[ad_1]

There are a number of the reason why you might must fill out a verify. For example, some companies offers you a reduction for writing a verify as an alternative of swiping a card.

It is because they are going to get monetary savings by not paying a processing charge.

So if you’ll fill out a verify, ensuring you might be doing it accurately is essential for those who don’t need there to be a problem.

That can assist you with this, listed below are six easy steps to write down out a verify accurately.

Find out how to Fill Out a Test

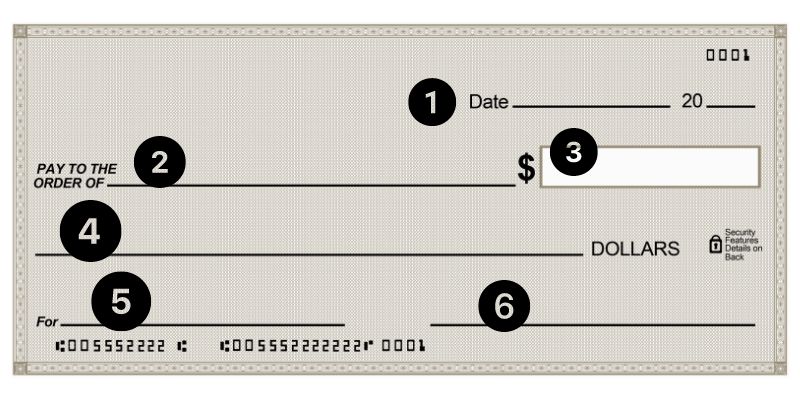

First, discover that the verify has numbered fields. All through this tutorial, we are going to talk about every numbered discipline and its goal in an effort to use the correct verify format.

1. Date the verify within the high proper nook

Any format of date is appropriate. For instance, June 1, 2024, or 6/1/2024, or another format. Nevertheless, consistency is essential because it lets you extra simply acknowledge a verify which will have been stolen out of your account.

For example, for those who at all times date your checks on this format: June 2, 2024, a solid verify will simply be recognized if the verify date is written in a distinct format.

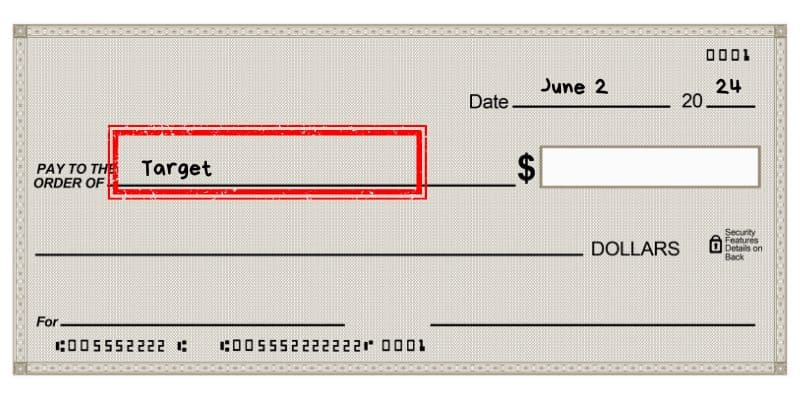

2. Write the title of who you might be paying

Within the “pay to the order of” discipline, write all the way down to whom the verify is made payable to. Within the case of this tutorial, that might be Goal.

You will need to write neatly when filling out your verify and to incorporate the primary and final title or all the enterprise title of the payee (the individual or enterprise to whom the verify is being written).

3. Write the quantity that you simply want to pay in numbers

Once more, it’s essential to be neat and exact right here. Make a transparent distinction between {dollars} and cents with a decimal level or by underlining the cents quantity to be able to keep away from confusion concerning the designated quantity.

This confirms the quantity in written type in order that there isn’t any confusion on how a lot must be paid. So on this instance, it might be $20.21.

4. Write the greenback quantity utilizing phrases

Neatness counts right here as nicely as a result of banks will, now and again, double verify the written quantity ought to they be unable to learn the numbers within the quantity field.

Write out the greenback quantity of the verify clearly, as proven within the field beneath. For this verify instance, it might be Twenty and 21/100. You don’t want to place {dollars} after the phrase twenty as a result of it’s already listed on the road.

