[ad_1]

Motley Idiot Inventory Advisor and TheStreet’s Motion Alerts PLUS are two common stock-picking companies. They can assist you discover particular person shares that can outperform the broad inventory market.

Nevertheless, every service caters to a special funding technique, has various advice frequencies and gives completely different platform options.

This Motley Idiot Inventory Advisor vs. TheStreet’s Motion Alerts PLUS comparability will show you how to select the higher funding service in your targets.

What’s the Motley Idiot Inventory Advisor?

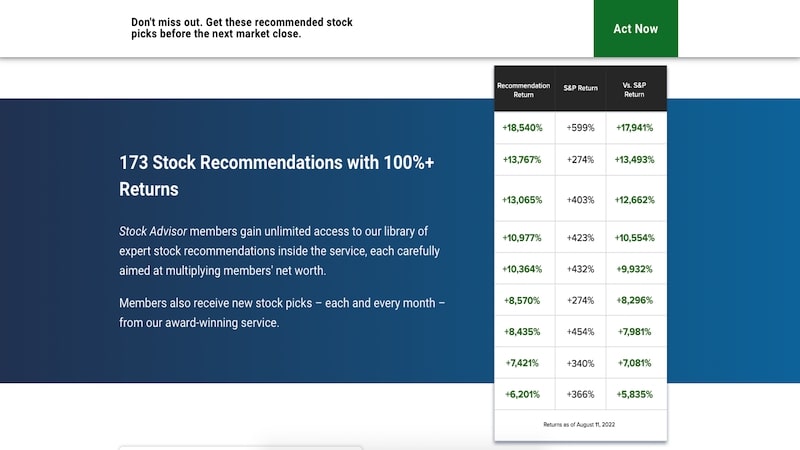

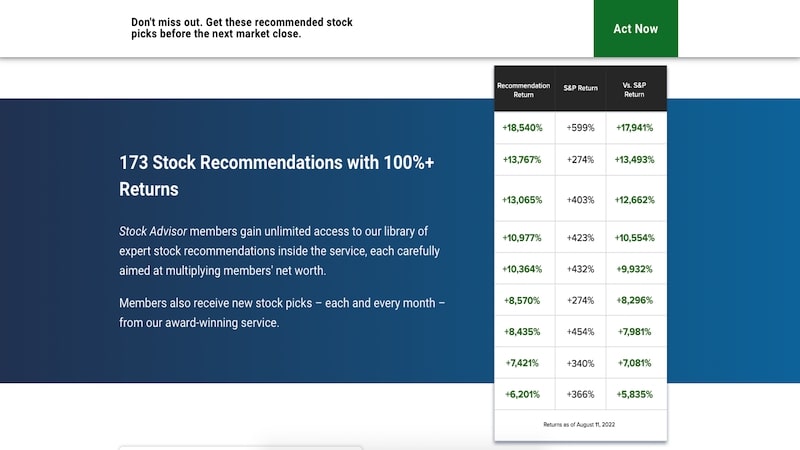

Motley Idiot Inventory Advisor is an entry-level investing publication that publishes two new inventory suggestions every month together with fixed portfolio updates.

You’ll obtain strategies from quite a lot of industries, together with info expertise, e-commerce and large-cap biotechnology.

Nevertheless, you gained’t see a mannequin portfolio that tells you ways a lot the corporate’s administration workforce is investing in every advice. As a substitute, you resolve a proportion of your portfolio to put money into every thought, when you resolve to purchase that specific inventory.

The anticipated holding interval for every advice is three to 5 years. This holding interval is longer than most competing publications, together with Motion Alerts PLUS (AAP).

I like that The Motley Idiot doesn’t require fixed buying and selling like AAP. As a mum or dad and full-time employee, I don’t all the time have time to learn a number of commerce alerts every week and in addition wish to reduce my promoting frequency to keep away from tax-reportable funding transactions that complicate tax prep.

Distinctive Options

Listed below are a number of the greatest member advantages of a Inventory Advisor subscription.

Present and Earlier Suggestions

You could have entry to all lively and closed inventory suggestions because the service’s inception.

Every inventory choose contains the funding efficiency together with a write-up to elucidate why the Inventory Advisor workforce selected that inventory at that specific time. I additionally like reviewing the reader-submitted questions and analyst video that accompany the inventory choose launch.

