[ad_1]

Did you ever see these Magic Eye posters that had been in style within the 90’s that had a hidden picture inside the image and also you needed to modify your eyes excellent and stand a sure distance away from the image to see the picture?

Did you ever see these Magic Eye posters that had been in style within the 90’s that had a hidden picture inside the image and also you needed to modify your eyes excellent and stand a sure distance away from the image to see the picture?

I personally keep in mind loving these as a child and I actually don’t know what occurred to them, however once I first began considering of immediately’s lesson these footage got here to my thoughts. That’s as a result of similar to these footage, the market accommodates a “hidden” message that solely these educated within the artwork and talent of value motion buying and selling will have the ability to see correctly. To the common individual taking a look at a value chart, they are going to see a bunch of seemingly random bars that imply nothing, however the value motion dealer sees the message that the footprint of cash (value motion) on the charts is telling them.

On this lesson, we’re going to focus on how one can begin seeing the hidden messages out there and what they imply.

Listening to The Market and Listening to What It’s ‘Saying’

To be able to hear what the market is making an attempt to inform you, it’s essential to first know precisely what to pay attention for. What you’re listening for are value motion clues, left behind because the “story” of the market performs out throughout a chart. And similar to studying a guide, to ensure that the present “web page” to make sense, you must know what occurred earlier than, so meaning you must know how one can analyze the previous value motion to make sense of the present value motion and use that to make an informed prediction about what MIGHT occur subsequent.

You see, any single bar, by itself, actually means nothing. It’s the bar COMBINED with the encompassing market construction or context that paints the image of that marketplace for you. When you begin following a market lengthy sufficient you’ll start to understand it intimately and begin to get a intestine really feel for it, this comes with time, nevertheless it’s really what “listening to the market” is all about.

Now, HOW EXACTLY do you hearken to the market and “HEAR” what it’s making an attempt to inform you? You do that by value motion evaluation and I’m going to present you some particular examples of this beneath…

The charts are the market’s means of “talking” to us, however should you don’t know what to pay attention for, the message will go proper over you head. Let’s check out a few of the primary items of the value motion language of the market…

Current Value Habits and Market Circumstances

The primary main message you could study to listen to on the charts is whether or not or not the market is trending. Whether it is trending, that’s very, superb for you as a result of pattern buying and selling is totally the best solution to earn a living within the markets. If it’s not trending then it’s most likely consolidating both in a big buying and selling vary (which could be good to commerce) or a really small and extra random buying and selling vary (uneven and never good to commerce normally). This is a crucial factor to study to decipher early-on as a result of it actually dictates which path you’re trying to commerce and what you’re general method must be to that market in that situation.

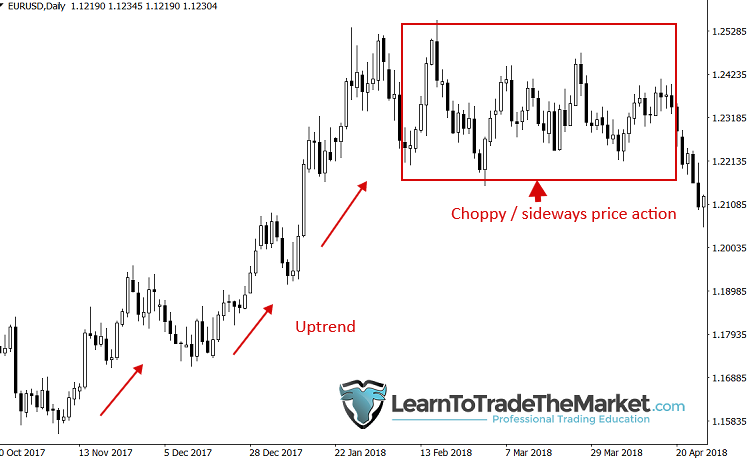

Discover within the chart beneath that value moved from a interval of uneven / sideways (small vary) value motion to a powerful breakout, then a pull again to the buying and selling vary midpoint, earlier than an uptrend took maintain and carried value larger for months…

On this picture, value was trending larger aggressively earlier than pausing and coming into an extended interval of sideways value motion. Clearly, the trending durations had been a lot simpler to commerce and extra fruitful. But, many merchants proceed to commerce (and lose their cash) as a result of they don’t know how one can interpret the language of value motion correctly, which was clearly telling them the market was coming into a interval of harder to commerce PA.

