeper insights and make higher, quicker, and extra predictive choices.

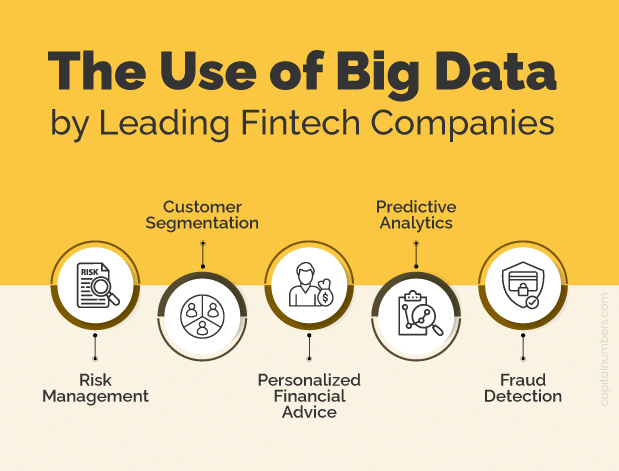

On this weblog, we’ll break down how massive knowledge is shaping fintech. From bettering danger administration and buyer segmentation to offering customized monetary recommendation and detecting fraud, massive knowledge is altering the way in which finance works. Welcome to the period of data-driven, tech-powered finance.

Understanding Large Information in Fintech

Large knowledge in fintech comes right down to what I name the 5 Vs:

- Quantity: Fintech offers with large quantities of knowledge, and it’s solely rising.

- Velocity: This knowledge isn’t simply massive—it’s coming in quick, and processing it shortly is a should.

- Selection: From structured knowledge like transactions to unstructured knowledge like social media, the various kinds of knowledge are essential.

- Veracity: Not all knowledge is nice knowledge. Ensuring you’re working with correct knowledge is a problem however a crucial one.

- Worth: The actual energy of huge knowledge lies within the insights you possibly can pull from it.

Fintech corporations are like engines, consistently pulling in knowledge from everywhere in the digital world:

- Buyer transactions: Each bank card swipe or on-line fee generates knowledge that fintechs can analyze for insights.

- Social media: Person habits, market traits, and sentiment are all hidden in each tweet and submit.

- Third-party knowledge: Credit score scores and market analysis are only a few examples of exterior knowledge fintechs use to create fuller buyer profiles.

- IoT units: From wearables to sensible units, fintech can now faucet into real-time knowledge streams for analytics.

This knowledge provides fintech corporations the sting to make higher choices, quicker.

Test Out This Case Examine: Information Science App Empowering Enterprise Capitalists to Discover Excessive-Worth Startups

How is Large Information Analytics Driving Innovation in Fintech?

In fintech, massive knowledge analytics isn’t only a software—it’s the engine fueling a brand new period of monetary providers. Right here’s how high fintech corporations are utilizing massive knowledge to reshape all the pieces from danger administration to buyer expertise.

1. Threat Administration:

In a world of prompt transactions and credit score choices, danger administration is getting a significant improve:

- Credit score danger evaluation: Conventional credit score scoring is outdated. Fintechs now use massive knowledge to evaluate creditworthiness in ways in which go far past previous fashions.

- Fraud detection: Machine studying spots fraud earlier than it occurs, figuring out patterns people would miss in huge knowledge streams.

- Market danger evaluation: Fintechs can monitor market traits in real-time, flagging dangers earlier than they develop into massive issues.

2. Buyer Segmentation:

Large knowledge is shifting fintech past one-size-fits-all advertising:

- Figuring out segments: With massive knowledge, fintechs group prospects by habits, preferences, and demographics—providing deeper insights than conventional strategies.

- Tailoring merchandise: Personalised, data-driven monetary merchandise are the longer term, and fintechs are creating choices that match every section completely.

3. Personalised Monetary Recommendation:

We’ve entered the age of customized finance, powered by massive knowledge and AI:

- Robo-advisors: Algorithms now act as monetary planners, providing automated recommendation tailor-made to particular person targets and danger profiles.