When you would possibly give attention to the most recent suggestions since they will have the very best potential for upside development, the service additionally publishes a month-to-month “High-Ranked Shares” checklist.

The advantage of this checklist is that it highlights the highest alternatives amongst all open suggestions with the very best potential to beat the inventory market.

No Inventory Advisor advice features a “purchase as much as” buying and selling worth or a stop-loss suggestion. It’s because the service discourages timing the market and reacting to short-term worth actions.

As a substitute, they give attention to buying high-quality firms with share costs that may enhance at a better fee than the general market.

You’ll be able to regularly scale your portfolio as your funds and investing targets allow. I feel this strategy helps diversify your brokerage account responsibly and the asset allocation device signifies which shares have a cautious, average, or aggressive technique.

Inventory Advisor recommends holding a minimum of 25 shares for a diversified portfolio and a most asset allocation of three% of your complete portfolio stability.

Starter Inventory Strategies

Along with the 2 month-to-month inventory picks, the service gives a listing of 10 Starter Shares—also referred to as Foundational Shares—which you could purchase at any time to doubtlessly enhance your portfolio efficiency.

The service updates this checklist quarterly and means that new subscribers put money into a minimum of two or three of those firms together with the month-to-month suggestions. Simply make it possible for your investments suit your technique.

The Starter Shares characteristic firms from quite a lot of industries which can be often a frontrunner of their area of interest. I’ve discovered a number of good investing concepts from this membership perk and it pairs effectively with the twice-monthly suggestions.

Since Inventory Advisor might have initially really useful a few of these shares a number of years in the past, they could not have as a lot development potential as a brand new month-to-month choose.

Nevertheless, Motley Idiot nonetheless believes they could be a successful thought, and their funding efficiency is likely to be much less risky than new suggestions.

Learn our Motley Idiot assessment to be taught extra about Inventory Advisor.

What’s Motion Alerts PLUS?

Motion Alerts PLUS (AAP) is the flagship funding publication run by TheStreet.

Anticipate a number of purchase and promote suggestions every month for firms from all 9 industries within the S&P 500 however with chubby publicity to industries with the very best development potential.

This service was based by legendary CNBC analyst Jim Cramer. Nevertheless, he stopped managing the portfolio a number of years in the past to give attention to different endeavors.

Buyers Bob Lang and Chris Versace oversee the mannequin portfolio now. They mix technical evaluation and basic analysis to suggest shares in addition to rebalance the portfolio.

This service has a extra lively funding technique and a shorter holding interval than Inventory Advisor. It may be the higher choice when you’re snug making a number of trades per 30 days.

I’ve subscribed to this service for a number of years and obtain a number of commerce notifications every week. That’s too frequent for some traders, however I feel it’s a very good stability between long-term and swing buying and selling to make the most of mid-term funding alternatives.

Whereas this service makes use of extra technical evaluation than Inventory Advisor, the AAP workforce tries to suggest shares which you could maintain for a minimum of the following six to 12 months. In my expertise, that’s often the case though not each thought matches or outperforms the S&P 500 market returns.

Consequently, it’s higher for long-term traders than short-term merchants who rely solely on chart evaluation.

Distinctive Options

Motion Alerts PLUS has a few distinctive options price mentioning.

Convention Calls

You’ll be able to name or stream a stay month-to-month convention name. The first focus of the decision is an in-depth assessment of every portfolio holding.

The analysts additionally touch upon a number of the developments they’re anticipating the following month and should reply some investor questions.

It’s attainable to observe these movies on-demand when you can’t attend the stay broadcast.

Along with the month-to-month one-on-one calls, you’ll obtain weekly portfolio updates and as-needed buying and selling alerts. I like this hands-on useful resource as a result of most funding newsletters don’t can help you talk immediately with the analysts.

Mannequin Portfolio

There are roughly 30 lively suggestions that you simply is likely to be prepared to purchase or put in your watchlist. You’ll be able to view the checklist of latest trades and the funding efficiency for every advice.

That will help you select the very best funding concepts, every holding has a purchase ranking.

The rankings embrace:

- Purchase Now: Shares we might purchase proper now

- Stockpile: Shares that we’d purchase on a pullback

- Holding Sample: Think about promoting this inventory on power

- Promote: Promote this inventory as quickly as attainable

Along with the open suggestions inventory screener, you possibly can see the closed positions, together with the promote date. The portfolio managers might solely promote a partial place to rebalance the portfolio.