Key Ranges and “Good” vs. “Imperfect” Technical Evaluation

Maybe the subsequent most vital “message”the market can ship you is HOW value is reacting / behaving round key chart ranges. Generally, a market will respect close by ranges very, very properly (nearly precise and even precise in lots of instances). Generally, not a lot. I favor to commerce markets which might be respecting key ranges as a result of that tells me that for no matter motive, this would possibly proceed within the close to future. When you establish these ranges you possibly can then anticipate high-probability value motion alerts to kind at them. Nevertheless, if value just isn’t respecting ranges very properly, you might wish to keep away from that marketplace for now.

How value reacts round apparent key ranges is extraordinarily vital; are we technically ‘excellent’ in the mean time or are the technicals messier and imperfect?

False-Breaks of Key Ranges and Contrarian Indicators

Human nature and are mind wiring makes most individuals actually, actually unhealthy merchants. It’s as a result of after we have a look at a chart and we see it going up, we FEEL prefer it’s going to maintain going up, however that is normally concerning the time it’s going to go down once more, lol. It may be very, very irritating to the newbie or to the dealer who doesn’t but perceive how one can pay attention and HEAR what the value motion is telling them. As soon as factor I’ve written about extensively each on my weblog and in my buying and selling programs, is how you must commerce like a contrarian to revenue out there. There are value motion clues that tip us off to when a contrarian transfer is underway and value is about to move again the other way. One in all them is a false break of a stage and naturally there may be the fakey buying and selling technique as properly. These are a few of my favourite patterns to commerce as a result of it exhibits the underlying market psychology and is a robust clue as to what would possibly occurs subsequent.

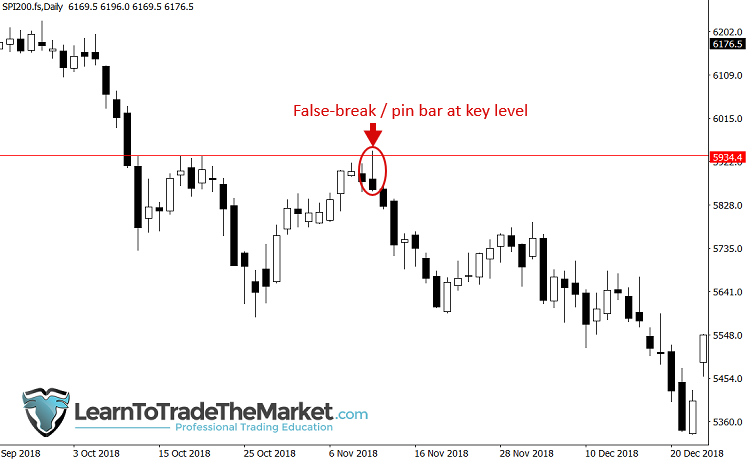

Observe, within the chart beneath value made a false-break of resistance earlier than reversing decrease once more in aggressive trend.

Failed Value Motion Indicators Are Superior. Wait, What?

Ah, the failed value motion sign, sure they are often painful and certainly generally a commerce merely doesn’t work out, that’s a reality of buying and selling you must take care of by correct danger administration. BUT, (you knew a however was coming) generally failed value motion alerts could be very highly effective alerts themselves. For instance, should you see value violate the excessive or low of a selected sign that you just thought was going to have the alternative final result, ask your self what’s that telling you? What’s the MARKET TRYING TO TELL YOU???