- Personalised suggestions: Fintechs use massive knowledge to recommend the best product on the proper time, completely matching buyer preferences.

4. Predictive Analytics:

Fintechs are turning into predictive powerhouses:

- Forecasting traits: Historic knowledge and machine studying assist fintechs predict future market actions with precision that was unthinkable only a few years in the past.

- Predicting habits: Fintechs are utilizing knowledge to anticipate buyer actions, realizing what they need earlier than they do.

5. Fraud Detection:

Fraud doesn’t take a break, and neither do fintech programs designed to cease it:

- Anomaly detection: Large knowledge flags uncommon habits that might sign fraud, a game-changer for fintech.

- Machine studying fashions: Fintechs are constantly bettering their fraud detection fashions, studying from previous knowledge to remain one step forward.

- Actual-time monitoring: Reactive fraud administration is a factor of the previous—right this moment’s fintechs monitor transactions in real-time, catching fraud because it occurs.

The underside line? Large knowledge isn’t simply serving to fintechs keep afloat—it’s giving them the instruments to thrive. By leveraging knowledge analytics, fintechs are making smarter choices, decreasing danger, and providing customized providers that conventional banks can solely dream about.

Test Out This Case Examine: Information Science App Empowering Enterprise Capitalists to Discover Excessive-Worth Startups

Large Information Analytics Instruments and Applied sciences

In fintech, knowledge isn’t only a useful resource—it’s the spine of innovation. To unlock the total potential of huge knowledge, fintech corporations want the best instruments and applied sciences to course of, analyze, and visualize large datasets. Right here’s how the highest gamers are making it occur.

In style Large Information Instruments and Frameworks

Fintech runs on knowledge, and these massive knowledge instruments are the engines behind the scenes:

- Hadoop: Consider Hadoop because the heavy lifter for distributed computing. It handles large datasets throughout clusters of computer systems, making massive knowledge manageable.

- Spark: When velocity issues, Spark is the go-to. This quick computing framework handles all the pieces from real-time knowledge to machine studying, giving fintechs the pliability they want.

- Kafka: Actual-time knowledge is essential in fintech, and Kafka is the platform that processes it. Whether or not it’s fraud detection or reside analytics, Kafka retains the information flowing.

- NoSQL databases: Neglect the previous relational databases. Fintechs take care of unstructured, large-scale knowledge, and NoSQL choices like MongoDB and Cassandra are constructed for that.

- Machine studying libraries: AI is reshaping fintech, and libraries like TensorFlow, PyTorch, and Scikit-learn flip knowledge into actionable intelligence. These instruments energy predictive fashions, personalization, and automation.

Cloud-Primarily based Large Information Platforms

The cloud is now important for scalable, on-demand massive knowledge processing. Right here’s the place fintech leaders flip for cloud muscle:

- Amazon Internet Companies (AWS): From EMR to Redshift and Kinesis, AWS affords fintechs the instruments to course of and analyze massive knowledge at scale.

- Google Cloud Platform (GCP): With options like BigQuery and Dataflow, GCP supplies high-performance analytics, serving to fintechs run highly effective queries in actual time.

- Microsoft Azure: Azure’s HDInsight, Databricks, and Synapse Analytics give fintechs the flexibility to course of massive datasets and run superior analytics easily.

Information Visualization Instruments

Information with out insights is simply noise. These visualization instruments flip uncooked knowledge into actionable insights:

- Tableau: Fintechs use Tableau to construct interactive dashboards and experiences, permitting groups to see traits and patterns as they occur.

- Energy BI: Microsoft’s Energy BI turns uncooked knowledge into visible tales, making it simpler for fintech corporations to see the larger image.

- Python libraries: For customized visualizations, Python libraries like Matplotlib and Plotly permit fintechs to create all the pieces from easy charts to complicated visible representations.

The fintech revolution is powered by knowledge, and data-driven monetary software program growth is the gas driving it. Through the use of the best applied sciences, fintechs can course of large datasets, uncover invaluable insights, and make smarter choices that preserve them forward of the competitors. Welcome to the way forward for finance, the place knowledge is the foreign money, and know-how is the important thing to staying forward.

