The US Greenback Index (DXY) displays the dynamics of adjustments within the worth of the US forex within the world monetary markets. On this article, we’ll find out how the index is calculated, discover its historic tendencies, study the components influencing its actions, and current doable methods for evaluation and funding.

You’ll be able to go to the RoboForex Market Evaluation webpage for the most recent Indices forecasts.

What’s DXY?

DXY or USDX tickers denote the index of the US greenback, which is the official forex of the US and serves as the worldwide reserve forex in worldwide commerce and monetary markets.

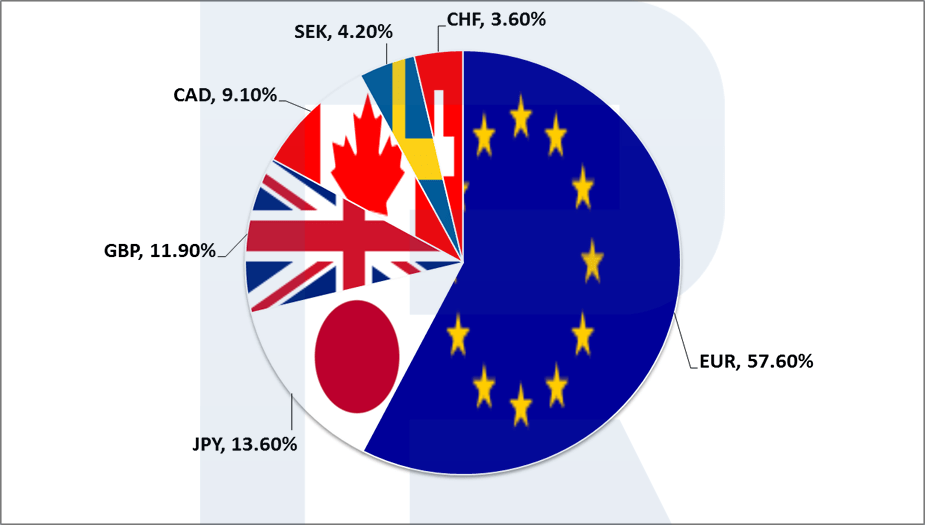

It’s a composite measure of the worth of the USD relative to a basket of six main currencies of serious US buying and selling companions, particularly the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Greenback (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). The DXY has a base worth of 100.00.

How the DXY index is calculated

The worth of the US Greenback Index is set by calculating a weighted geometric imply of the USD trade charge towards the basket of foreign exchange, with every having a special weight:

- EUR – 57.6%

- JPY – 13.6%

- GBP – 11.9%

- CAD – 9.1%

- SEK – 4.2%

- CHF – 3.6%

The DXY index will increase when the USD trade charge rises in comparison with different currencies, and it decreases when the US forex trade charge drops.

DXY historic perspective and knowledge

Understanding the trajectory and nuances of the DXY requires a deep dive into its previous. By analysing the historic context of the Greenback Index, we are able to acquire insights into its present positioning and potential future path.

Origin and evolution of the DXY

The US Greenback Index, popularly referred to as the DXY, is a measure that represents the worth of the US greenback in comparison with a basket of six vital world currencies. Established in 1973, the DXY has since grow to be a benchmark for gauging the worldwide worth of the US greenback.

The beginning of the DXY coincided with the breakdown of the Bretton Woods system, a framework that had been in place because the finish of World Conflict II and pegged main world currencies to the USD (with the US greenback itself pegged to gold). With the collapse of this method, there was an imminent want for a metric that might effectively gauge the power or weak spot of the greenback towards different main currencies, which led to the creation of the DXY.

The index began with a base of 100, which means that if the DXY reads 120 at this time, the USD’s worth has appreciated by 20% since its initiation in 1973. Conversely, a studying of 80 would point out a 20% depreciation.

All through its existence, the DXY has undergone periodic evaluations and adjustments when it comes to the weightage of the constituent currencies, although the core set of currencies has remained largely constant.

