[ad_1]

Two of the first options of any worth chart which might be vital elements for any worth motion dealer to totally perceive, are help & resistance ranges and worth motion occasion zones.

Two of the first options of any worth chart which might be vital elements for any worth motion dealer to totally perceive, are help & resistance ranges and worth motion occasion zones.

You’re in all probability extra accustomed to “help and resistance ranges” since they’re one of many extra fundamental technical evaluation ideas and are fairly simple to grasp.

Nevertheless, worth motion occasion zones (additionally known as occasion areas) are one thing I got here up with years in the past and they also could also be a bit much less acquainted to you. However, they’re equally as necessary as normal help & resistance areas, if no more.

In at this time’s lesson, I needed to take a while to show you about each of those items of the technical evaluation ‘puzzle’ in addition to help you in differentiating between the 2.

An elephant by no means forgets, neither does the market…

Elephants are stated to have among the best recollections within the animal kingdom. The market, additionally has a tremendous ‘reminiscence’ in that main turning factors on a worth chart are likely to carve out ranges and zones that stay related for months and years into the longer term.

What number of occasions have you ever seen a market flip, just about on a ‘dime’, and then you definately zoom the chart out and see that very same stage was additionally a significant turning level a number of years in the past? THESE are the forms of worth motion ‘footprints’ that we NEED to study to comply with and make the most of.

While I’ve written an article about occasion areas earlier than, titled The Market By no means Forgets, I need to reiterate precisely what these necessary areas on the chart are…

An occasion space (or zone) is a major horizontal space on chart the place an apparent worth motion sign shaped OR from which a large directional (up or down) transfer initiated (similar to a large sideways buying and selling vary breakout, for instance). You possibly can and will consider these occasion zones as a “sizzling spots” on the chart; a major / necessary space on a chart that we should always proceed watching fastidiously as worth retraces again to it sooner or later. We’ve an expectation that subsequent time / if worth re-visits these occasion zones, the market will AT LEAST pause and ‘suppose’ about whether or not or not it’s going to reverse route there.

- Occasion zones are key worth motion sign areas or main breakout zones from a key stage or consolidation.

- Assist & resistance ranges are apparent horizontal ranges which might be drawn on a chart connecting bar highs or lows which might be at or close to the identical worth stage. These ranges can stay related on the chart for days, weeks or years, however they’re, general, much less vital than worth motion occasion zones. See my tutorial on how to attract help and resistance ranges for extra.

Worth Motion Occasion Areas

As mentioned above, a worth motion occasion space will stay related effectively after it types. If a market comes again and re-tests these areas, they supply a “sizzling spot” and an excellent opportunity-area to search for a second likelihood commerce entry. So, don’t fear in case you missed the unique transfer from the occasion space, there may be normally one other alternative at an occasion zone and the market will probably be there tomorrow, don’t overlook!

Massive and vital occasions / strikes on the worth charts are remembered and different skilled merchants know this. These previous occasion zones typically change into self-fulfilling turning factors just because so many different merchants anticipate worth to show there and are already ready to purchase or promote at them.

Let’s take a look at some instance charts…

Maybe the simplest option to perceive a “worth motion occasion space” is by a transparent and unmistakable occasion, similar to a pin bar sign. If an apparent worth motion sign types and worth follows-through in settlement with the sign, making a powerful transfer, you now have an occasion space on the stage / space of the sign’s formation.

An necessary level to recollect about that is that in case you miss the unique occasion transfer, don’t fear! You possibly can typically get a second likelihood entry by merely ready for worth to retrace again to that very same occasion space. You don’t even want a worth motion affirmation sign on the retrace both, you’ll be able to enter blindly at an present occasion space. Nevertheless, in case you do get one other clear worth motion sign on the retrace, as within the instance chart beneath, it’s even higher!

The occasion space seen beneath via 1305.00 in Gold, was solidified by each a sign and a breakout. Discover the primary pin bar sign on the chart simply above that stage, then worth ultimately broke down via 1305.00, breaking out, additional hammer-home that this stage was a powerful occasion stage.

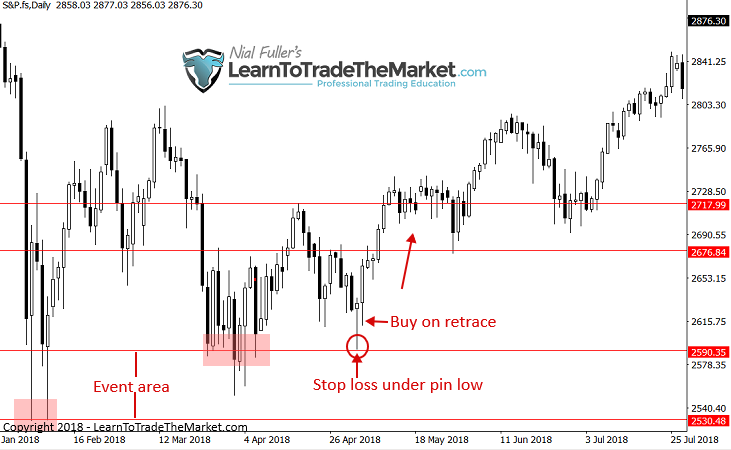

Within the subsequent occasion space instance, we’re trying on the S&P 500 every day chart. Discover that after a robust down-move, a few long-tailed bullish reversal bars shaped in early February, resulting in a robust up-move. The event-zone was cast at that time. We now can watch that space as a “hotspot” on the chart to observe when worth pulls again to it once more.

