[ad_1]

Ford Motor Firm (NYSE: F) was anticipated to attain a income of 43 billion USD primarily based on the This autumn 2023 outcomes. Nonetheless, the end result exceeded expectations by 7%. Moreover, the US automaker introduced common and particular dividend payouts and shared an optimistic outlook for 2024. Consequently, its inventory surged.

On 12 February 2024, we examined the auto big’s monetary efficiency, carried out a technical evaluation of its inventory, and explored knowledgeable forecasts for its prospects in 2024.

About Ford Motor Firm

Ford Motor Firm is an American firm that designs, manufactures, and sells passenger and business automobiles, together with electrical and hybrid automobiles, beneath the Ford and Lincoln manufacturers. Henry Ford based it in 1903 in Detroit, Michigan.

Moreover, the corporate supplies monetary, infrastructure, and different providers to its prospects. The vast majority of its income comes from automobile gross sales, particularly pickups and vehicles. Based on the report, in 2023, 1.08 million items had been bought, which is 13.2% greater than the 2022 statistics. It additionally generates earnings from its subsidiaries and joint ventures in China, Europe, and different areas.

In 2023, the corporate bought 1.99 million automobiles, which is 7.1% greater than the whole in 2022. The preferred fashions had been the Ford Explorer, the F-Collection with the F-150 electrical model, and the Transit, together with the E-Transit electrical model.

About Ford Blue, Ford Mannequin E, and Ford Professional

On 26 Might 2021, Ford Motor Firm unveiled Ford+, the corporate’s improvement plan for the electrical and hybrid automobile period, which launched new distinct auto items. On the identical day, it launched Ford Professional, a service unit that gives a variety of providers to business automobile homeowners.

Ford Professional elements:

- Ford Professional Software program – a collection of digital instruments working primarily based on real-time automobile information, enhancing effectivity and decreasing gasoline consumption

- Ford Professional Charging – electrical automobile charging options encompassing public charging stations, house and workplace chargers, and charging administration and optimisation software program

- Ford Professional Service – automobile upkeep and restore providers, together with service centres, gross sales of spare elements and equipment, in addition to guarantee and insurance coverage providers

- Ford Professional FinSimple – monetary options for automobile buy and lease, together with lending, particular provides and reductions

Based on Ford Motor Firm’s 2023 report, Ford Professional income reached 58.1 billion USD, marking a 19% progress in comparison with 2022 statistics.

The following stage concerned establishing the companies for Ford Blue and Ford Mannequin E. The previous specialises in creating and manufacturing inner combustion engine vehicles, whereas the latter focuses on producing electrical automobiles, software program improvement, and communication instruments. Ford Blue and Ford Mannequin E revenues for 2023 amounted to 101.9 billion USD and 5.9 billion USD, respectively, reflecting an 8% and 12% improve in comparison with 2022 outcomes.

Analysing the monetary efficiency of Ford Motor Firm

On 6 February 2024, Ford Motor Firm launched the This autumn and full-year 2023 report, exhibiting that monetary efficiency has exceeded expectations.

This autumn 2023 outcomes in comparison with This autumn 2022 statistics:

- Income: +4.55%, as much as 46 billion USD, forecasted at 43 billion USD

- Web loss: 0.53 million USD in comparison with a earlier revenue of 1.3 billion USD

- Adjusted loss per share: 0.13 USD versus the earlier EPS of 0.32 USD, with a forecast of 0.12 USD

- Working money circulation: +111%, reaching 2.49 billion USD

Full-year 2023 outcomes in comparison with 2022 statistics:

- Income: +11.47%, reaching 176.19 billion USD

- Web revenue: 4.35 billion USD in comparison with a earlier internet lack of 1.98 billion USD

- Adjusted EPS: 1.08 USD versus a earlier internet lack of 0.49 USD

- Working money circulation: +117.7%, reaching 14.9 billion USD

The manufacturing facility employees’ strike in This autumn negatively impacted the monetary statistics, which value the corporate 1.7 billion USD. We’ll present extra particulars under.

The day after the report’s launch, Ford Motor Firm’s inventory added 6.05% on the shut of the buying and selling session, rising to 12.80 USD.