A 3rd portfolio part to take a look at is the Bullpen checklist of shares the workforce is watching. A few of these firms might ultimately obtain a purchase advice if the funding situations enhance.

For transparency, the AAP portfolio has underperformed its S&P 500 index benchmark (together with dividends paid) for many years since its 2002 inception. This pales compared to Inventory Advisor that has outperformed in most years.

Similarities

Inventory Advisor and AAP share some similarities that make them extraordinarily helpful for traders.

Inventory Suggestions

You’ll obtain a number of purchase suggestions every month from each companies. They search for growth-focused firms which will additionally pay a dividend.

The corporate is likely to be within the S&P 500 index. Nevertheless, the suggestions are additionally prone to be different large-cap and mid-cap shares with extra long-term development potential.

In time, these firms might ultimately make it into the S&P 500, and you’ll take pleasure in their development alongside the way in which earlier than the S&P 500 index funds purchase a place. I like that each companies give attention to well-known firms and trade leaders that may be tomorrow’s leaders.

Since these are each entry-level newsletters, you gained’t be investing in obscure small-cap shares which can be very risky and inherently riskier.

Each platforms suggest shares with excessive liquidity and comparatively secure share costs. You should buy these firms commission-free by most free investing apps.

These platforms allow you to work together with different subscribers utilizing on-line boards. You’ll be able to focus on latest buying and selling alerts and different investing matters.

The discussions can assist you acquire a greater understanding of why you would possibly put money into a selected firm or how it may be a very good match in your investing technique.

This dialogue alternative can present further worth if you would like hands-on steering to doubtlessly enhance your analysis and shopping for course of.

Academic Assets

You too can discover fundamental academic instruments which may assist enhance your investing expertise. These assets can provide you a greater understanding of the publication’s funding philosophy.

Even when you’re an skilled investor, reviewing a few of these assets can assist you arrange your funding portfolio and interpret the funding suggestions.

New traders may discover an funding glossary that defines fundamental funding phrases.

You’ll be able to even learn inventory market commentary on both web site. A few of these articles focus on a selected lively advice, whereas others give attention to the broad market or an trade sector.

Buyer Assist

It’s straightforward to e mail buyer assist when you have got questions on your subscription and need assistance navigating the web platform.

Motion Alerts PLUS additionally affords phone-based assist, though I’ve often communciated by e mail.

Variations

Listed below are a number of of the ways in which Inventory Advisor and AAP are completely different.

Worth

The worth distinction is notable for both service, as are the subscription choices.

Motley Idiot Pricing

Inventory Advisor is cheaper than Motion Alerts PLUS. Your annual subscription is barely $99 for the primary yr and $199 for every renewal.

Whereas Motley Idiot payments your fee card instantly, you get a 30-day risk-free trial interval to request a refund when you don’t just like the service.

There isn’t a month-to-month subscription choice for Inventory Advisor.

Motion Alerts PLUS Pricing

The membership payment for AAP is now bundled into TheStreet Professional subscription:

- Month-to-month billing: $5 for the primary month after which $99 per 30 days

- Annual billing: $5 for the primary month after which $984 per yr ($82/month)

There isn’t a trial interval however you possibly can cancel anytime and obtain a prorated refund.

A Professional subscription contains the next memberships:

- Motion Alerts PLUS portfolio

- Every day diary

- Choices indicators

- Sentiment indicators

- Buying and selling exercise monitor

This subscription is dear however contains entry to over 200 month-to-month buying and selling concepts and 125 day by day analysis articles from over funding professionals and former hedge fund managers.

Inventory Strategies

Whereas there could also be some overlap between the inventory suggestions, each platforms have a special holding interval.

Earlier than investing in any suggestion, understand that not each inventory advice from any service will earn a living.

Inventory Advisor Inventory Strategies

Inventory Advisor recommends shopping for shares with promising long-term fundamentals. The minimal holding interval is three to 5 years below regular circumstances.

You’ll solely see promote suggestions when the Motley Idiot workforce believes it’s time to shut your complete place. As compared, AAP is extra prone to suggest decreasing your publicity to maximise short-term weak point or power.

