[ad_1]

Definition of a freelancer beneath GST

There isn’t a separate definition of a freelancer beneath the GST Act.

Any one who offers companies to a different individual on a contract foundation is called a freelancer. They don’t seem to be employed by a single firm or a person enterprise proprietor — freelancers are self-employed and supply their companies to a number of firms/ enterprise homeowners concurrently. Since freelancers usually are not common staff of any group, employment legal guidelines don’t apply to them.

Nonetheless, as service suppliers, freelancers fall inside the ambit of GST provisions.

So whether or not you’re a freelance content material author, a web site designer, or a advertising and marketing guide, you’ll fall beneath this class.

When ought to a freelancer get a GST registration?

GST registration refers back to the course of by way of which a taxpayer can register beneath GST.

A freelancer ought to get hold of a GST registration as soon as they meet the turnover threshold, as follows:

- In case your turnover is greater than INR 20 lakhs in a monetary yr (or INR 10 lakhs within the case of particular class states), you have to get a GST registration, no matter the place your shoppers are situated.

In case you present companies of lower than or upto INR 20 lakhs in a monetary yr (or INR 10 lakhs within the case of particular class states), you don’t need to get registered beneath GST mandatorily. This rule applies no matter whether or not the companies are being offered inside the state the place you’re registered, one other state, or outdoors India.

Freelancers offering companies lined beneath On-line Data and Database Entry and Retrieval should additionally get a GST registration.

Benefits and downsides of GST

Listed here are a number of advantages and downsides of GST in India at a look:

Benefits of GST

- Eliminates the necessity for small companies to adjust to totally different oblique taxes

- Eliminates double taxation that will increase the hidden prices of doing enterprise.

- Minimizes tax evasion

- Necessary registration linked to a better turnover exempts a big group of service suppliers liable to pay VAT and repair taxes.

- Service suppliers can declare enter tax credit score to cut back their tax burden.

Disadvantages of GST

- Enterprise homeowners must appoint tax professionals to make sure GST compliance. This will increase operational prices.

- Registering beneath GST, elevating invoices with the GST part included, and submitting returns will be overwhelming and time-consuming.

What’s the minimal restrict for GST registration?

Registration beneath GST is linked to the annual turnover of the service supplier.

There are two sorts of registration in GST:

Necessary registration

GST registration is obligatory if:

- Your turnover exceeds INR 20 lakh in a monetary yr (INR 10 lakh in a monetary yr for particular class states)

- You present companies lined beneath On-line Data and Database Entry and Retrieval companies, equivalent to promoting on the Web, gaming companies on the Web, cloud-based companies, promoting e-books, music, or motion pictures, and so forth.

- You’re finishing up any inter-state provide of products/companies.

Particular class states embrace:

- Uttarakhand

- Arunachal Pradesh

- Assam

- Jammu & Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

Voluntary registration

If the annual turnover of a taxpayer is lower than the boundaries specified above, they’ll select to register beneath GST. As soon as registered, the taxpayer is topic to all GST provisions, together with paying the relevant GST and submitting returns.