Automobile gross sales statistics by phase

On 4 January 2024, Ford Motor Firm offered automobile gross sales statistics for the final quarter and the complete 12 months 2023.

This autumn 2023 gross sales versus This autumn 2022:

- Electrical automobiles: +27.5%, reaching 25,937 items

- Hybrid automobiles: +55.5%, reaching 37,229 items

- ICE automobiles: −3.4%, reaching 424,674 items

2023 gross sales versus 2022 statistics:

- Electrical automobiles: +17.9%, reaching 72,608 items

- Hybrid automobiles: +25.3%, reaching 133,743 items

- ICE automobiles: +5.5%, reaching 1,789,561 items

Ford Motor Firm monetary forecast for 2024

- Adjusted EBIT: 10-12 billion USD

- EBIT Ford Professional: 8-9 billion USD

- EBIT Ford Blue: 7-7.5 billion USD

- EBIT Ford Mannequin E: from −5 to −5.5 billion USD

- Dividends: Common dividends of 0.15 USD per share and supplemental dividends of 0.18 USD per share are payable on 1 March 2024.

Affect of the economic motion on Ford Motor Firm’s inventory

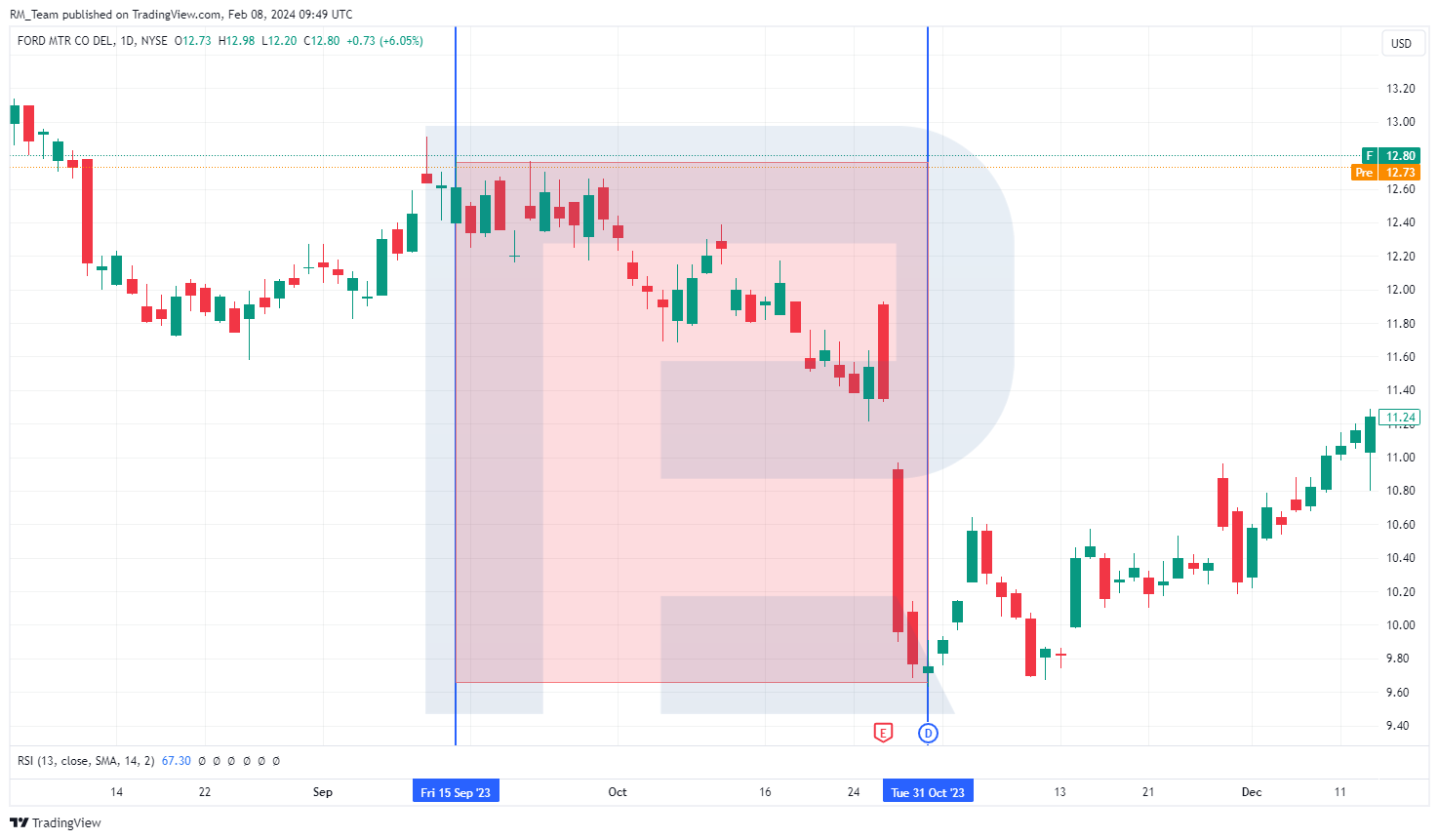

The latest strike, as of the preparation of this materials, involving the UAW (United Auto Staff), signifies a serious battle between the commerce union representing automotive business employees striving for higher working circumstances and the three automotive giants, particularly, Ford Motor Firm, Common Motors Firm (NYSE: GM), and Stellantis NV (NYSE: STLA). The strike lasted from 15 September to 31 October 2023, leading to a compromise between the events.

Based on Ford Motor Firm’s administration, the strike value the producer 1.7 billion USD. Moreover, employees’ new contracts until 2028 will improve manufacturing prices by 900 USD per automobile. The corporate plans to extend labour productiveness and cut back manufacturing prices to offset these losses. The automaker’s inventory fell 23.7% throughout the strike, from 12.70 to 9.70 USD.

Ford Motor Firm inventory evaluation for 2024

Since 19 September 2022, Ford Motor Firm shares have traded between 11.20 and 14.60 USD per unit. Amid the UAW strike, the quotes broke under its decrease boundary, reaching a low of 9.63 USD. After the events to the battle reached an settlement, the inventory costs retraced to the buying and selling vary and hovered at 12.68 USD on the time of writing.

