[ad_1]

Technique Overview and Parameter Settings

Chinese language model person information is offered on the finish(最后有中文说明版本)

Product Hyperlink: https://www.mql5.com/en/market/product/125733

You need to use any timeframe. This technique operates on the precept of “small fluctuations, massive lot sizes.” To accommodate shoppers with low leverage, the default setting is decrease lot sizes, maintaining the danger comparatively low. It is suggested to set the Compound Multiplier between 20 and 200. Even with the default setting of 20, the technique has achieved 30x returns between 2020 and 2024. The long-term compounding impact of high-frequency methods is kind of spectacular.

Nonetheless, you will need to word that excessively massive lot sizes might trigger slippage, and the severity of this subject varies throughout completely different platforms. To mitigate this, we make use of a batch entry technique. If the backtest interval is simply too brief, you possibly can improve the Compound Multiplier to boost backtesting outcomes. If no orders are generated, lowering this worth might assist.

As soon as loaded, the primary window will show the account leverage. For leverage under 1:30, the Compound Multiplier needs to be set to lower than 20. For leverage under 1:100, it needs to be lower than 80. Decrease leverage will improve margin utilization, which might lead to inadequate accessible funds, stopping the system from inserting orders.

Because of the uniqueness of this technique, some customary platform account varieties might carry out poorly. Solely ECN accounts or platforms with low spreads and excessive liquidity can generate income. Typically talking, accounts that may revenue utilizing the “Each tick primarily based on actual ticks” mode are more likely to obtain related ends in dwell buying and selling, with efficiency being very shut.