Unlock the total potential of your knowledge. Our knowledge engineering providers can assist you extract invaluable insights and drive innovation. Schedule a session to debate your particular wants.

Large Information Analytics in Fintech: Challenges and Alternatives

Large knowledge is the engine driving fintech innovation, however navigating this data-driven world comes with its personal set of challenges. From making certain knowledge high quality to staying forward of traits, right here’s how fintechs can flip these hurdles into alternatives.

- Information High quality: In fintech, unhealthy knowledge results in unhealthy choices. Accuracy and consistency are non-negotiable. Fintechs want strong knowledge cleansing and validation processes to get the dependable insights that drive sensible providers.

- Information Privateness: Fintechs deal with large quantities of delicate buyer data, so defending that knowledge is a high precedence. It’s not nearly assembly rules like GDPR and CCPA—it’s about constructing buyer belief. Robust safety measures are essential to safeguarding knowledge in an period of frequent breaches.

- Scalability: As knowledge volumes develop, fintechs want scalable options to handle the load. Cloud-based platforms and distributed computing frameworks like Hadoop and Spark are important for dealing with massive knowledge and delivering real-time insights.

- Expertise Scarcity: Discovering expert knowledge scientists is hard, and the demand retains rising. Sensible fintechs are investing in coaching applications to upskill their groups and keep forward.

Future Tendencies and Alternatives

- AI and Machine Studying: The mixture of AI and large knowledge is the place the true breakthroughs occur. Machine studying permits fintechs to automate decision-making, acquire deeper insights, and ship hyper-personalized providers at scale.

- Actual-time Analytics: In fintech, velocity issues. Actual-time knowledge processing allows corporations to make prompt choices, whether or not it’s approving a mortgage, catching fraud, or responding to market adjustments on the fly.

- Edge Computing: Processing knowledge nearer to the supply improves efficiency and reduces latency. With IoT and linked units on the rise, fintechs can leverage edge computing to enhance providers like funds and fraud detection.

- Explainable AI: Belief in AI is essential in finance. Explainable AI fashions, which make choices extra clear, can increase buyer confidence and meet regulatory necessities.

- Moral Concerns: As AI turns into extra integral to fintech, addressing moral points like knowledge privateness, bias, and equity is crucial. Fintechs that construct moral AI programs will set themselves aside and lead the way forward for finance.

By tackling these challenges and embracing rising traits, fintech corporations can unlock the total energy of huge knowledge analytics. The way forward for finance isn’t nearly crunching numbers—it’s about making smarter, quicker, and extra moral choices. The fintechs that get this proper will drive innovation and set the tempo for your entire trade.

You Might Additionally Learn: AI-Powered FinTech: The Way forward for Monetary Software program Improvement

Conclusion

Large knowledge analytics is not only a bonus for fintech corporations—it’s the engine driving innovation and progress. The fintech corporations that absolutely harness the ability of huge knowledge will form the way forward for monetary providers. Right here’s why:

- Improved danger administration: Large knowledge helps fintechs establish dangers quicker and mitigate them extra successfully.

- Enhanced buyer expertise: Personalization is vital. With knowledge, fintechs can provide tailor-made services and products that align completely with buyer preferences.

- Aggressive benefit: In a crowded market, being data-driven is the differentiator. Fintechs that leverage massive knowledge will make smarter, quicker choices, staying forward of the competitors.

- Innovation at scale: The true energy of huge knowledge lies in creating services and products that didn’t exist earlier than—turning insights into groundbreaking improvements.

For fintech corporations, the trail ahead is evident: embrace massive knowledge analytics or danger falling behind. By investing in the best infrastructure, expertise, and instruments, you possibly can unlock the total potential of your knowledge and lead the following wave of monetary innovation.

The way forward for fintech is data-driven, and those that perceive its potential would be the ones defining what comes subsequent.

[ad_2]