Discover the pin bar purchase sign that shaped after a pull again to that occasion zone. This was a close to picture-perfect purchase sign as a result of we had the confluence of the event-zone in addition to a well-defined sign.

Assist & Resistance Ranges

Assist and resistance ranges are merely horizontal ranges on the chart that may be drawn throughout bar highs and lows. There will be many help and resistance ranges on a chart, so we primarily take note of the extra vital ones.

I’ve written a number of tutorials on how to attract help and resistance ranges in addition to how professionals draw help and resistance ranges.

Within the instance beneath, discover there may be not apparent worth motion sign and no sturdy breakout from consolidation or a stage. These ranges are simply normal help and resistance ranges being drawn in throughout bar highs and lows.

There are normally many extra normal help and resistance ranges than occasion zones on a chart, even on a every day chart timeframe / increased timeframe. The principle level to grasp about this reality, is that event-zones are extra necessary since they replicate a significant worth occasion, whereas help and resistance ranges will be drawn throughout smaller market turning factors which might be sometimes much less vital. See instance beneath of ordinary help and resistance ranges.

What are the primary variations between the 2?

The distinction between an occasion zone and normal help and resistance stage or space can appear fairly delicate, however there’s a distinction.

The simplest option to put it could be, each event-zone can also be a help or resistance stage / space, however not each help and resistance stage is an occasion zone.

Right here’s how one can differentiate the 2…

An occasion zone has to both have a worth motion sign that led to an enormous transfer OR a significant worth breakout from a consolidation space or stage. Let’s take a look at some chart examples to indicate this extra clearly:

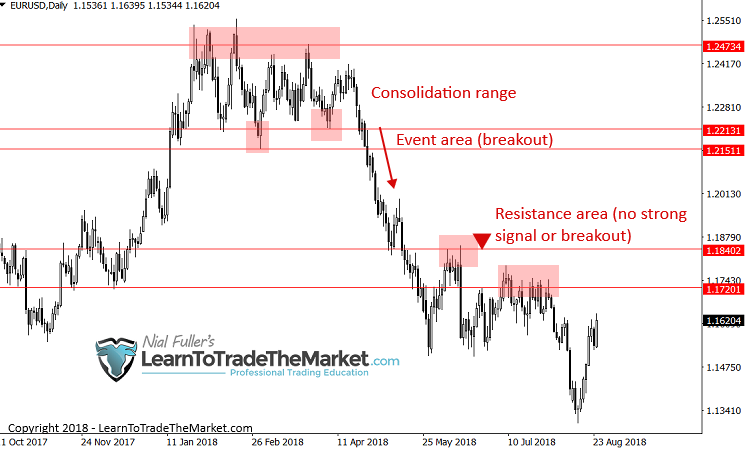

Under, we see a transparent instance of an occasion zone, it was an occasion zone as a result of:

- It was the world on the chart the place a significant breakout occurred. Discover the lengthy consolidation vary earlier than the breakout. Therefore when that breakout lastly occurred, it was a robust worth motion “occasion”. This stage on the EURUSD chart will doubtless stay related effectively into the longer term.

Subsequent, we see a transparent instance of help and resistance ranges drawn on a chart. These are usually not occasion areas as a result of:

- There was no lengthy consolidation previous a breakout.

- There was no sturdy / vivid worth motion sign that kicked off a robust transfer from these ranges.

Occasion zones and help / resistance ranges assist outline commerce threat

One other necessary function and advantage of occasion zones and help and resistance ranges is that they assist us outline our threat on a commerce. Extra particularly, they assist us decide the place to position our cease losses and how you can know when the market has invalidated our commerce concept.

You possibly can clearly place a cease loss simply past a help or resistance stage, as a result of if worth violates that stage, the considering is that the market is altering and your authentic commerce concept is now unlikely to work.

An occasion zone is commonly a extra vital help / resistance space so it’s a good higher barometer of commerce threat than an ordinary stage. If a market breaks previous an occasion zone, you KNOW your commerce concept will not be working and market sentiment is severely shifting.

In case you have a transparent worth motion sign / sample at an occasion zone, you’ll be able to fine-tune your threat much more, as a result of these indicators are sometimes very-high chance and therefore we are able to place our cease loss on the excessive or low of the sign and sometimes we are able to then enter on a retrace of the sign, on what I name a commerce entry trick, which permits for big potential threat reward trades:

Conclusion

Turning into a proficient worth motion dealer is all about studying to skillfully interpret and correctly make the most of the footprint of cash on the chart, this footprint is left behind as the worth motion performs out over time.

There are numerous ‘instruments’ in a worth motion merchants toolbox and the instruments that I train in my skilled buying and selling programs are (clearly) what I really feel are an important ones. Worth motion occasion zones in addition to normal help and resistance ranges are simply as necessary as studying particular person worth motion indicators and patterns. Occasion zones and help and resistance ranges play the vital position of serving to you to grasp the general chart context and market dynamics {that a} explicit commerce has shaped inside. It’s THIS interaction between the precise commerce sign / entry itself and the general market situations it types inside, that constitutes a high-probability buying and selling alternative. Not merely “Oh, there’s a pin bar, I’ll commerce it”.

It may possibly take years of display time and expertise to fine-tune your capacity to grasp and correctly commerce with all of the completely different items of the worth motion “puzzle”. Nevertheless, studying from tutorials like this one in addition to getting a extra structured worth motion buying and selling training will go a good distance in decreasing the educational curve and shortening the time required to change into a grasp worth motion dealer.

I REALLY WANT TO HEAR YOUR FEEDBACK IN THE COMMENTS BELOW 🙂

[ad_2]