Don’t over-think it. When you see a value motion sign fail, that may be a robust clue that value could maintain shifting in that very same path…

Occasion Areas and Current Worthwhile Value Motion Indicators

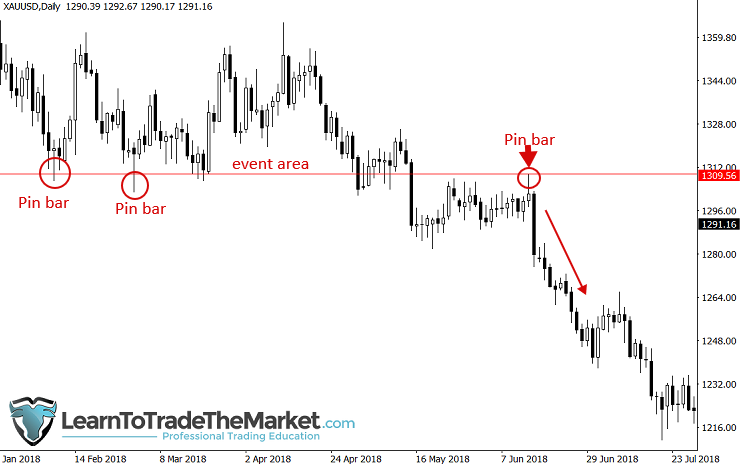

When you don’t know what are occasion areas, I counsel you learn my lesson on the subject, as a result of they’re essential message areas that the market desires you to look at. While you see a number of value motion alerts that labored out coming from the identical or related space, you’ll have an occasion space, and should you see one other sign at that space, it’s a really robust sign to think about.

Discover the pin bars this stage, when the final one on the best fashioned you missed out on a vastly worthwhile transfer should you didn’t know how one can interpret the message the market was providing you with…

I Want You to Assume Past the Precise Act of Buying and selling

Technical Evaluation is a language and we have to interpret that language if we wish to have an opportunity at long-term, on-going buying and selling success.

Like most rich enterprise individuals will inform you; a variety of listening, hear what others need to say and collect suggestions, then decide. It’s usually stated ‘”Be the final man within the room to talk”; a cliche enterprise phrase from most enterprise management books, nevertheless it occurs to be true. Translated into the buying and selling world, we will ‘pay attention’ to the markets message after which let the market present us what it desires to do, then we use that gathered suggestions to kind our opinion, make a plan after which act accordingly.

Nevertheless, it’s extra than simply “listening to the message”, you must mix the messages the market is sending you (see above examples) and formulate these messages into the ‘story’ being informed on the chart from left to proper. You wish to paint a visible “map” by annotating the technical components in your charts similar to I do in my weekly market commentary.

We use the message to each take trades AND to keep away from trades and to develop a common really feel of market circumstances, very like studying the climate and forming forecasts. You’re not performing on each forecast you make however a few of them would possibly show very helpful for planning what you’ll do subsequent.

In that vein, you wish to act on the clearest messages and act on the strongest market forecasts solely, the messages we interpret usually are not merely what I’d usually train as confluence of things. The idea of “listening to the market’s messages” actually is one thing higher than simply recognizing a commerce setup. We’re speaking about listening to the message the market is telling us concerning the good cash, with that data we will decipher many many issues, we’re going far past the thought of “hey I can see 1 + 2 issues, so now I have to take motion.” When you attain a sure level in your value motion mastery, you’ll being to really feel just like the market is definitely “chatting with you” and telling you what to do fairly than you making an attempt to inform it what to do (which by no means works fyi).

Conclusion

My buying and selling method relies round watching charts day by day and deciphering the messages being broadcast from the market. We have to be there to pay attention for it, map it and interpret it. Consider it as studying a web page in a guide every single day. Within the buying and selling world, meaning on the New York shut every single day Monday to Friday, I’m there listening to the message being broadcast (i.e. studying the value motion, mapping the charts and deciphering its hidden message). Nevertheless, that doesn’t imply that I’m sitting there ALL day staring on the charts. I’ve my deliberate instances to examine the markets every day and if I’m not “listening to” something from the charts that day then I neglect about them till tomorrow. I don’t sit there making an attempt in useless to “drive” one thing that isn’t there

9 instances out of ten I don’t take motion, however that one day trip of ten that I do take motion I’m pulling the “set off” on the commerce like a lethal sniper ready to take the “kill shot” as soon as the correct commerce setup is in focus. If you wish to study extra about listening to what the market is saying and studying to interpret it successfully, take a look at my skilled buying and selling course for extra data.

Please Go away A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.

[ad_2]