Vital historic shifts and their causes

The trajectory of the DXY through the years is a testomony to the assorted financial, political, and monetary occasions which have formed the worldwide financial panorama. A few of the most notable shifts within the DXY worth have been:

- Mid-Nineteen Eighties appreciation: the Plaza Accord in 1985 was a serious settlement among the many G5 nations (France, Germany, Japan, the UK, and the US) to depreciate the US greenback towards the Japanese Yen and the German Deutsche Mark. The rationale behind this settlement was the massive commerce deficit of the US. This intervention led to a major dip within the DXY

- Late Nineteen Nineties surge: this period noticed the US economic system thriving, with speedy technological developments and progress within the tech sector resulting in the dot-com growth. The sturdy financial efficiency and capital inflows made the DXY contact new highs

- 2008 financial crisis: the worldwide monetary meltdown triggered by the housing bubble burst within the US had vital ramifications for the DXY. Initially, there was a flight to security, inflicting the greenback to understand. Nevertheless, because the severity of the disaster turned evident, and central banks worldwide began slashing rates of interest, the DXY skilled substantial volatility

- Submit-2015 depreciation: within the aftermath of the 2008 disaster, the Federal Reserve launched into a sequence of quantitative easing programmes. It was solely round 2015 that the Fed started to normalise its insurance policies, resulting in a relative weakening of the US greenback in anticipation

- 2022 surge: because the starting of 2022, the Federal Reserve has initiated a financial tightening coverage amid the top of the Covid-19 pandemic. Moreover, the Russian invasion of Ukraine and the vitality disaster performed a job within the strengthening of the USD

Elements influencing the DXY

Financial indicators

Political situations

- Presidential and congressional elections

- Speeches and feedback from political leaders

- Speeches and feedback from Federal Reserve officers

- Debates and choices on the nationwide debt ceiling

- Political scandals

World crises and their influence

The US greenback, as the worldwide reserve forex, tends to strengthen throughout disaster developments and inventory market declines. Subsequently, the DXY index additionally strengthens when rates of interest rise, as worldwide buyers understand the USD as a safe-haven asset for preserving and rising their capital throughout difficult instances.

Methodologies for DXY forecasting

The US Greenback Index can be utilized each for short-term DXY buying and selling and long-term investing. It’s unimaginable to purchase or promote the index immediately since that is only a calculated worth, however it could actually function steering when buying and selling varied monetary devices. Elementary evaluation, technical evaluation, or indicator evaluation can be utilized to make a buying and selling resolution.

Elementary evaluation

When making buying and selling choices, this method addresses fundamentals such because the Fed’s coverage, financial statistics, and the present state of affairs in world monetary markets. This can be each short-term buying and selling on vital information and long-term investing based mostly on adjustments within the US regulator’s financial coverage.

Instance:

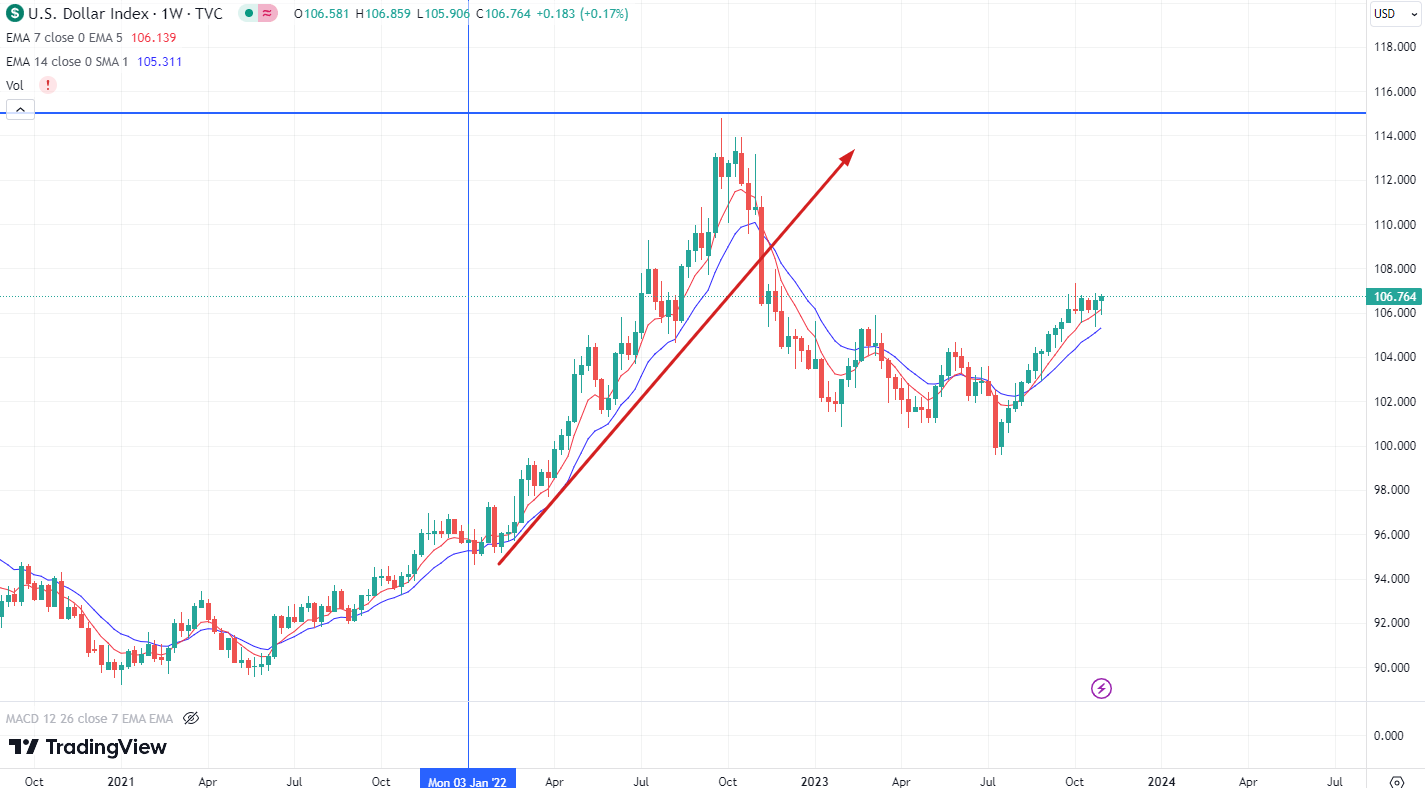

- The US Federal Reserve has been tightening its financial coverage since 2022 to fight rising inflation. With rate of interest hikes being a constructive issue for the US greenback, the DXY confirmed vital progress in 2022, climbing from about 95.00 to 115.00

