[ad_1]

On 27 December 2023, we examined the well-known Dow Jones inventory index, exploring the components influencing its dynamics and assessing the size of its progress in 2023. We carried out a technical evaluation of the Dow Jones chart and reviewed analysts’ forecasts relating to its prospects for quotes in 2024.

You may go to the RoboForex Market Evaluation webpage for the most recent Indices forecasts.

Complete overview of the Dow Jones index

The Dow Jones Industrial Common Index (DJIA, US 30) is likely one of the main and oldest inventory indices within the US. It was created in 1896 by journalist and Wall Road Journal editor Charles Dow and his enterprise companion Edward Jones.

The Dow Jones index tracks the inventory dynamics of the 30 largest US corporations relating to market capitalisation. Moreover, these enterprises exhibit excessive inventory values and excessive ranges of trustworthiness. To be included within the DJIA listing, an organization should conduct a good portion of its financial exercise within the US, and its shares have to be traded on the NASDAQ or NYSE. The index’s composition is periodically reviewed and permitted by a particular committee.

In-depth evaluation: prime 7 influential shares within the Dow Jones

To find out the worth of the Dow Jones Industrial Common Index, a price-weighted common calculation is employed, utilising the Dow adjustment issue. This technique assigns extra weight to corporations with excessive inventory costs, giving their inventory worth modifications extra affect on the prevailing index quotes. In line with Slickcharts knowledge as of twenty-two December 2023, the highest seven weight leaders within the index are:

| No | Firm | Index Weighting | Value in USD |

| 1 | Unitedhealth Group Inc. (NYSE: UNH) | 9.17% | 520.40 |

| 2 | Goldman Sachs Group Inc. (NYSE: GS) | 6.70% | 381.34 |

| 3 | Microsoft Company (NASDAQ: MSFT) | 6.60% | 374.71 |

| 4 | House Depot Inc. (NYSE: HD) | 6.14% | 349.45 |

| 5 | McDonald’s Company (NYSE: MCD) | 5.14% | 293.00 |

| 6 | Caterpillar Inc. (NYSE: CAT) | 5.11% | 295.60 |

| 7 | Amgen Inc. (NASDAQ: AMGN) | 5.00% | 282.42 |

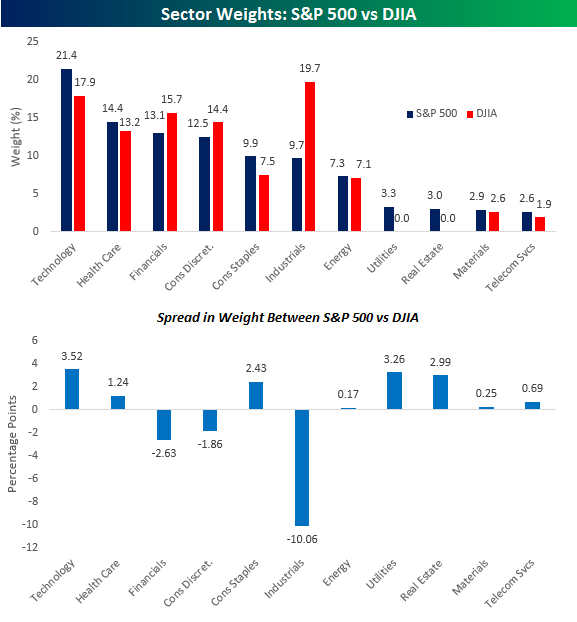

Sector breakdown: understanding Dow Jones’ firm distribution

- Know-how – 17.9%

- Healthcare – 13.2%

- Financials – 15.7%

- Client Discretionary – 14.4%

- Client Staples – 7.5%

- Industrials – 19.7%

- Power – 7.1%

- Fundamental Supplies – 2.6%

- Telecommunications – 1.9%

2023: a retrospective take a look at the Dow Jones index

In 2023, the Dow Jones Common Index demonstrated spectacular progress: originally of the yr, the quotes crossed the 33,150-point mark and reached 37,641 factors on 22 December. Notably, the earlier excessive set on 5 January 2022 stood at 36,953 factors.

Stability within the US financial system, the Federal Reserve’s success in controlling again inflation, and the anticipated rate of interest lower helped traders overcome their fears of a potential recession, enabling them to proceed investing in shares of main corporations. The first query now could be whether or not this strong inventory market rally will persist in 2024.

Progress of the Dow Jones index in 2020 – 2023*

Financial indicators shaping the Dow Jones

- The Fed’s financial coverage. Adjustments within the rate of interest can affect corporations’ expenditures and their method to borrowing, subsequently impacting index quotes

- World financial progress. Sustained progress on the planet financial system usually boosts manufacturing and consumption, positively affecting the income and inventory costs of corporations listed within the index

- US financial indicators. A rise in important US financial indicators such because the GDP, the unemployment fee, industrial manufacturing output, and retail gross sales positively influences the US 30 index

- Monetary studies of corporations. Sturdy quarterly and yearly outcomes for Dow Jones corporations can drive up their inventory costs, creating beneficial situations for index progress

- Necessary home occasions. As an illustration, tax reforms or regulatory modifications can considerably influence the inventory market and, consequently, the index

- World geopolitical occasions. For instance, army conflicts can result in the rupture of commerce agreements and disruption of provide chains, inflicting elevated uncertainty and volatility in monetary markets

- Commodity costs. This usually issues the index companies, the share values of which depend upon commodity costs

- Market sentiment and investor behaviour. Speculative exercise, for instance, can strongly affect the dynamics of index quotes

Technical deep dive: Dow Jones index evaluation

Following a downward correction in 2022, Dow Jones quotes skilled a gradual uptrend in 2023. Having began the yr round 33,150 factors, in December, the index surpassed the historic most of 36,953 factors recorded in 2022. Supported by the Alligator and SMA (200) indicators, robust upward momentum persists on the time of writing, emphasising uptrend stability.