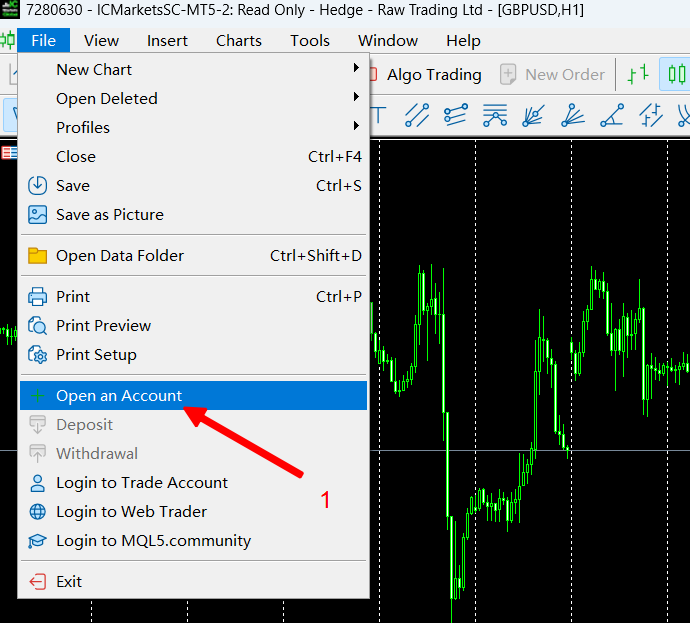

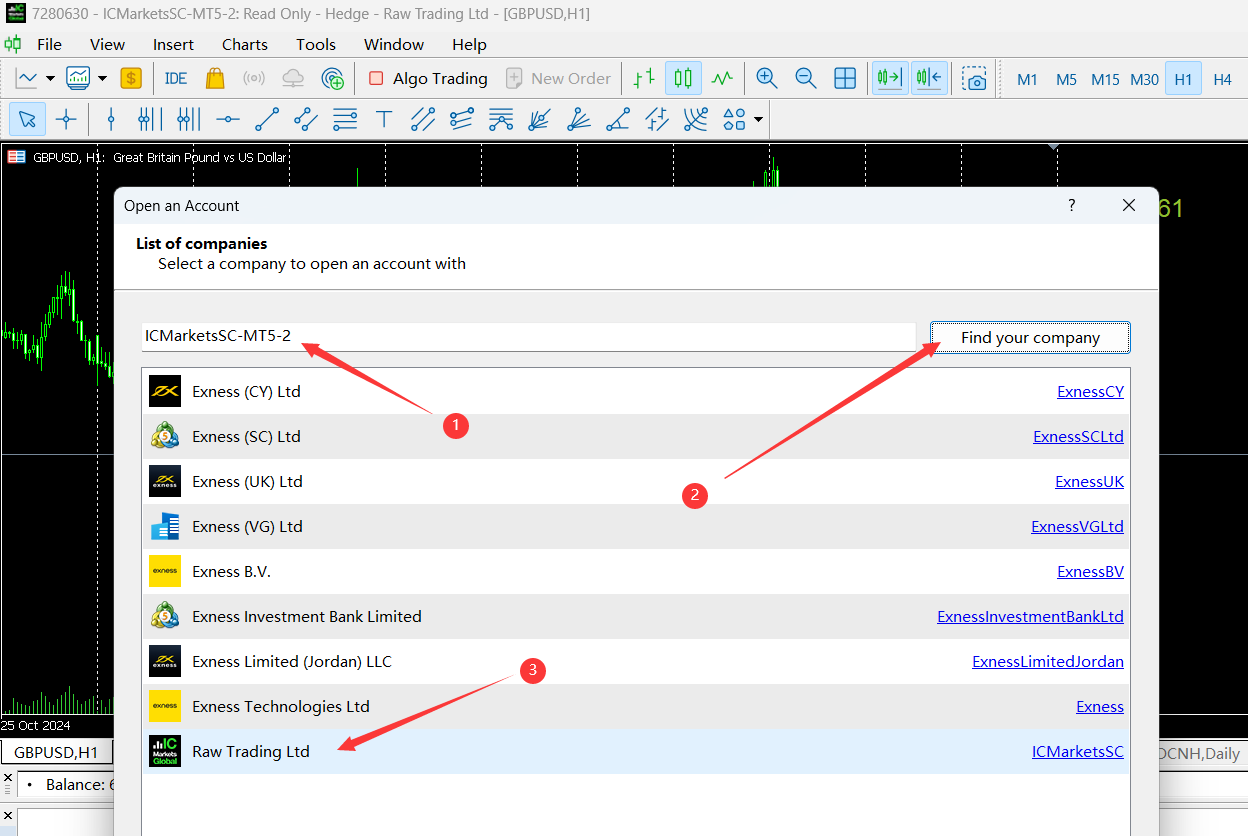

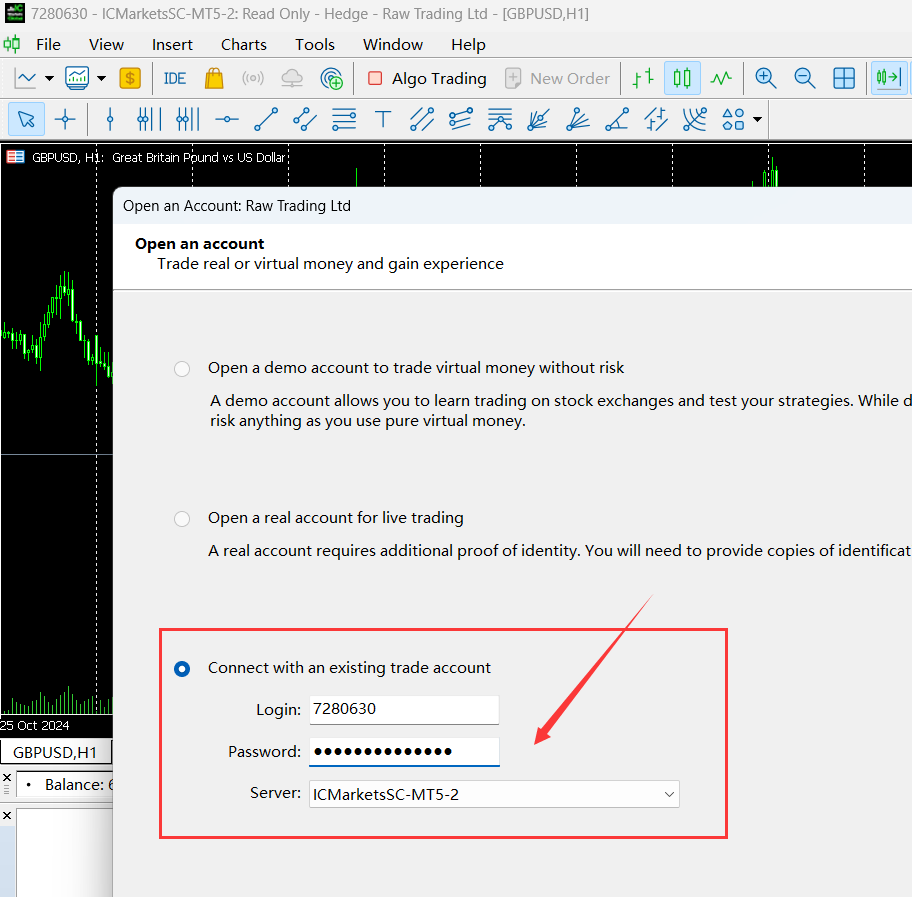

There are a lot of such platforms accessible. For reference, we offer a sign monitoring account you could log into for viewing and backtesting:

- Login: 7280630

- Investor: f$XvTE4HiM4$ND

- Server: ICMarketsSC-MT5-2

In case you already know easy methods to log in to the monitoring account or don’t want our monitoring account for backtesting, you possibly can skip this step. (Step pictures are on the finish)

Parameter Rationalization:

Non-numerical parameters normally enable double-clicking the parameter worth to open a drop-down choice.

- word: Meaningless parameter, can be utilized for annotations, and so on.

- Auto GMT: Vital parameter, default is enabled. The EA is time-sensitive, and if the GMT is wrong, the impact will probably be very poor. Nonetheless, because of our efforts in growth, the automated GMT recognition is extremely correct, so maintaining it TRUE is usually advantageous.

- GMT: This takes impact when Auto GMT is ready to FALSE. The EA will output the GMT data within the EA log as soon as when loaded and at the beginning of every day.

- Daylight Saving Time: Daylight Saving Time swap, solely takes impact when Auto GMT is disabled.

- Present order entry and exit factors: When enabled, the EA will mark purchase and promote positions with a thumbs-up icon. The tip of the thumb represents the entry level. Upward signifies a purchase, and downward signifies a promote. If there’s a discrepancy with the precise order level, it signifies slippage. Slippage happens when the platform’s liquidity is inadequate, and long-term slippage might require lowering the order dimension. Moreover, the platform’s unfold might widen through the EA’s buying and selling hours, which can be a liquidity subject.