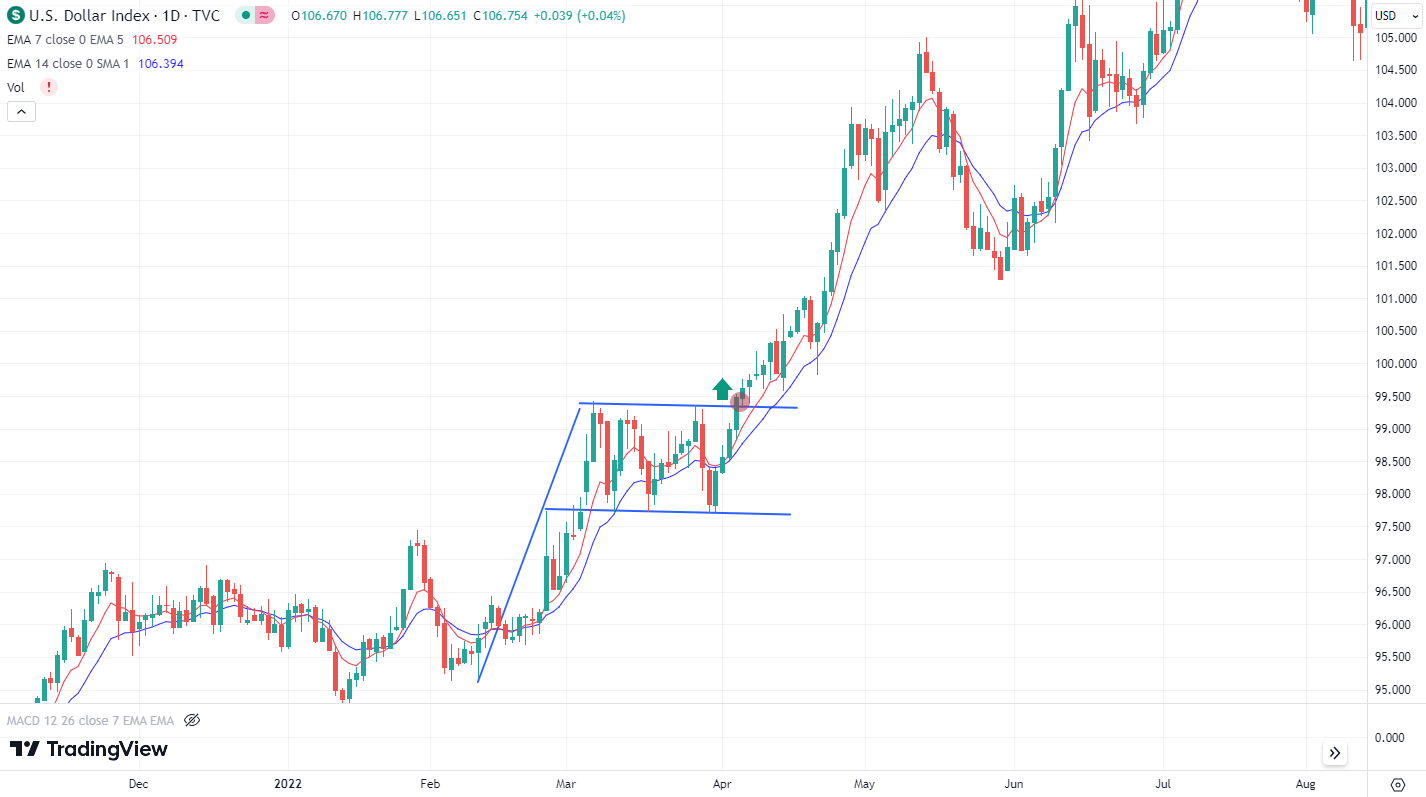

Technical evaluation

Technical evaluation entails assessing historic market knowledge, primarily costs and transaction volumes, to forecast future value actions. This technique implies that the value displays the complete present market info, which is why it focuses primarily on a value motion, not on the explanations behind any adjustments.

Offers are based mostly on the DXY chart evaluation. For this function, classical technical evaluation is used together with varied proprietary strategies such because the Elliott wave idea and methods of Linda Raschke, Invoice Williams, and different well-known merchants. Value patterns, candlestick mixtures, and Value Motion patterns may additionally be used for buying and selling.

Instance:

- In March-April 2022, throughout an energetic rise within the index, a Flag continuation value sample shaped on the every day chart

- When the value closed above the higher sample line, this was a sign to purchase, which was confirmed by additional value progress

