[ad_1]

Managing payroll is certainly one of small companies’ most complex and time-consuming duties. With numerous laws, ever-changing tax regulation, and sophisticated worker classifications, payroll administration is a problem that requires razor-sharp precision.

Even one small mistake in calculating wages, submitting taxes or making certain compliance can result in pricey penalties and monetary dangers. The IRS discovered that just about 40% of small companies within the US get hit with a median penalty of $845 annually for payroll errors.

As a enterprise proprietor, your time is gold. That’s why outsourced payroll companies for small companies are non-negotiable. With the assistance of skilled service suppliers, you possibly can streamline your monetary operations, keep away from pricey errors, and release useful time to concentrate on extra strategic initiatives.

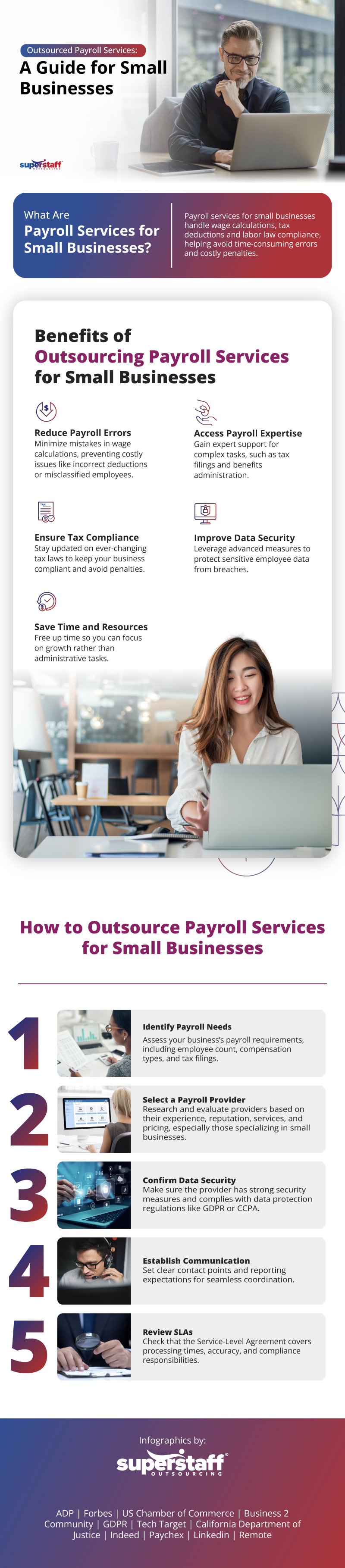

In case you’re seeking to improve your operations with accounting and payroll companies tailor-made for small companies, make sure you try the information within the infographic beneath!

What Are Payroll Providers for Small Companies?

Small enterprise accounting and payroll companies deal with duties like wage calculations, tax deductions, and labor regulation compliance. Leveraging cutting-edge AI and automation, service suppliers streamline tax filings and direct deposits, serving to you pay your workers precisely and on time.

Managing this in-house could be difficult, particularly with guide processes, sophisticated tax filings and compliance dangers. Any mistake can simply result in pricey penalties that might harm worker belief.

With out devoted HR or accounting departments, dealing with payroll in-house can distract from what actually issues—rising your corporation. Outsourcing payroll offers an economical resolution and skilled steering that may hold you compliant, reduce errors, and release your time to concentrate on success.

Advantages of Outsourcing Payroll Providers for Small Companies

On-line payroll companies for small companies may give you many benefits whenever you associate with the correct supplier. With this service, you possibly can:

Cut back Payroll Errors

Payroll errors usually are not solely irritating but additionally costly. Even minor errors can result in substantial monetary penalties. Thankfully, outsourcing to specialised suppliers who use automated, exact techniques can drastically scale back the probability of such errors.

Small enterprise on-line payroll companies typically combine superior know-how to mechanically calculate taxes and guarantee correct payroll computations.

Guarantee Tax Compliance

Compliance with payroll tax legal guidelines is a typical concern for small companies, primarily as a result of laws change incessantly. Every year, the IRS points hundreds of thousands of employment tax penalties on account of errors in reporting, depositing or submitting payroll taxes.

A specialised payroll supplier helps guarantee compliance with native, state and federal legal guidelines, avoiding pricey penalties and authorized repercussions. In accordance with a Nationwide Small Enterprise Affiliation survey, 45% of small companies outsource payroll to alleviate administrative burdens and enhance accuracy.

With payroll small enterprise companies, you profit from up-to-date experience and the reassurance that they file all varieties accurately and on time.

Save Time and Assets

Managing payroll in-house could be laborious, particularly for small companies with restricted administrative workers. In accordance with the Nationwide Small Enterprise Affiliation, one-third of small enterprise house owners spend greater than six hours month-to-month on payroll-related duties.

Small enterprise payroll service suppliers mean you can reclaim this time and concentrate on core actions like rising your corporation, bettering customer support, or growing new merchandise. Not solely does this save time, however it additionally reduces overhead prices related to hiring and coaching workers to handle payroll.

Entry Payroll Experience

If you outsource payroll, you acquire a staff of pros with specialised information in payroll administration. Their experience can change the sport for small companies missing the sources to rent in-house consultants.