- Open Slippage: Slippage restrict for purchase orders, ineffective on some platforms.

- Shut Slippage: Slippage restrict for promote orders, ineffective on some platforms.

- Open place unfold restrict: Unfold restrict for opening positions.

- Shut place unfold restrict: Unfold restrict for closing positions.

- FridayMethod: Friday order technique, with three choices: halve the standard order dimension, proceed as standard, or pause orders. Double-click the choice to open the drop-down menu.

Subsequent are the order dimension management parameters:

-

Compound Mode: When TRUE, the EA makes use of a share of fairness for order dimension, and the order dimension modifications with fairness. When FALSE, a hard and fast lot dimension is used.

-

Preset Compound Multiplier: Preset threat ranges, with 5 ranges akin to the Customized Compound Multiplier values of 20, 40, 60, 80, and 100. The default Customized worth refers back to the Customized Compound Multiplier worth under.

-

Customized Compound Multiplier: Takes impact when the above choice is ready to Customized. Since completely different leverages use completely different margins, excessively massive values might trigger orders to cease attributable to inadequate funds. The default worth of 20 carries minimal threat and can be utilized with 1:30 leverage. The default worth is small to make sure that shoppers with low leverage can check usually. It is suggested to fluctuate between 20 and 200. Additionally, word that giant values mixed with massive funds might lead to extreme order sizes, inflicting slippage attributable to inadequate platform liquidity. If vital, you should utilize a number of platforms or a number of foreign money pairs.