Periodically, Motley Idiot advises promoting a inventory for a revenue if the corporate receives a buyout provide, it is going to be tough to proceed outperforming the market or it’s merely a dropping inventory thought.

Along with hardly ever receiving promote suggestions, Inventory Advisor gained’t suggest ETFs.

Motion Alerts PLUS Inventory Strategies

AAP tasks a holding interval of six to 12 months for shares and ETFs. Nevertheless, it’s not unusual for the core positions to have a multi-year funding horizon.

The advisory workforce makes use of a combination of basic and technical evaluation to suggest a purchase, maintain or promote ranking.

Many of the suggestions are for particular person shares. Periodically, the workforce provides a sector ETF for extra diversified publicity to an investing thought.

It’s additionally important to notice that many promote suggestions are solely a suggestion to cut back your present place measurement.

For instance, you would possibly promote a few of your shares after a latest runup to take some earnings and make investments the proceeds in a special inventory that’s extra prone to have sturdy features.

This article requires extra portfolio upkeep. For those who’re investing in a taxable brokerage account as an alternative of a tax-advantaged IRA, your inventory gross sales could be topic to taxation.

Entry

AAP traders can work together with the portfolio managers within the on-line discussion board and month-to-month convention calls.

It’s tough to immediately talk with the Motley Idiot analysts because the boards are principally conversations between particular person traders.

Nevertheless, you might have the prospect to ask questions through the stay video classes the place Inventory Advisor pronounces the brand new month-to-month suggestions.

You’ll be able to entry each companies out of your laptop or internet cell browser.

Who Is Every Service Finest For?

Inventory Advisor is greatest for long-term traders who wish to make a minimal variety of trades every month. In most months, you could solely act on the 2 new inventory suggestions.

Nevertheless, the multi-year holding interval can require a better danger tolerance. It’s because Motley Idiot is extra prone to ignore short-term worth swings which will encourage you to rebalance.

Think about Motion Alerts PLUS if you’re keen to purchase and promote shares on a month-to-month foundation. Relying on the macroeconomic situations, some months can be busier than others.

Moreover, you could recognize the weekly and month-to-month portfolio critiques that may present extra in-depth evaluation than Inventory Advisor.

Alternate options

Relying in your funding technique and analysis wants, you could choose these funding companies as an alternative.

Morningstar Investor

Morningstar Investor gives analyst critiques for shares, ETFs and mutual funds. Nevertheless, this service doesn’t present centered month-to-month suggestions for a mannequin portfolio like Inventory Advisor or AAP.

As a substitute, you’ll find funding concepts through the use of the inventory screener, studying market commentary articles and referring to inventory and fund funding lists that includes investments with five-star rankings for sure classes.

This service additionally features a portfolio x-ray device that may fee your present holdings.

Learn our Morningstar assessment to be taught extra.

In search of Alpha

In search of Alpha gives an abundance of market analysis articles for shares and funds. You’ll be able to learn the bullish and bearish viewpoints for a lot of funding concepts. A Premium subscription contains Quant Scores and a personalizable inventory screener for a number of funding methods.

Whereas this service doesn’t provide mannequin portfolios, you possibly can observe analysts which will share their portfolios. A paid subscription additionally enables you to monitor their historic funding efficiency.

Learn our In search of Alpha assessment to be taught extra

Zacks

Zacks gives evaluation for shares and funds with its well-known Zacks Rank. This rating estimates how doubtless a inventory will outperform the marketplace for the following 30 days. Lengthy-term traders may benefit from the Focus Record that ranks shares the service believes will outperform the marketplace for the following 12 months.

This inventory screener may even make it simpler to seek out funding concepts with choose basic and technical metrics. Along with the inventory and fund rankings, you possibly can learn market commentary articles and analyst stories for a selected firm.

Learn our Zacks Premium assessment to seek out out extra.

Abstract

Motley Idiot Inventory Advisor and TheStreet’s Motion Alerts PLUS present a number of inventory suggestions every month to assist information your investments.

Whereas both service could make it simpler to seek out successful funding concepts, you have to examine your investing targets to the common holding interval and the required portfolio upkeep.

The higher choice general could be Inventory Advisor as you’ll be promoting shares much less continuously, and its annual subscription is extra inexpensive. Nonetheless, each provide inexpensive first-month trial durations to seek out the proper match in your investing fashion.

[ad_2]