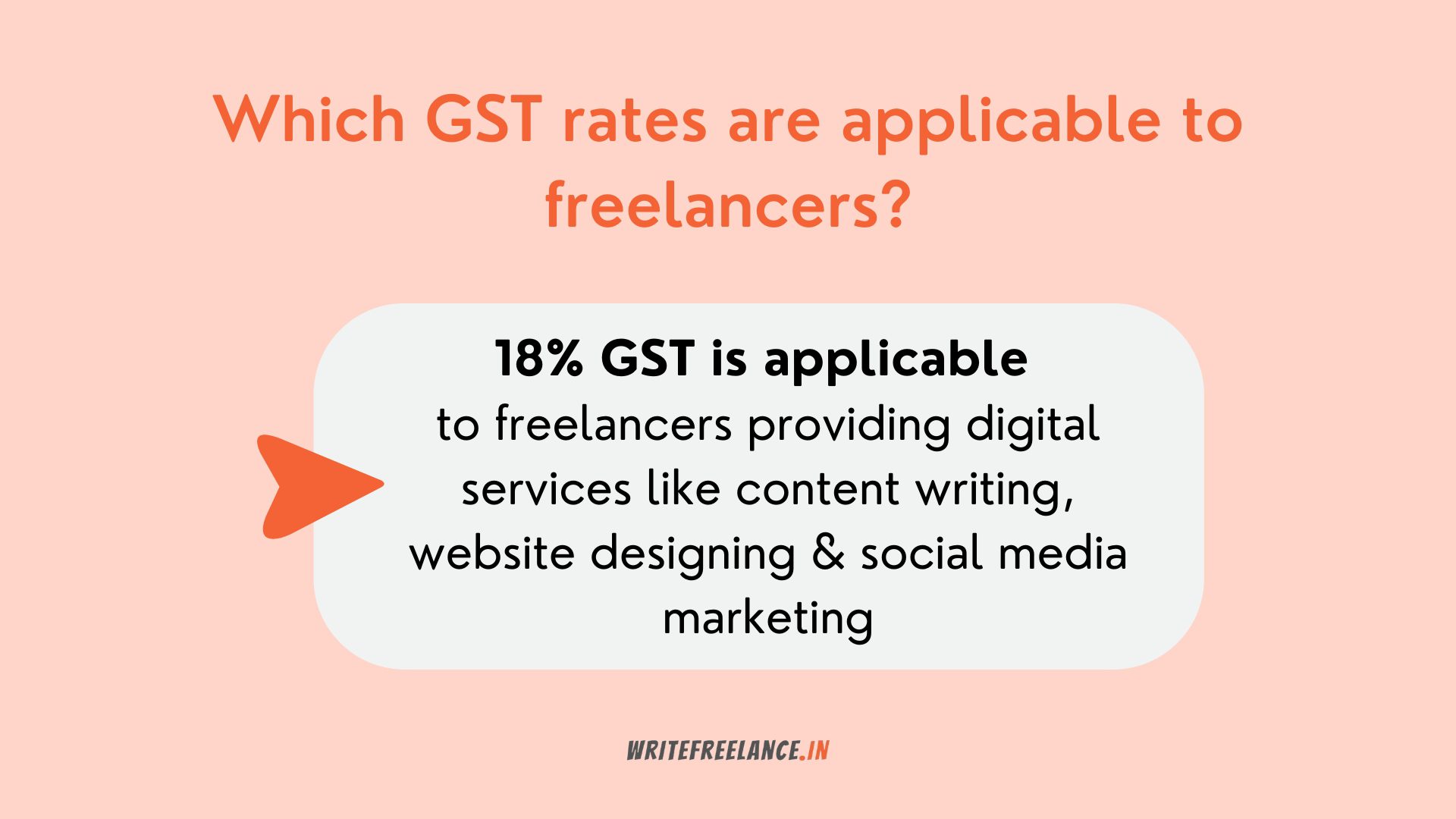

Which GST charges are relevant to freelancers?

The relevant GST price relies on the kind of service offered.

Presently, the GST council has categorized the assorted companies offered in India into 4 slabs 5%, 12%, 18%, and 28%. There may be additionally a nil-rated slab with a GST price of 0%. You need to use any GST price calculator or go to the authorities web site to search out the relevant price on your service.

Whereas digital companies equivalent to content material writing, web site designing, digital advertising and marketing, and digital help usually are not explicitly listed, all companies offered by way of the Web often appeal to a GST of 18%.

Since 2019, the federal government has additionally launched a composition scheme for service suppliers with a turnover of lower than INR 50 lakhs, the place the GST price is 6%. Whereas some freelancers might profit from the scheme, it may be difficult for content material writers or digital entrepreneurs, as companies offered to an individual in a special state or nation are excluded.

