[ad_1]

On 17 January 2024, we appeared on the prevailing gold (XAU/USD) market developments, exploring historic developments and the important thing elements influencing the value of the valuable steel. We performed a technical evaluation of the value chart and uncovered knowledgeable opinions on the gold value outlook for 2024.

You’ll be able to go to the RoboForex Market Evaluation webpage for the most recent Gold (XAU/USD) forecasts.

Historic evaluation of XAU/USD costs

Allow us to check out the gold value efficiency during the last 140 years:

- Since 1887, through the gold commonplace interval, the US authorities mounted the gold value at 20.67 USD per troy ounce. After abandoning the gold commonplace and devaluing the greenback in 1933, the price of an oz elevated to 35 USD and remained at this stage till 1967

- Later within the Seventies, gold costs elevated considerably resulting from worldwide financial and geopolitical instability. From 1971 to 1980, quotes skyrocketed by over 1600%, from 35 to 800 USD per ounce

- Within the Nineteen Eighties-Nineties, gold costs corrected downwards as the worldwide and US economies skilled a interval of relative stability, with declining oil costs

- Within the 2000s, the value stage remained comparatively steady till the 2008 monetary disaster, when quotes soared once more from 800 to over 1,900 USD per ounce in 2011. The surge in costs and the top of the disaster had been adopted by a powerful downward correction in direction of 1,100 USD

- From 2012 to 2020, the worldwide economic system and inventory markets confirmed regular development, with gold buying and selling inside a sideways value vary from 1,100 to 1,400 USD per ounce

- In 2020, pushed by the COVID-19 disaster, gold quotes resumed their upward motion, surpassing 2,000 USD per ounce

- In December 2023, amid rising inflation and geopolitical turbulence, the gold ounce set an all-time value document of two,150 USD

Regardless of the excessive rates of interest of the central banks, many traders desire to take a position their funds in gold. This steel is a safe-haven asset amid rising inflation and the present financial and geopolitical instability.

Key elements influencing XAU/USD

- Financial indicators. This contains inflation, rates of interest, unemployment, GDP, and different financial knowledge. For instance, a excessive inflation price and financial instability could enhance the demand for gold as a retailer of worth

- Geopolitics. Traders historically think about gold a safe-haven asset towards dangers and uncertainty throughout wars, conflicts, sanctions, political and geopolitical instability, and tensions. Demand for gold sometimes will increase throughout such intervals

- New monetary know-how. For instance, the event of the cryptocurrency market could negatively have an effect on the demand for the valuable steel. Traders would possibly spend money on digital property as a substitute of gold, lured by the potential for prime returns

- US greenback trade price. As international gold costs are set within the USD, the US forex trade price fluctuations might also affect the value of the valuable steel. Gold costs usually fall when the US greenback strengthens because it turns into costlier for patrons. Conversely, with a weak USD, gold costs could also be on the rise

- Provide and demand. The valuable steel’s value could improve, propelled by robust demand, for instance, from central banks, traders, and jewelry corporations, or decreased provide triggered, as an example, by mining restrictions or a scarcity of recent deposits

2023 XAU/USD value market outlook

2023 noticed a long-term development development in gold costs, with a mean value of 1,950 USD per ounce. Beginning the yr on the 1,823 USD mark, quotes traded inside a value vary of 1,805 USD-2,150 USD all through 2023. A brand new all-time excessive of two,150 USD per ounce was reached in December 2023.

Geopolitical tensions, navy conflicts, financial turbulence, and a worldwide inflation surge drove gold quotes’ development in 2023. The speed hike coverage pursued by the Federal Reserve and different central banks and the strengthening US greenback acted as headwinds. The value decreased after reaching an all-time excessive, displaying indicators of a downward correction.

2023 XAU/USD value market outlook*

Technical evaluation of XAU/USD developments

Allow us to look at a weekly chart to analyse the present development and the mid-term outlook for the value of the valuable steel. On the time of writing, XAU/USD quotes hovered close to 2,020 USD per ounce.

Since April 2020, they’ve been transferring inside a broad sideways vary, with the decrease boundary at 1,611 USD-1,615 USD and the higher one at 2,070 USD-2,078 USD. The value broke above the vary’s higher boundary in December 2023 however pulled again, failing to achieve a foothold above 2,078 USD. Consequently, a ‘false breakout’ technical construction has shaped on the chart.

Though gold has been experiencing a gradual uptrend confirmed by the Alligator and 200-day SMA indicators, there’s a excessive probability {that a} downward correction could develop within the medium time period. This may be supported by a closing value drop under the psychological threshold of two,000 USD.

A decline goal could also be a significant help space of 1,805 USD-1,810 USD. If the quotes break above 2,078 USD once more and set up themselves there, a corrective state of affairs will possible be cancelled. Subsequently, the uptrend will most likely be anticipated to proceed, with the value hitting an all-time excessive of two,150 USD.

