[ad_1]

At present I current you an outline of trades made utilizing the Owl technique – good ranges for the EURUSD, GBPUSD and AUDUSD forex pairs for the week from October 28 to November 1, 2024.

For comfort and well timed receipt of indicators I exploit the Owl Sensible Ranges Indicator. The principle buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to substantiate the development route of the upper timeframe.

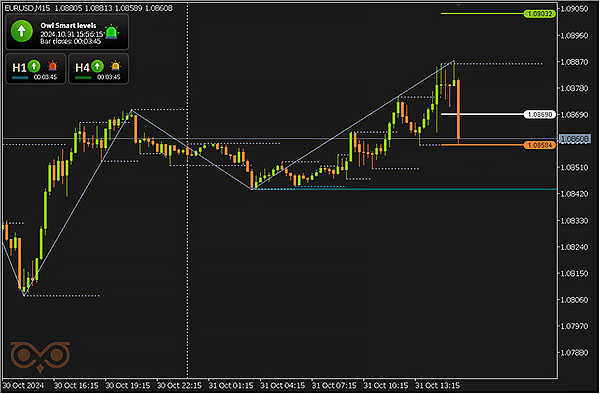

EURUSD assessment

The primary commerce on this forex pair was opened by the Owl sign on Thursday at 15:45 and was closed at StopLoss with a lack of 15$.

Fig. 1. EURUSD BUY 0.14, OpenPrice = 1.108690, StopLoss = 1.108584, TakeProfit = 1.09032, Revenue = -$15.00.

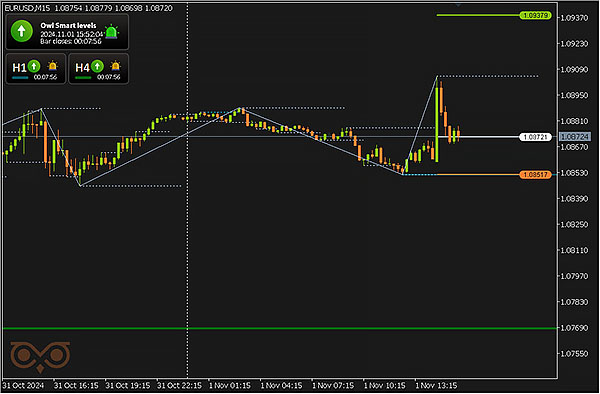

The second commerce on this instrument was opened on Friday at 15:15. In accordance with the technique, the commerce was opened with a better threat – 1.75%. The danger for the primary commerce is ready at 1.5% and if the commerce is closed with a loss, the chance is elevated by 0.25%. The commerce was closed once more at StopLoss with a lack of $17.

Fig. 2. EURUSD BUY 0.09, OpenPrice = 1.08721, StopLoss = 1.08517, TakeProfit = 1.09379, Revenue = -$17.50.

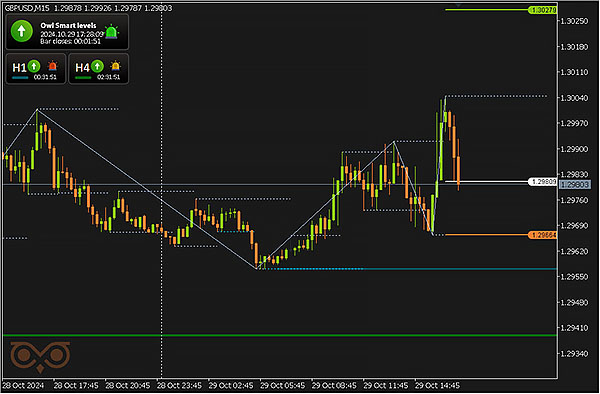

GBPUSD assessment

The primary commerce on this forex pair was opened by the Owl sign on Tuesday at 17:15 and was closed in response to the rule of liquidation of all trades after 23:00 with a revenue of 33$.

Fig. 3. GBPUSD BUY 0.10, OpenPrice = 1.29809, StopLoss = 1.29664, TakeProfit = 1.30279, Revenue = $33.52.

