[ad_1]

On this article, I current the “RC ATR Primarily based Trendlines,” a free indicator for MQL5 designed to establish key trendlines primarily based on the Common True Vary (ATR) volatility. This indicator serves as a basis for an built-in buying and selling system, which is enhanced by means of the mixed use of the “RC ATR Volatility Hedge Zones.” Collectively, these instruments provide a strong framework for knowledgeable decision-making available in the market.

Buying and selling System Overview: Sign Convergence for Precision

The buying and selling technique outlined right here leverages the mixed insights of each indicators to verify commerce entries. The premise is easy however exact: each indicators should align for a commerce to be initiated. Beneath are the foundations governing the system:

-

Step 1: Trendline Detection

The RC ATR Primarily based Trendlines identifies key bullish or bearish trendlines primarily based on ATR calculations. The trendlines generated by this indicator function the first sign of a possible worth motion. These trendlines replicate the broader market construction and spotlight rising tendencies with elevated accuracy attributable to their volatility-based basis. -

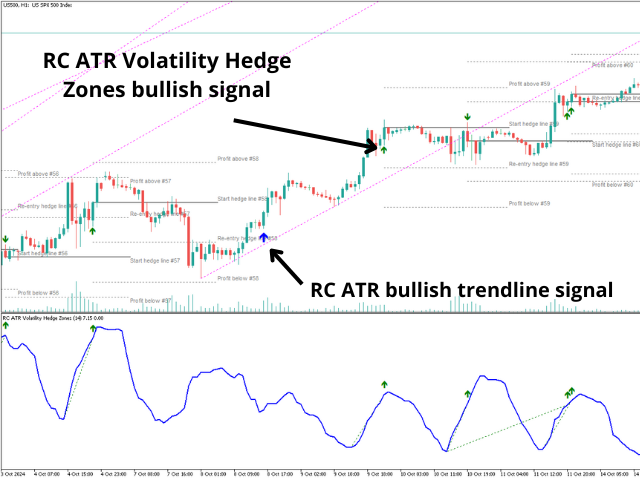

Step 2: Affirmation by way of Volatility Hedge Zones

After the trendline is fashioned, the dealer should await a corresponding sign from the RC ATR Volatility Hedge Zones indicator. The sign should align with the trendline:- For a bullish trendline, anticipate a bullish sign from the Volatility Hedge Zones. Crucially, this sign ought to happen above the recognized trendline, indicating convergence between pattern route and volatility dynamics.

- For a bearish trendline, anticipate a bearish sign, which ought to happen under the bearish trendline. This ensures that each the route of the pattern and the volatility atmosphere help a brief place.

-

Step 3: Commerce Execution

A place ought to solely be opened after each the trendline sign from the RC ATR Primarily based Trendlines and the corresponding affirmation from the RC ATR Volatility Hedge Zones have been acquired. This double affirmation acts as a filter, minimizing false indicators and growing the chance of commerce success.

Instance: Bullish Setup

Contemplate a situation the place the RC ATR Primarily based Trendlines identifies and creates a bullish trendline. On this case, the dealer would monitor the RC ATR Volatility Hedge Zones for a bullish sign. The commerce entry is barely legitimate if the bullish sign from the Volatility Hedge Zones happens above the bullish trendline. This ensures that volatility is transferring within the route of the trendline, growing the reliability of the setup. If each circumstances are met, an extended place could also be opened.

For a bearish setup, the method is mirrored: the RC ATR Volatility Hedge Zones ought to generate a bearish sign under the bearish trendline to validate a brief place.

Technical Rationale Behind the Technique

The power of this technique lies in its reliance on sign convergence. The RC ATR Primarily based Trendlines identifies tendencies rooted in volatility, whereas the RC ATR Volatility Hedge Zones assesses the volatility context through which worth motion happens. By ready for indicators to align—each in route and place relative to the trendline—the system filters out noise and enhances sign reliability.

This convergence technique ensures that merchants usually are not solely buying and selling within the route of the pattern however are additionally taking positions when volatility confirms the value motion, decreasing the chance of untimely entries and false breakouts.

Conclusion

The mix of the RC ATR Primarily based Trendlines and RC ATR Volatility Hedge Zones gives a structured strategy to buying and selling, rooted in volatility evaluation. This method is especially appropriate for merchants in search of a methodical, rules-based technique that minimizes ambiguity in commerce indicators.

Each indicators can be found totally free and could be simply built-in into any dealer’s workflow. By following the outlined technique, merchants can acquire an edge in figuring out high-probability commerce setups by means of the convergence of pattern and volatility indicators.

Discover the symptoms and check the technique in your buying and selling platform to guage its effectiveness in stay market circumstances.

//—

RC ATR Primarily based Trendlines (MT4 model)

RC ATR Primarily based Trendlines (MT5 model)

[ad_2]