Payroll suppliers that provide back-office outsourcing companies work with consultants who deeply perceive tax regulation, advantages administration and wage laws. This helps hold payroll operations easy and prevents potential points from escalating.

Enhance Information Safety

Information safety is vital for any enterprise that handles delicate worker data reminiscent of social safety numbers, financial institution particulars, and private contact data. Sadly, many small companies don’t have the means to supply safety to guard this information from breaches or cyberattacks.

It’s an excellent factor they will depend on payroll service suppliers for small companies. These suppliers spend money on strong safety measures, together with encryption and multi-factor authentication, to defend this information. By outsourcing payroll, you possibly can relaxation assured that industry-leading safety protocols shield your delicate data.

Now that you realize the advantages that payroll service suppliers give your small enterprise, how do you discover the correct one for you? The next part tackles pointers on how one can outsource your payroll.

How you can Outsource Payroll Providers for Small Companies

Outsourcing payroll doesn’t finish with handing off administrative duties; it additionally entails deciding on the correct associate and making certain you align together with your plans and expectations. Right here’s how you can get began:

1. Establish Payroll Wants

Begin by taking inventory of your particular payroll necessities. You should take into account many components, such because the variety of workers, pay frequency, and particular tax obligations. Understanding these components helps you select a supplier that may deal with your corporation’s distinctive calls for, whether or not it’s multi-state tax compliance or worker advantages administration.

If your corporation affords totally different fee constructions, reminiscent of hourly wages or commissions, ensure the supplier can accommodate these wants. Contemplate whether or not you want full-service payroll administration or focused help with duties like tax submitting. Getting this readability upfront ensures your partnership is ready up for fulfillment.

2. Choose a Payroll Supplier

Selecting the best payroll supplier is essential for a easy partnership. Search for payroll companies with a demonstrated observe report in your {industry} and expertise working with companies your measurement. Testimonials and case research are a strategic option to measure their carry outance in comparison with rival firms and assess buyer satisfaction.

Pricing is one other essential consideration—select a supplier that provides packages inside your price range, reminiscent of SuperStaff.

As a trusted outsourced customer support supplier within the Philippines, we may help you discover a payroll associate that matches your organization’s wants, together with tax submitting, direct deposit choices and worker self-service portals.

3. Affirm Information Safety

Payroll entails dealing with delicate worker information, like social safety numbers and checking account particulars, so safety is non-negotiable. Make sure that your supplier complies with information safety laws like GDPR or CCPA.

Scrutinize their safety measures, together with the usage of encrypted techniques, multi-factor authentication, and different safeguards to guard delicate information. Many payroll firms now use cloud-based techniques with enhanced safety protocols, lowering the danger of information breaches.

4. Set up Communication

Open communication is the spine of any profitable outsourcing partnership.

You need to arrange designated contact factors for your corporation and the payroll supplier and clearly outline reporting timelines. Common updates, whether or not by way of emails or messaging functions like Slack, assist handle points earlier than they escalate so payroll runs easily.

Routine check-ins with the supplier can even enable you keep knowledgeable of any payroll discrepancies or regulation adjustments which will have an effect on your corporation.

5. Evaluation SLAs

Earlier than finalizing your partnership, it’s essential to overview and signal a Service-Stage Settlement (SLA). The SLA outlines vital elements reminiscent of service timelines, accuracy ensures, penalties for non-compliance and information safety protocols.

Reviewing SLAs ensures that each events clearly perceive their expectations and duties, serving to to stop potential misunderstandings.

FAQs About Outsourced Payroll Providers for Small Companies

How A lot Do Payroll Providers Price for a Small Enterprise?

Payroll companies for small companies can value about $30 to $100 per thirty days, relying on the supplier and particular companies you want. In case your payroll wants are extra advanced—like dealing with frequent payrolls, tax filings, or a bigger staff—you might even see extra prices. However the comfort and peace of thoughts are finally price it!

Is Payroll Outsourcing Secure?

Sure, payroll outsourcing is mostly protected. If you outsource to a good payroll supplier, your information is in protected palms. Prime suppliers observe strict safety protocols, together with encryption and multi-factor authentication, to safe delicate worker data.

Search for companies that adjust to laws reminiscent of GDPR or CCPA to safeguard delicate worker data.

Can Payroll Providers Deal with Multi-State Taxes?

Sure, many payroll service suppliers concentrate on multi-state tax filings, which could be significantly advanced for small companies with workers in numerous states. When searching for a associate, make sure you test their web site or inquire instantly about this service. Ensure additionally to test whether or not they supply multilingual buyer help for smoother communication.

Take the Stress Out of Payroll

Managing payroll is a kind of must-do duties that may drain your time and vitality. But it surely doesn’t should be a burden. Outsourcing payroll companies may help scale back errors, guarantee compliance with advanced tax legal guidelines, save useful time and sources, present skilled steering and enhance information safety.

This strategic strategy permits small enterprise house owners to concentrate on their core competencies whereas leaving payroll administration to professionals.

In case you’re able to streamline your payroll course of and allocate extra time to enterprise actions, take into account outsourcing to the Philippines with a trusted supplier like SuperStaff. We will match you with nearshore name facilities focusing on back-office features, together with payroll companies, serving to your corporation keep compliant and environment friendly.

Contact us as we speak to discover how outsourcing can help your development and success.

[ad_2]