What’s the course of for GST registration for freelancers?

Registration for GST for freelancers will be accomplished on-line by way of the GST portal.

Right here’s a short overview of generate your GST registration certificates:

Half A

- Choose the ‘New Registration’ possibility from the drop-down menu of the GST portal.

- Refill the applying kind by getting into the authorized title of your online business as indicated in your PAN card and the e-mail ID of the approved signatory.

- Click on the Proceed button to start the verification course of.

- Enter the OTP obtained in your cellular quantity and e-mail when prompted

- As soon as the OTP is verified, the portal will generate a GST Transaction Reference Quantity (TRN).

Half B

- Log into the GST portal and click on ‘Register’ beneath the ‘Companies’ menu.

- Click on on ‘Short-term Reference Quantity (TRN)’, enter the TRN generated, and click on the ‘Proceed’ button.

- Enter the OTP obtained in your e-mail tackle and registered cellular quantity and click on on ‘Proceed.’

- It is possible for you to to see the standing of your utility. Click on on the Edit icon to add the paperwork wanted for GST registration, as listed under:

- Pictures

- Proof of enterprise tackle

- Financial institution particulars (account quantity, financial institution title, financial institution department, and IFSC code)

- Authorization kind

- Constitutional paperwork for your online business

- Submit the paperwork, go to the ‘Verification’ web page, and tick the field for declaration.

- You may submit the applying by way of an digital verification code, importing a digital signature certificates, or e-signing.

- Select the suitable possibility and full the submission. You’ll obtain an Utility Reference Quantity (ARN) in your registered cellular quantity and e-mail ID.

You need to use the ARN to trace the standing of your GST registration utility. Often, the GST registration certificates is issued inside seven days of producing ARN.

The certificates additionally features a Items and Companies Tax identification quantity or GSTIN for freelancers. GSTIN is a novel 15-digit quantity issued to each taxpayer.