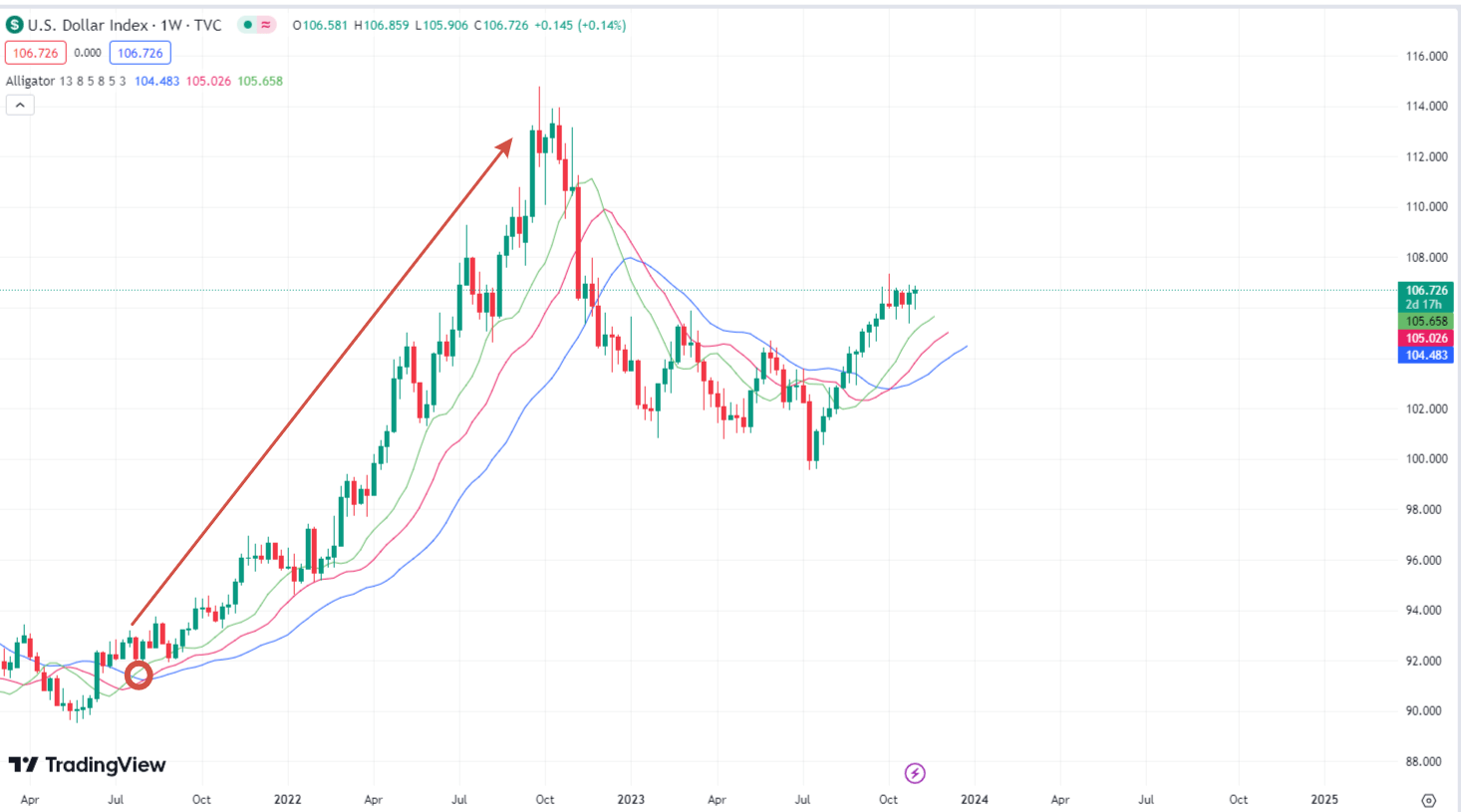

Indicator evaluation

Quite a lot of buying and selling indicators can be utilized to analyse and seek for buying and selling options involving the DXY. The widespread follow is to take one compound built-in indicator or a number of easy indicators. They’ll even assist automate buying and selling, creating particular algorithms – buying and selling advisors.

Instance:

- We use a preferred Alligator pattern indicator

- Amid a recovering economic system, in 2021 the W1 chart shaped a sign to purchase an asset by the index: the indicator strains crossed one another and reversed upwards

- Sooner or later, the index quotes continued to rise

DXY index efficiency: the power of the USD displays the Federal Reserve’s charge hike cycle

The US Federal Reserve has been taking energetic measures in latest instances to fight inflation by tightening financial insurance policies. Since 2022, the rate of interest has step by step risen from 0.25% to five.5%, the best worth for 22 years. The rate of interest hike cycle had a major influence on the US Greenback Index, which skilled constant progress in 2022, rising from about 95.00 to 115.00.

In 2023, the DXY exhibits blended sideways efficiency. It began the 12 months close to the 103.50 mark, hit a excessive of 105.88 later, after which corrected downwards, pushed by considerations over a possible recession within the US. When drafting this text on 31 October 2023, the quotes have been on the rise, hovering round 106.71. In case of additional rate of interest hikes within the US and no indicators of a recession, the index quotes in 2024 could attain the 2022 excessive of 115.00.