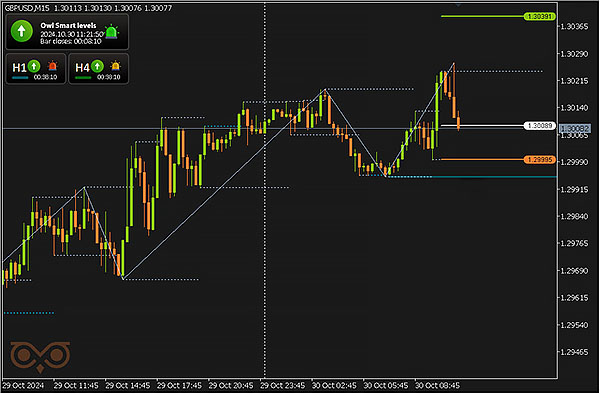

The second commerce on this instrument was opened by the Owl sign on Wednesday at 11:15 and was closed at StopLoss with a lack of 15$.

Fig. 4. GBPUSD BUY 0.16, OpenPrice = 1.30089, StopLoss = 1.29995, TakeProfit = 1.30391, Revenue = -$15.00.

AUDUSD assessment

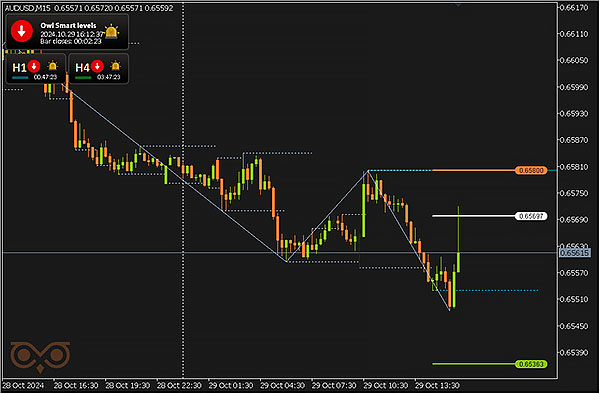

The primary commerce on this forex pair was opened by the Owl sign on Tuesday at 16:00 and was closed in response to the rule of liquidation of all trades after 23:00 with a revenue of 15$.

Fig. 5. AUDUSD SELL 0.15, OpenPrice = 0.65697, StopLoss = 0.65800, TakeProfit = 0.65363, Revenue = $15.44.

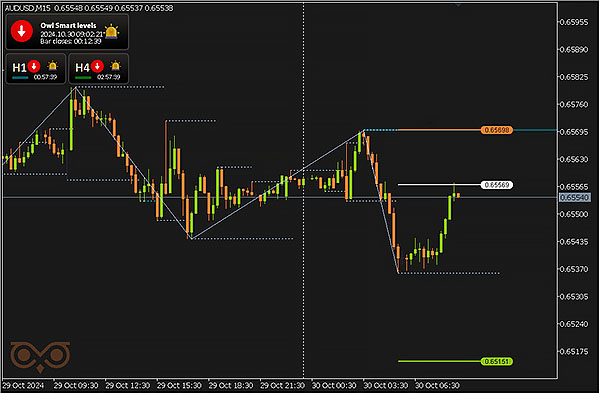

The second commerce on this instrument was opened by the Owl sign on Wednesday at 08:45 and closed at StopLoss with a lack of 15$.

Fig. 6. AUDUSD SELL 0.12, OpenPrice = 0.65569, StopLoss = 0.65698, TakeProfit = 0.65151, Revenue = -$15.00.

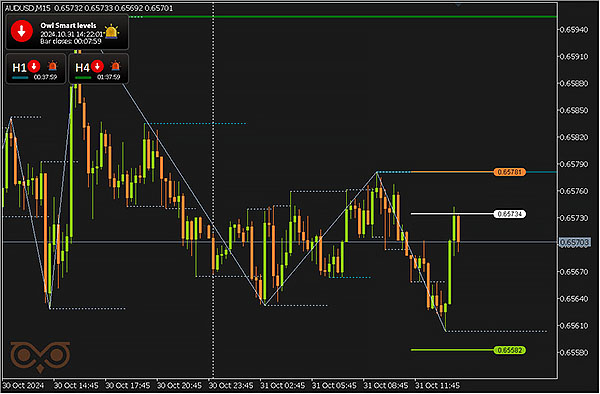

The third commerce on this forex pair was opened by the Owl sign on Thursday at 14:00. In accordance with the technique, the commerce was opened with a better threat – 1.75%. The danger for the primary commerce is ready at 1.5% and if the commerce is closed with a loss, the chance is elevated by 0.25%. The commerce was closed at TakeProfit with a revenue of 56$.