Calculation system:

Heaps = ACCOUNT MARGIN FREE * 0.0001 * compoundMultiplier / 10 -

Order common distribution: When TRUE, the whole lot dimension is break up into a number of elements.

-

Disperse Common Components: The variety of elements into which the whole lot dimension is break up. When set to 1, no distribution happens.

-

lotSizePerPart: Takes impact when Disperse Common Components is ready to 0 and Order common distribution is TRUE. On this case, the lot dimension per half is set by this worth, and the whole lot dimension stays unchanged.

-

Heaps: Takes impact when Compound Mode is ready to FALSE, that means a hard and fast lot dimension is used, and there’ll solely be one order with none distribution.

- SecondsAfterMidnightToOpen: The variety of seconds after midnight when buying and selling begins. Buying and selling earlier than midnight will not be affected.

- TakeProfit: Take revenue.

- StopLoss: Cease loss.

Beneath are the Key optimization parameters:

The next 4 parameters could be optimized for various foreign money pairs or platforms. Utilizing completely different foreign money pairs can unfold liquidity and cut back the chance of slippage. The default parameters are solely appropriate for GBPUSD. Different foreign money pairs require their very own optimization. We might present optimized parameters for different foreign money pairs sooner or later.

- FilterLevel: Filter degree.

- FilterParameter1: Filter parameter 1.

- FilterParameter2: Filter parameter 2.

- RangeLength: Vary size.

- Order Mode (1-3): Might be merely understood because the order frequency. The default is Mode 2, which balances order frequency and accuracy. Mode 1 has a excessive order frequency however low accuracy, whereas Mode 3 has a low order frequency however excessive accuracy. If the mode is modified, the 4 parameters above have to be re-optimized.

- Open Vary Restrict (level): Limits the vary of worth motion for opening positions. That is additionally a comparatively essential efficiency parameter.

- Remark: Order remark.

- Magic: EA identifier. Don’t use the identical identifier as every other EA. If utilizing this EA on a number of foreign money pairs, the identifier could be the identical or completely different, and the EA will distinguish between the foreign money pairs.

- EA swap: EA on/off swap. When disabled, the EA stops inserting new orders however will proceed to handle present orders till they’re closed.

- Output Commerce Information: Default is off. When enabled, the EA will output further data comparable to slippage to the EA log. Nonetheless, this is probably not displayed precisely on all platforms.

Reference Sign Commentary Login Information

- Login: 7280630

- Investor: f$XvTE4HiM4$ND

- Server: ICMarketsSC-MT5-2

Chinese language Model Consumer Information:

策略使用说明

1. 时间框架与基本策略

你可以使用任何时间框架。该策略采用“小波动、大手数”的方式运行,为了照顾低杠杆客户,默认设置为较低手数,风险也较低。建议将 复利倍数(Compound Multiplier) 设置在 20 到 200 之间。即便是默认的 20 值,在 2020 年至 2024 年期间也实现了 30 倍的利润。高频策略的长期复利效果非常惊人。

请注意,过大的订单手数可能会导致滑点,且不同平台的滑点情况有所不同。我们采用了分批入场的方式来应对这一问题。如果回测时间较短,你可以适当提高 复利倍数 以增强回测效果;如果没有订单生成,则可以降低该值。

加载后,主窗口将显示账户杠杆。对于杠杆低于 1:30 的账户,复利倍数 应设置为 20 以下;对于杠杆低于 1:100 的账户,复利倍数应低于 80。较低的杠杆会增加保证金占用,导致可用资金不足,从而无法下单。

2. 平台与账户类型

由于该策略的特殊性,一些标准平台的账户类型可能表现不佳。只有 ECN 账户 或 低点差、高流动性 的平台才有可能实现盈利。一般来说,能够在“Each tick primarily based on actual ticks”模式下获得收益的账户,在实盘交易中也能产生类似的利润,且表现非常接近。

市面上有许多这样的平台。为方便观摩与回测,我们提供了一个参考信号的监控账户,朋友们可以登录进行查看:

- 登录账号: 7280630

- 投资者密码: f$XvTE4HiM4$ND

- 服务器: ICMarketsSC-MT5-2

如果你已经熟悉如何登录观摩账户,或者不需要这个账户进行回测,可以跳过这一步。(图片在上面的英文版本结尾)

3. 参数解释

- Auto GMT: 重要参数,默认开启。EA 对时间非常敏感,如果 GMT 错误会导致效果不佳。经过我们的优化,GMT 自动识别的准确率非常高,建议保持 TRUE。

- GMT: 当 Auto GMT 设置为 FALSE 时,该值生效。加载 EA 或每天开始时,日志中会输出一次 GMT 信息。

- Daylight Saving Time: 夏令时开关,关闭 Auto GMT 时生效。

- Present order entry and exit factors: 开启后,EA 会用大拇指图标标注买卖点位。拇指朝上表示买入,朝下表示卖出。如果图标与实际点位有差异,说明产生了滑点。长期滑点可能与平台流动性不足有关,建议降低订单手数。

- Open Slippage: 多单滑点限制,一些平台可能无效。

- Shut Slippage: 空单滑点限制,一些平台可能无效。

- Open place unfold restrict: 限制开仓点差。

- Shut place unfold restrict: 限制平仓点差。

- FridayMethod: 周五的订单策略,三种选择:平时手数的一半、照常操作、暂停下单。双击可选择。

订单大小控制参数

-

Compound Mode: 设置为 TRUE 时,使用资金百分比模式,订单大小随资金变化;设置为 FALSE 时,使用固定手数。

-

Preset Compound Multiplier: 预设风险等级,共 5 个等级,分别对应 Customized Compound Multiplier 的 20、40、60、80、100。默认使用自定义值。

-

Customized Compound Multiplier: 当使用自定义模式时生效。不同杠杆的保证金占用不同,过大的值可能因资金不足而停止下单。默认值 20 风险较小,适用于低杠杆账户。建议该值在 20 到 200 之间变化。需要注意的是,过大的值可能会让订单手数过大,导致平台滑点。如果必要,可以在多个平台或货币对上分散操作。

计算公式:

手数 = 账户可用保证金 * 0.0001 * CompoundMultiplier / 10 -

Order common distribution: 设置为 TRUE 时,会将订单手数平均分成多份。

-

Disperse Common Components: 订单手数分成的份数,设置为 1 时不分散。

-

lotSizePerPart: 当 Disperse Common Components 设置为 0 且 Order common distribution 为 TRUE 时,每份订单手数按此值分配,总和不变。

-

Heaps: 当 Compound Mode 设置为 FALSE 时生效,使用固定手数,不分散订单。

交易时间与止盈止损

- SecondsAfterMidnightToOpen: 每天午夜后多少秒开始下单,午夜前不受影响。

- TakeProfit: 止盈。

- StopLoss: 止损。

关键优化参数

不同的平台和货币对可以通过优化以下参数来适配。使用不同的货币对可以分散流动性,减少滑点的可能性。默认参数适用于 GBPUSD,其他货币对需要自行优化。未来我们可能提供其他货币对的优化参数。

- FilterLevel: 筛选等级。

- FilterParameter1: 筛选参数 1。

- FilterParameter2: 筛选参数 2。

- RangeLength: 区间长度。

- Order Mode (1-3): 订单模式,模式 2 为平衡订单频率与准确率,模式 1 订单频率高但准确率低,模式 3 则相反。更改模式后,前四个参数需要重新优化。

- Open Vary Restrict (level): 限制开仓的行情振幅,此参数对性能影响较大。

订单注释与其他设置

- Remark: 订单注释。

- Magic: EA 识别号,不要与其他 EA 相同。使用多个货币对时,可以相同也可以不同,EA 会自动识别不同的货币对。

- EA swap: EA 开关。关闭时,EA 停止下单,但仍会管理已有订单,直到平仓。

- Output Commerce Information: 默认关闭。开启后,EA 日志会输出额外信息,如滑点等。但不同平台的显示可能不准确。

[ad_2]