5. Fill within the For / Memo discipline on the underside left

Individuals don’t usually use the For line when writing a verify, however it may be essential in relation to a possible cost dispute. Observe: Some banks will use the phrase “Memo” or “For” on this discipline.

Every time paying a invoice, we propose writing the account quantity within the For line. Or, if the verify is for paying lease, write “June 2024 lease” within the For line.

Utilizing the For line when writing a verify helps safe your checking account and shield you towards doable cost disputes.

It additionally can be utilized to assist observe your spending so you possibly can know the way a lot cash you’re spending in every funds space. On this instance, it might be Garments.

6. Signal the verify within the backside proper

That is presumably probably the most very important a part of the check-writing course of. Corporations gained’t settle for checks and not using a legitimate signature. Since every individual’s signature is exclusive, the signature in your verify has the potential of defending you from potential check-writing forgers.

When writing a verify, be sure you make your signature neat and write it as you often would on another formal doc. See Your signature goes right here field within the instance beneath.

Your verify ought to look just like this when it’s accomplished:

There are three extra items of data that you ought to be conscious of in relation to the format of a verify.

Routing quantity

That is particular to your banking establishment and is discovered on the underside left of the verify. It is usually used if you give your employer data to obtain direct deposit in addition to establishing computerized funds.

Account quantity

That is self-explanatory; nevertheless, simply know that yow will discover this quantity on to the precise of your routing quantity.

Test quantity

Your checkbook is about up in a numerical sequence, so for those who write quite a lot of checks over time, it makes it simpler to return and ensure funds and ‘verify’ disputes.

FAQ

Solely write checks with a pen, ideally blue or black ink. Though you possibly can write checks in pencil, anyone with an eraser can erase all the data to vary the greenback quantity and the recipient’s title.

Individuals will usually post-date a verify after they know there aren’t adequate funds presently within the account to cowl the verify. They’re ready for a deposit to come back in in order that the verify won’t bounce.

They might additionally post-date the verify as a result of that’s when the invoice is due. You want to watch out as a result of when writing a verify as a result of it’s authorized tender.

Simply because there’s a future date on the verify, doesn’t imply {that a} financial institution gained’t money it on an earlier date.

Two fields make completely clear what the quantity of the verify is meant to be. Writing the quantity twice additionally helps eradicate fraud in addition to the inaccurate quantity being debited from one’s account.

Now that you understand the fundamentals of writing a verify, you’re ready for when there aren’t different cost choices corresponding to money or computerized cost.

Sure, you possibly can write a verify to your self to money it out. Within the “Pay to the order of” discipline, you possibly can write a verify to your self by writing your individual title or by writing the phrase “Money.”

Additionally, you will must signal the again of the verify such as you’re going to deposit the verify into your checking account.

In the event you incorrectly write a verify, the depositing financial institution won’t settle for the verify. Many companies cost returned verify charges–between $20 and $40–plus any relevant late charges as a result of they’re not receiving appropriate cost by the due date.

Often, you will want to void a verify for those who incorrectly write it or to arrange direct deposit along with your employer, charity, or computerized month-to-month invoice funds

Identical to you write a verify in pen, use a pen to write down “VOID” on the entrance of the verify. Every individual does it barely otherwise, as you would possibly want to write down the phrase as soon as in large letters or write the phrase in every of the 5 fields.

In the event you’re writing a voided verify to schedule computerized month-to-month funds or deposits, you often don’t should fill in any of the 5 fields. Nevertheless, you would possibly determine to write down a quick notice within the memo on your private report.

No. A private verify is one that you simply write by hand with a pen. Licensed checks–that are typically referred to as official checks or cashier’s checks–are printed by your financial institution to confirm the verify has adequate funds.

Aspect notice: you additionally might have the ability to money a verify on-line as nicely by depositing by means of the app of your financial institution.

Abstract

Writing a verify would possibly really feel like a “misplaced artwork,” but it surely’s nonetheless an important ability to know. We don’t pay for every little thing with plastic or a digital pockets but, and plenty of companies want a verify to money for giant purchases as a result of it’s safer.

Now that you know the way to write down a verify accurately, you don’t have to fret about having to rewrite your verify or getting charged these pesky returned verify charges.

[ad_2]