Learn: Earnings Tax for Freelancers in India

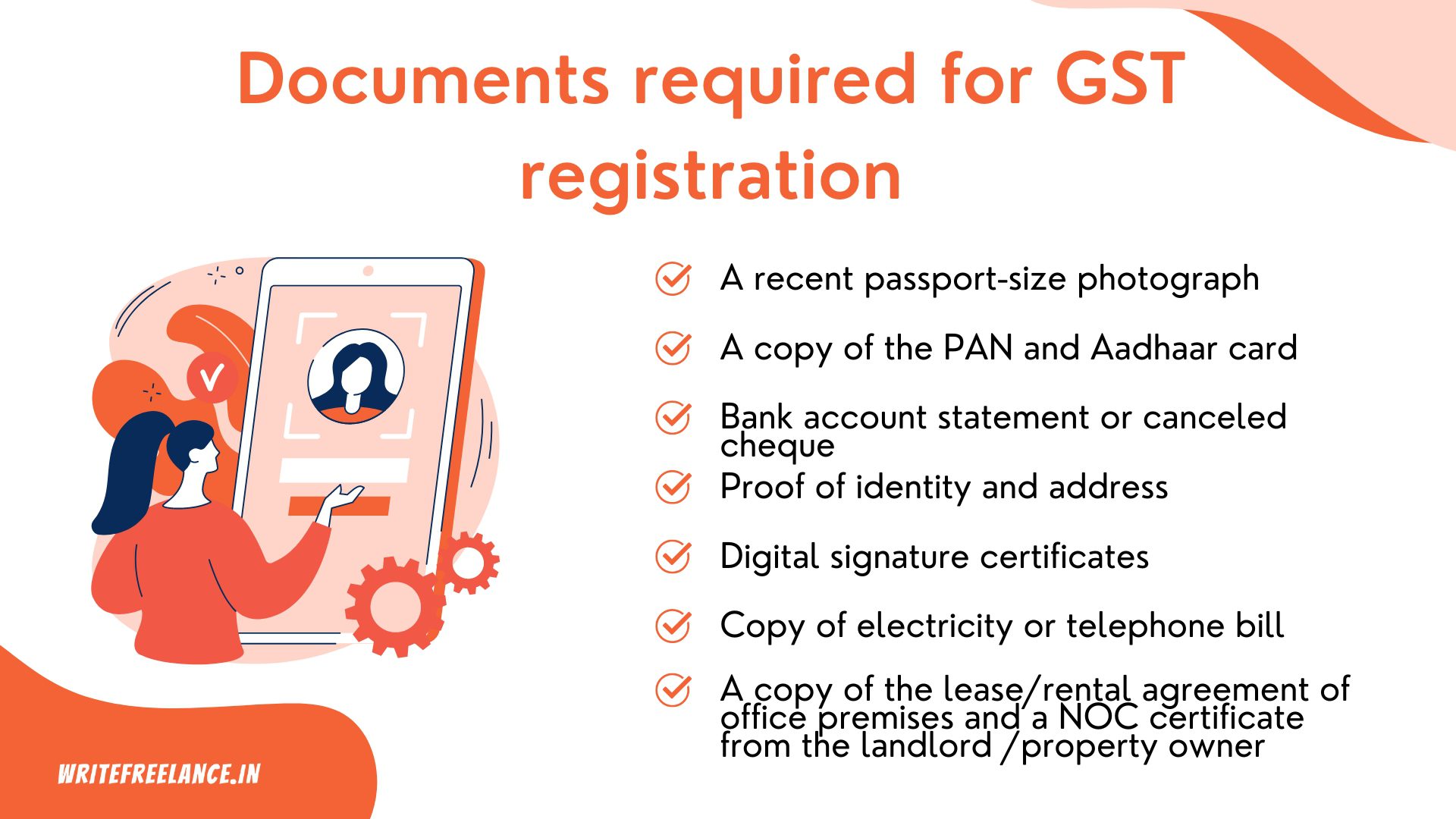

What are the paperwork required for GST registration?

Here’s a checklist of paperwork for GST registration for freelancers:

- A latest passport-size {photograph}

- A duplicate of the PAN and Aadhaar card of the freelancer

- Newest checking account assertion or a canceled cheque

- Proof of id and tackle

- Digital signature certificates

- A duplicate of utility payments equivalent to electrical energy or phone

- A duplicate of the lease/rental settlement of workplace premises and an NOC certificates from the owner /property proprietor/lessor stating that they don’t have any objection to the taxpayer utilizing the premises for conducting enterprise

What occurs after GST registration?

As soon as registered beneath GST, each bill you increase ought to embrace GST on the entire invoice quantity– which, within the case of freelance writers, B2B SaaS writers, or consultants, can be 18%

For instance, in case you are billing your consumer for INR 20,000, the bill ought to embrace GST calculated at 18% and point out that the entire quantity payable is INR 23,600.

Make it possible for each bill has a novel quantity and contains your GSTIN.

When you obtain the cost, you have to file your GST return and deposit the GST quantity to the federal government by way of the GST portal.

Additionally, notice that your consumer might pay your bill after deducting TDS for freelancers at 10%. Nonetheless, their legal responsibility to deduct TDS doesn’t have an effect on your proper to cost GST. Try our information on make a contract bill to grasp incorporate GST into your normal invoicing course of.

Do I cost GST to abroad shoppers?

In case you present companies to abroad shoppers and so they pay you in any foreign money aside from INR, you don’t have any legal responsibility to cost GST.

For instance, in case you are a contract author with shoppers solely within the US, UK, and Australia and your whole earnings when transformed is INR 50 lakhs, your GST is 0%. This additionally applies to GST for freelance work for abroad shoppers by way of on-line marketplaces like Upwork, Fiverr, Freelancer.com, and so forth.