DXY reside chart

DXY forecast for 2024

Within the quick run, DXY forecasting will depend on upcoming financial occasions, world sentiments, and adjustments in financial insurance policies altogether. Provided that the monetary panorama can change quickly in the course of the 12 months, beneath are some ideas and forecasts for the DXY for the subsequent 12 months.

- Specialists on the Financial system Forecast Company (EFA) count on the DXY charge to be 101.34 by the top of 2024

- The Pockets Investor portal predicts that the index could rise to 113.51 by the top of 2024

- Based on the forecast of information aggregator Buying and selling Economics, the index will attain 111.74 by the top of 2024

How you can use DXY forecasting

The DXY forecast shouldn’t be merely a speculative device however holds vital pragmatic worth for varied stakeholders within the monetary world. Understanding the potential trajectory of the USD in comparison with a gaggle of different main currencies can inform choices starting from funding methods to financial coverage. Let’s discover how totally different entities can utilise DXY forecasting.

For Buyers

Portfolio Diversification: By predicting the power or weak spot of the USD, buyers could make knowledgeable choices on asset allocation, making certain they’ve a mixture of property that may stand up to potential forex fluctuations.

International Investments: If the DXY is predicted to weaken, investments in overseas property may supply higher returns when transformed again to USD. Conversely, a strengthening DXY would possibly favour home investments or these in dollar-denominated property.

Hedging Methods: Predicting the motion of the DXY may help buyers hedge their portfolios towards forex dangers. For example, if the DXY is forecasted to say no, buyers would possibly take into account investing in property which might be inversely correlated to the greenback.

For Merchants

Foreign money Buying and selling: Foreign exchange merchants can utilise DXY forecasts on to commerce the USD towards different currencies. Predictions on the index’s motion can information purchase or promote choices.

Commodities Buying and selling: Many world commodities, like oil, are priced in {dollars}. A forecasted rise within the DXY would possibly trace at potential declines in commodity costs and vice versa.

Technical Methods: Brief-term merchants, particularly those that depend on technical evaluation, can use DXY forecasts to substantiate or problem their chart-based predictions, incorporating basic insights into their methods.

Danger Administration: By maintaining a tally of the anticipated trajectory of the DXY, merchants can place cease losses, take income, and handle their leverage extra successfully, defending their positions from sudden shifts.

FAQ

The DXY, generally referred to as the US Greenback Index, is a measure of the worth of the USD relative to a gaggle of six main world currencies: the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Greenback (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). The significance of the DXY lies in its illustration of the US greenback’s power and total standing within the world economic system. Monitoring the DXY can present insights into world financial well being, commerce balances, and potential shifts in worldwide capital flows.

The DXY index is a weighted geometric imply of the USD’s worth towards the six main world currencies talked about earlier. Every forex is assigned a selected weight based mostly on its significance and relevance in worldwide commerce and finance. The most important weight is given to the Euro, adopted by the Yen, Pound, and so forth. The index was initially set to 100.000 in its base 12 months of 1973, and its worth fluctuates based mostly on the relative power of the US greenback towards the basket of currencies.

The DXY serves as a benchmark for the USD’s power. When the DXY rises, this is a sign that the USD is strengthening in comparison with the opposite main currencies within the basket. Conversely, when it falls, it suggests a weaker USD. As many commodities (like oil and gold) are priced in US {dollars}, a stronger greenback can imply increased commodity costs for nations utilizing different currencies.

You could find detailed details about it within the article. Briefly, a number of components can affect the DXY: rates of interest, main financial indicators (GDP, employment, and inflation charges), political points, market volatility, and commerce balances.

Sure, the DXY is usually a worthwhile device for Foreign exchange merchants. Because it displays the USD’s power towards a basket of main currencies, it can provide merchants insights into broader market tendencies.

* – The TradingView platform provides the charts on this article, providing a flexible set of instruments for analyzing monetary markets. Serving as a cutting-edge on-line market knowledge charting service, TradingView permits customers to have interaction in technical evaluation, discover monetary knowledge, and join with different merchants and buyers. Moreover, it supplies worthwhile steering on the right way to learn foreign exchange financial calendar successfully and affords insights into different monetary property.