Technical Evaluation of XAU/USD Developments*

Professional XAU/USD value predictions for 2024 and past

- UBS International forecasts that gold costs will rise to 2,250 USD per ounce by the top of 2024

- Based on Saxo Financial institution’s specialists, the valuable steel quotes will attain the two,300 USD mark in 2024

- J.P. Morgan expects gold costs to face at 2,175 USD by mid-2024 amid potential price cuts by the Federal Reserve

- Based on Pockets Investor, the quotes will hover at 2,058 USD by the top of 2024, rising to 2,104 USD by December 2025

- The Financial system Forecast Company (EFA) analysts counsel that the valuable steel value will climb to 2,158 USD by the top of 2024 and proper to 2,019 USD in December 2025

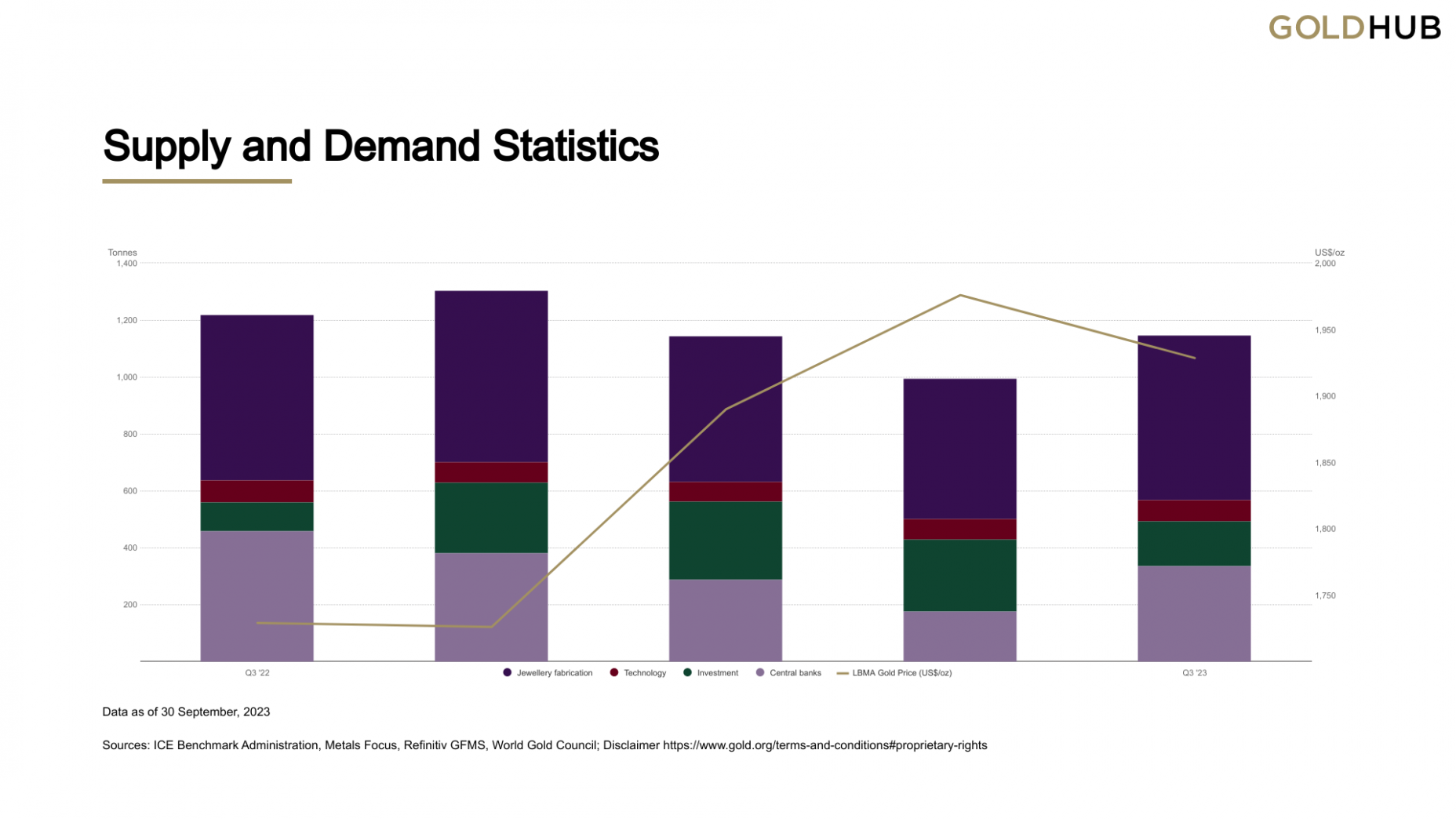

International demand and provide dynamics for gold in 2023

Based on the Q3 2023 survey by the World Gold Council (WGC), international gold demand and provide confirmed the next efficiency:

- Demand was 8% larger than a five-year common, reaching 1,147 tonnes. Whole demand, together with OTC provides, was up 6% from 2022 at 1,267 tonnes

- Central financial institution shopping for was 337 tonnes, falling wanting the document 459 tonnes in Q3 2022. Nonetheless, because the starting of 2023, demand from central banks is 14% larger than in the identical interval of 2022, coming in at a document 800 tonnes

- Bar and coin investments decreased by 14% in comparison with the Q3 2022 outcomes, right down to 296 tonnes, though remaining firmly above the quarterly common of 267 tonnes. A decline from 2022 is attributed to a droop in European gross sales

- Jewelry purchases had been down 2% y/y to 516 tonnes amid rising gold costs. Jewelry fabrication sank by 1% to 578 tonnes resulting from a rise in inventories

- Mine manufacturing reached a document 971 tonnes in Q3, marking a 6% improve from the corresponding interval in 2022. Recycling was additionally larger than in 2022, up 8% to 289 tonnes

Methods for buying and selling XAU/USD

Numerous monetary devices comparable to futures, choices, ETFs, CFD contracts, and spot can be utilized for buying and selling gold.

Lengthy-term buying and selling – investing

The underlying precept of this technique is to purchase an instrument firstly of a brand new development wave attributable to basic elements, anticipating it to achieve peaks once more or set new highs. This technique is comparatively easy however requires endurance to await the projected income.

Particular ETFs are sometimes used for investments. Gold ETFs had been created to allow investments in gold with out having to purchase, hold, and handle the valuable steel itself. As an alternative, traders should purchase and promote shares of a gold ETF on a inventory trade, just like inventory buying and selling. One of many largest ETFs like that is SPDR Gold Shares (GLD), with property beneath its administration amounting to 58.27 billion USD in January 2024.

Quick and medium-term buying and selling

This buying and selling sometimes includes leverage. Quick-term buying and selling methods purpose to maintain a place from one to a number of days, whereas medium-term ones preserve it from a number of days to 1 or two months. Buying and selling varieties comparable to swing buying and selling, day buying and selling, and scalping can be utilized for gold buying and selling.

Other than basic elements, the decision-making relies on a technical evaluation. Assist/resistance ranges and contours, value patterns, candlestick mixtures, value motion patterns, and indicator alerts – all these and different instruments assist discover promising buying and selling alternatives.

The principle precept of such buying and selling is to enter a place utilizing leverage (for instance, primarily based on a technical evaluation sample that has shaped), having small targets and controlling dangers.

Abstract

Gold stays a beautiful funding instrument as it’s believed to be a dependable retailer of worth over the long run. In 2023, the value reached an all-time excessive of two,150 USD per ounce, pushed by rising inflation, geopolitical tensions, and the top of the Federal Reserve’s financial tightening cycle.

Whereas the valuable steel chart reveals indicators of a downward correction firstly of 2024, the long-term uptrend persists. Specialists count on gold quotes to proceed their upward trajectory in 2024 amid potential price cuts by the Federal Reserve, geopolitical tensions, and persisting robust demand from central banks. The forecasts vary from 2,058 to 2,300 USD per ounce.

FAQ

XAU is the forex code used to indicate one troy ounce of gold within the international monetary markets. This code is derived from the periodic desk of parts, the place ‘Au’ is the image for gold. The ‘X’ in entrance signifies that gold just isn’t a nationwide forex however a commodity. This coding system is standardised by the Worldwide Group for Standardization (ISO) for treasured metals.

Numerous elements, together with international financial stability, inflation charges, US greenback power, rate of interest selections by main central banks just like the Federal Reserve, geopolitical tensions, and demand for gold in jewelry and know-how, affect the value of XAU/USD. Moreover, market sentiment and funding developments can play important roles within the fluctuation of gold costs.

Specialists counsel that XAU/USD costs in 2024 can be within the vary of two,058 USD-2,300 USD per troy ounce.

Deciding to spend money on gold will depend on your particular person monetary targets, danger tolerance, and funding portfolio. Gold is usually thought of a ‘safe-haven’ asset that may diversify your portfolio and hedge towards inflation and forex devaluation. Nevertheless, like all funding, it carries dangers, and its value could be risky. It’s advisable to seek the advice of with a monetary advisor to find out if investing in gold aligns along with your general funding technique.

A number of strategies for investing in gold embody bodily gold, mutual funds, ETFs, futures, CFDs, and extra. For extra detailed info, please discuss with our publish “Tips on how to Put money into Gold“.

* – The TradingView platform provides the charts on this article, providing a flexible set of instruments for analyzing monetary markets. Serving as a cutting-edge on-line market knowledge charting service, TradingView permits customers to have interaction in technical evaluation, discover monetary knowledge, and join with different merchants and traders. Moreover, it offers precious steerage on the right way to learn foreign exchange financial calendar successfully and gives insights into different monetary property.

[ad_2]