Fig. 7. AUDUSD SELL 0.37, OpenPrice = 0.65734, StopLoss = 0.65781, TakeProfit = 0.65582, Revenue = $56.60.

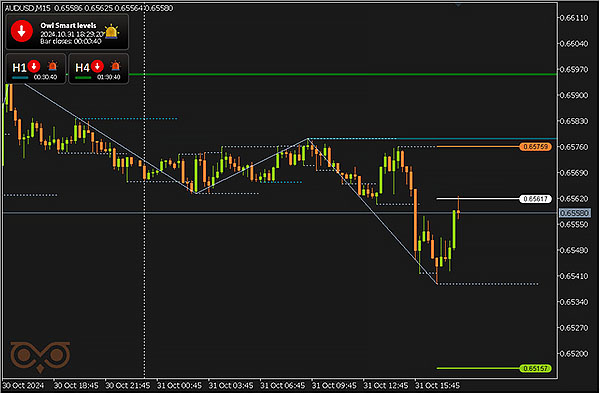

The fourth commerce on this instrument was opened on Thursday at 18:15 and closed by the rule of arrow reversal of the primary timeframe with a lack of 1$.

Fig. 8. AUDUSD SELL 0.11, OpenPrice = 0.65617, StopLoss = 0.65759, TakeProfit = 0.65157, Revenue = -$1.27.

Abstract:

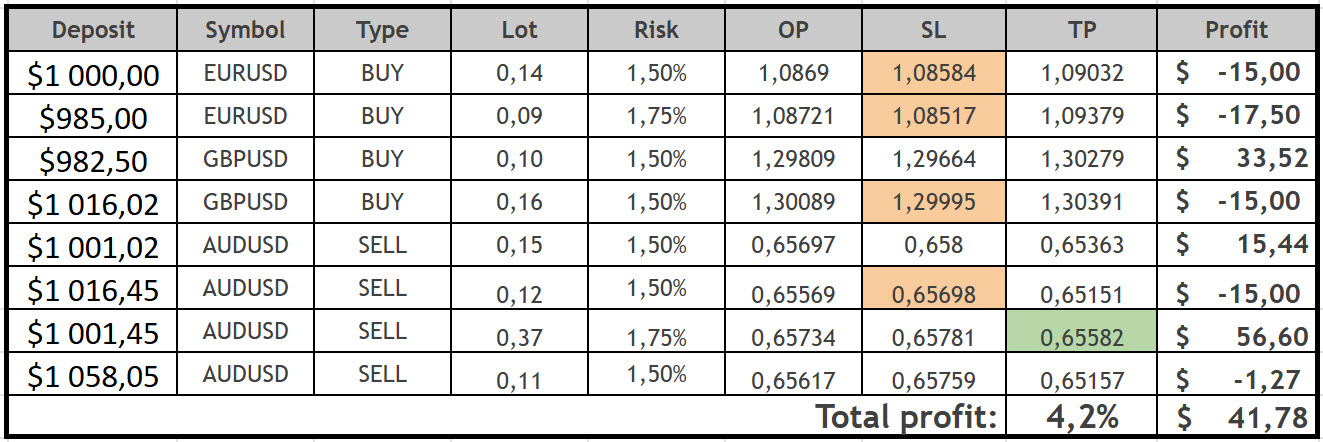

There have been 8 trades over the past buying and selling week, the whole stability is optimistic. The Owl Sensible Ranges indicator and the buying and selling system developed on its foundation have proven their effectivity in buying and selling and introduced revenue – 4.2%. The detailed information are within the ultimate desk.

See different critiques of the Owl Sensible Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]