A retracement of the inventory costs to the vary might point out a excessive likelihood of additional progress in direction of its higher boundary at 14.60 USD. The formation of an inverse Head and Shoulders sample on the chart may function an extra sign confirming a possible inventory rise.

If Ford Motor Firm’s shares surpass the resistance stage of 14.60 USD, they’ll possible climb to the subsequent resistance stage of 16.50 USD.

Technical evaluation of Ford Motor Firm*

Professional forecasts for Ford inventory for 2024

- Based on Barchart, 5 out of 17 analysts rated Ford Motor Firm inventory as Sturdy Purchase, two as Reasonable Purchase, seven as Maintain, and three as Sturdy Promote, with a mean worth goal of 13.52 USD

- Primarily based on the knowledge from MarketBeat, 4 out of 14 specialists assigned a Purchase ranking to the shares, 9 gave a Maintain advice, and one designated a Promote ranking, with a mean worth goal of 13.66 USD

- As TipRanks studies, six out of 15 specialists designated a Purchase ranking for the automaker’s inventory, six rated it as Maintain, and three gave a Promote ranking, with a mean worth goal of 13.74 USD

- Based on Inventory Evaluation, two out of 13 analysts rated the shares as Sturdy Purchase, three as Purchase, six as Maintain, one as Promote, and one as Sturdy Promote, with the typical 12-month inventory worth forecast of 13.78 USD

Conclusion

CEO of Ford Motor Firm, Jim Farley, words that the US authorities’s infrastructure bills, as per Joe Biden’s plan, positively impression the corporate’s earnings as demand for Ford vehicles is rising. As well as, in 2024, the corporate plans to fabricate electrical automobiles in keeping with demand. It is going to be poised to ramp up its manufacturing if the buyer focus shifts from hybrid automobiles to electrical ones.

The Ford Mannequin E enterprise is projected to see a better loss this 12 months, however a rise in hybrid automobile gross sales can offset this loss. It’s price noting that gross sales of this kind of transport rose by greater than 25% in 2023. Moreover, the particular dividend payout could make the auto big’s inventory extra interesting to traders whereas positively affecting its worth.