After hitting a brand new all-time excessive, the quotes hover at 37,545 factors. The earlier most worth of 36,953 factors presently acts as a assist stage. The value will possible endure a slight correction and take a look at this stage within the quick run.

If the index quotes fail to interrupt it, an upward rally could proceed, with the worth often reaching new all-time highs. Ought to the quotes consolidate under this stage, a deeper downward correction will possible comply with, focusing on a assist stage of 35,680 factors.

Technical Evaluation of Dow Jones

Trying forward: Dow Jones predictions for 2024

- In line with LeoProphet forecasts, the Dow Jones will rise to 38,777 factors in 2024

- Pockets Investor predicts index quotes to face at 37,861 factors in December 2024

- Analysts on the Financial system Forecast Company (EFA) recommend {that a} world fall in inflation will enable central banks to decrease rates of interest, thereby propelling the Dow Jones to a file stage of 46,594 factors by the top of 2024

The right way to spend money on the Dow Jones

The US 30 index can be utilized for each short-term buying and selling and long-term investing. Shopping for or promoting the index straight is unimaginable since that is only a calculated worth. Subsequently, varied monetary devices similar to shares, futures, choices, CFD contracts, and ETFs are used for buying and selling. Elementary and technical analyses and indicator methods can be utilized for analysis and decision-making.

Some of the standard funding automobiles is the acquisition of an ETF (exchange-traded fund). Constructing a portfolio comprising all index shares may be costly. Consequently, varied ETFs have been created to make investing inexpensive, together with DJIA shares on the proper share correlation. Buyers should buy the fund’s shares and generate earnings from potential inventory progress and dividend payouts. Some of the standard ETFs for the Dow Jones is the SPDR Dow Jones Industrial Common ETF Belief (DIA).

Assessing the dangers: a cautionary word on Dow Jones investments

Regardless of the inventory indices generally displaying a constructive development in long-term investing, investments within the Dow Jones carry sure dangers. For instance, an financial downturn adopted by a long-lasting, deep recession can ship down inventory costs and the index for a very long time.

Particularly, the 2008 monetary disaster within the US, brought on by a housing bubble, triggered an index decline of about 50% from its most values seen in 2007. It took the Dow Jones 5 years to retrace to its highs and proceed rising.

Conclusion

The Dow Jones Industrial Common (US 30) is likely one of the world’s most generally used inventory indices, rating among the many prime three hottest US indices. Its basket consists of shares of the 30 US largest corporations by market capitalisation, all traded on US inventory exchanges. This index is taken into account an important indicator of the nation’s financial well-being.

In 2023, the index demonstrated a assured upward rally, updating the historic most set in 2022. Inventory market consultants are reasonably optimistic, anticipating continued progress in 2024 amid expectations for a discount within the rates of interest by the US Federal Reserve. Essentially the most optimistic forecasts predict progress of round 46,000 factors. Nevertheless, the dangers of a possible slowdown within the US financial system could impede the realisation of those forecasts.

FAQ

The Dow Jones Industrial Common (DJIA) is a inventory market index that measures the inventory efficiency of 30 massive, publicly owned corporations listed on inventory exchanges within the US. It is likely one of the oldest and mostly adopted fairness indices, usually used as a barometer for the general well being of the US inventory market and financial system.

The DJIA is a price-weighted index, which means that corporations with larger inventory costs considerably influence the index’s worth. Its worth is calculated by including the costs of all 30 shares and dividing this complete by a divisor, which is adjusted to account for inventory splits, dividends, and different components.

A spread of things can affect the DJIA’s efficiency, together with financial indicators (like GDP progress charges, unemployment figures, and rate of interest modifications), company earnings studies, geopolitical occasions, and world market tendencies. Investor sentiment and market hypothesis additionally play important roles.

Particular person traders can spend money on the Dow Jones by buying shares of mutual funds or exchange-traded funds (ETFs) that observe the efficiency of the DJIA. Alternatively, traders should buy shares within the particular person corporations that make up the DJIA or purchase a Contract for Distinction based mostly on DJIA, like US 30 Index Money.

Widespread dangers embrace market threat (the potential of all the market declining), sector-specific dangers (if specific industries inside the DJIA carry out poorly), and particular person firm threat. Financial downturns and geopolitical occasions may also negatively have an effect on the DJIA.

Sure, the DJIA is commonly seen as an indicator of the financial well being of American corporations’ industrial sector. Whereas it doesn’t signify all the financial system, tendencies within the DJIA can mirror investor confidence and financial situations.

Key occasions to observe embrace choices by the Federal Reserve on rates of interest, ongoing commerce negotiations, geopolitical developments, and main company earnings studies. The result of those occasions can considerably influence investor sentiment and the efficiency of the DJIA.

Buyers can comply with DJIA updates by monetary information web sites, inventory market apps, monetary information channels, and funding platforms. Commonly studying market analyses and studies from monetary consultants may also present worthwhile insights.

* – The charts showcased on this article come from the TradingView platform, well known for its complete suite of instruments crafted for analyzing monetary markets. Serving as a complicated and user-friendly on-line service for charting market knowledge, TradingView empowers customers to conduct technical evaluation, delve into monetary knowledge, and join with fellow merchants and traders. Moreover, it imparts worthwhile steering on adeptly comprehending how you can learn foreign exchange financial calendar, together with providing insights into varied different monetary property.

[ad_2]