Guarantee to get a international inward remittance certificates proving that the cost is certainly in international foreign money, and likewise make a zero GST submitting each month.

But when your abroad consumer pays you in INR from a checking account in India, you need to cost GST in case you are mandatorily or voluntarily registered beneath GST.

In keeping with CAs, freelancers who completely present companies to abroad shoppers and have an annual turnover of greater than INR 20 lakhs ought to mandatorily register beneath GST, regardless that they don’t have any obligation to cost GST from shoppers.

For example, if you happen to provide content material advertising and marketing companies solely to shoppers based mostly out of India and paying you thru financial institution accounts registered overseas, you’ll not be liable to cost them any GST on your companies.

Is a freelancer eligible to say an enter tax credit score?

Underneath the GST Act, enter tax refers back to the items and companies tax that an individual pays whereas buying any items or availing of any service used whereas working their enterprise. When an individual has to pay GST, they’ll deduct the tax they’ve already paid for the inputs and solely pay the steadiness.

The GST Act has no particular provisions for enter tax credit score for freelancers. Tax practitioners recommend that freelancers can declare the enter tax paid for items they use for companies, offered they’re registered beneath GST. For instance, the GST paid on the laptop computer buy will be claimed as enter credit score when the freelancer discharges their GST legal responsibility.

In case you are an unregistered freelancer, any GST paid on buying items for offering your companies will rely as a price.

Conclusion

Whether or not you’re starting your freelancing journey or a seasoned skilled — there isn’t any escaping GST. Nonetheless, determining GST compliance and file returns might look intimidating.

When you can all the time go online to the GST web site and do all of it your self, hiring a chartered accountant who works with freelancers and solopreneurs will be sure that you by no means end up on the unsuitable aspect of the legislation.

FAQs

What are the penalties beneath GST for freelancers?

Freelancers appeal to the next penalties if they’re liable to register beneath GST however don’t register themselves.

- INR 25,000 for non-registration, and

- INR 100 per day for not submitting the returns

Freelancers who register themselves beneath GST however don’t discharge their tax legal responsibility or file their returns on time additionally appeal to penalties as follows:

- INR 200 per day for late submitting of annual returns

- 18% curiosity every year, relevant from the following day of the due date, for delayed GST funds

If a freelancer registered beneath GST doesn’t repeatedly file returns for six months, their GST registration could also be suspended. Such freelancers can solely undertake exercise as soon as the suspension is revoked.

Do freelancers must pay GST?

Indian freelancers should pay GST when their turnover exceeds INR 20 lakhs/INR 10 lakhs in particular class states) in a monetary yr.

If a freelancer who doesn’t exceed the required turnover voluntarily registers beneath GST, they’re additionally obligated to pay and accumulate GST and file returns on time.

Do freelancers must pay each GST and earnings tax?

GST and Earnings Tax are separate tax liabilities. Earnings tax is a direct tax legal responsibility, and it’s levied on the earnings. GST is an oblique tax legal responsibility levied on items and companies offered.

Each freelancer’s earnings is topic to earnings tax except it falls inside a wage bracket exempted from paying such tax. That is no matter their legal responsibility to pay GST.

How does the GST have an effect on freelancers?

Like some other service supplier, freelancers are additionally topic to provisions of GST. Often, a GST of 18% applies to the companies offered by freelancers.

In case you are a registered freelancer, amassing GST from the service recipients and depositing it with the federal government may cause money circulation points. That is because of the lag between receiving the cost and the deadline for depositing the quantity to the tax division.

Your freelance earnings may get impacted in case your clients don’t conform to pay GST, forcing you to exit of pocket to discharge the tax legal responsibility.

What’s the GST exemption restrict for freelancers?

Freelancers with an annual turnover of as much as INR 20 lakhs/ INR 10 lakhs are exempted from mandatorily registering beneath GST.

[ad_2]