Given the knowledge supplied within the textual content, it may be assumed that the optimistic forecast of Ford Motor Firm administration might show true, supplied that the US economic system continues to develop in 2024. On this case, the inventory will possible have the prospect to achieve the degrees projected by specialists.

FAQ

On the time of writing, the inventory worth of Ford Motor Firm stands at 12.68 USD, with a 52-week excessive of 15.42 USD and a low of 9.63 USD.

To buy Ford Motor Firm inventory, you possibly can observe these normal steps:

1. Open a buying and selling account. Select a brokerage account that fits your buying and selling wants. For instance, RoboForex provides accounts of a number of sorts for numerous platforms.

2. Make a deposit. For instance, for RoboForex, the minimal first deposit begins from 10 USD, relying in your account kind.

3. Select Ford Motor Firm inventory.

Decide the funding quantity, holding your price range and funding technique in thoughts.

4. Shut the commerce. Log in to your buying and selling platform, choose Ford Motor Firm inventory, and place a purchase order.

5. Monitor your funding. Hold observe of your inventory positions, analyse efficiency, and alter as wanted.

The dividend yield of Ford Motor Firm shares is 4.73% on the time of writing. Nonetheless, a particular dividend of 0.18 USD per share payable on 1 March 2024 must be added to the yield.

Ford Motor Firm delivered constructive outcomes on the year-end 2023 amid intense competitors and the massive UAW strike, surpassing the 2022 figures. Annual income rose by 12% to 176.2 billion USD. Web revenue reached 4.4 billion USD; a 12 months in the past, the corporate posted a lack of almost 2 billion USD. The shares gained 10% over 2023, climbing from 11 to 12 USD.

A number of Web assets present Ford Motor Firm inventory evaluation and forecasts, comparable to Weblog Roboforex, Yahoo Finance, MarketBeat, WallStreetZen, and StockScan.

Investing in Ford Motor shares includes the next dangers:

1. Cyclical enterprise operations. The corporate’s gross sales and earnings largely rely on the financial cycle. When the economic system is weak or unstable, customers might postpone or reduce their auto spending, doubtlessly impairing the auto maker’s earnings and revenue

2. Disadvantages of worth shares. Ford Motor Firm shares are thought-about worth inventory, buying and selling at a low worth relative to their earnings, belongings, and progress potential. Whereas worth securities might usher in interesting income in the long run, they might additionally encounter challenges comparable to low investor curiosity, destructive market sentiments, or gradual progress

3. Debt burden. The corporate has a excessive debt stage of 129.29 billion USD as of 31 December 2023. The debt-to-equity ratio is 3.02, significantly greater than 1. The debt will increase the automaker’s curiosity bills and limits its monetary flexibility and talent to spend money on progress alternatives. The corporate can also face issues with refinancing its debt or fulfilling its obligations in case of a enterprise decline or a credit standing downgrade

Ford Motor Firm information sources:

1. The first supply is the corporate’s official web site

2. Yahoo Finance information aggregator provides full, invaluable, and up-to-date info on the corporate, together with the newest information, analysts’ scores, forecasts, worth targets, information on monetary earnings studies, dividends, and plenty of extra

3. Information assets comparable to The Motley Idiot, MarketWatch, CNBC, and so forth.

As talked about above, monetary earnings studies and full vital info on Ford Motor Firm are revealed on its official web site beneath the Report & Fillings Part.

It’s price noting that Ford Motor Firm supplied an optimistic annual outlook and raised dividend payouts. Moreover, the automaker focuses on manufacturing optimisation and a extra balanced strategy to electrical automobile manufacturing, learning demand on this phase to launch probably the most sought-after fashions. All these elements must be thought-about when assessing the automaker’s inventory prospects. Based on the above respected sources, 2024 worth targets for the corporate’s shares vary from 13.52 USD to 13.78 USD.

* – The charts offered on this article are sourced from the TradingView platform, well known for its complete suite of instruments tailor-made for monetary market evaluation. Serving as each a user-friendly and complex on-line market information charting service, TradingView empowers customers to conduct technical evaluation, delve into monetary information, and have interaction with fellow merchants and traders. Furthermore, it furnishes invaluable steering on adeptly comprehending the best way to learn foreign exchange financial calendar, whereas additionally providing insights into numerous different monetary belongings.

[ad_2]