[ad_1]

Staying on prime of your payments is important if you wish to enhance your funds. Rocket Cash can monitor your due dates and monitor the way you spend your cash so you’ll be able to keep away from surprising bills.

The app may make it easier to cancel undesirable subscriptions, make a price range, and supply customized solutions to enhance your spending habits. These free and premium options are helpful should you’re on a decent price range.

Our Rocket Cash evaluation reveals how the varied app options will help decrease your month-to-month payments and which membership tier is right in your wants.

What’s Rocket Cash?

Rocket Cash is a private finance app that was initially launched in 2015 as Truebill. The app rebranded underneath its present title in 2022 after being acquired by Rocket Corporations.

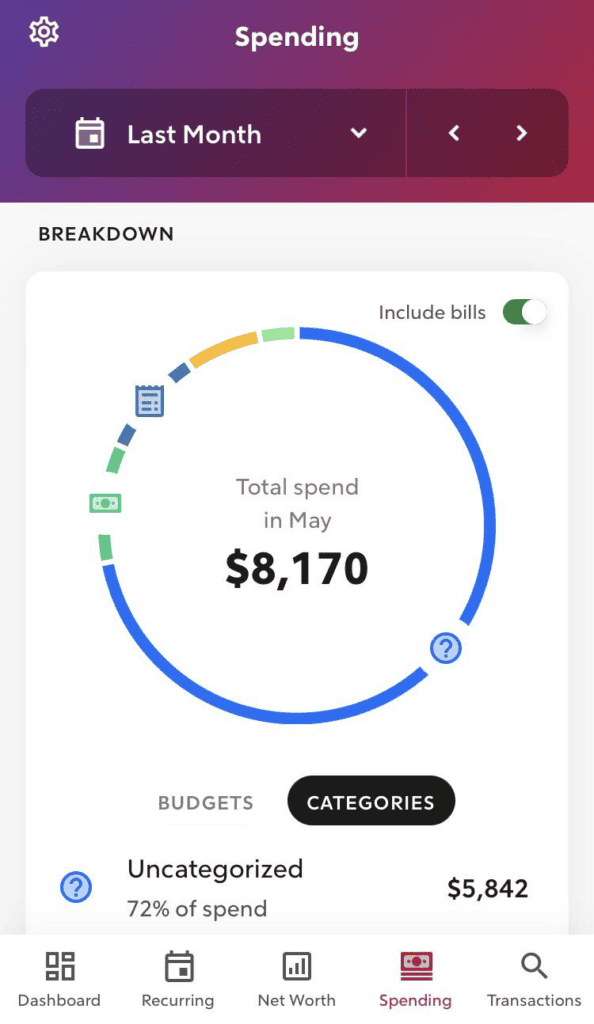

It connects to your financial institution accounts and bank cards to obtain current bills, retrieve your present account balances, and forecast your month-to-month spending. You possibly can see the main points in easy-to-read charts which you could categorize for elevated accuracy.

This cash app additionally gives customized solutions that will help you get monetary savings, reminiscent of decreasing recurring bills.

How Does the Rocket Cash App Work?

Rocket Cash is mobile-only and accessible from Android or iOS smartphones and tablets. You possibly can join from an internet browser however should obtain the app to hyperlink your accounts and make the most of the finance instruments.

There are free and paid pricing plans that supply numerous cash administration instruments specializing in decreasing bills and planning for future purchases.

Core options out there to all members embody:

- Account stability syncing

- Invoice negotiation

- Budgeting

- Canceling undesirable subscriptions

- Credit score rating monitoring

- Downloading transactions

- Charge refunds

- Cost reminders

You possibly can simply maintain tabs in your spending, create a price range, and obtain customized insights with this free budgeting app.

A premium subscription makes assessing your full monetary image simpler since there are extra automated options to scale back present bills and plan long-term monetary targets. Moreover, a paid membership is required for joint accounts.

A number of the platform’s premium instruments embody:

- Automated financial savings

- Cancellation concierge

- Creating limitless budgets

- Credit score report updates

- Exporting information

- Internet price monitoring

- Premium chat customer support

- Actual-time account stability updates

- Shared accounts

If you happen to desire limitless app entry or the comfort of automated options, the paid subscription is healthier.

How A lot Does Rocket Cash Value?

The free model by no means incurs charges, however you’ll have restricted capabilities. For instance, you’ll be able to solely make a primary price range and may’t request on-demand account updates.

For any paid membership, you select how a lot you need to pay primarily based on what you assume is honest.

The app affords a seven-day free trial to resolve should you’ll profit from the in-depth options, together with the flexibility to create limitless budgets, web price monitoring, and extra hands-on buyer assist.

Upgrading to Rocket Cash Premium prices between $3 and $12 month-to-month. An annual subscription prices $36 or $48 and is billed upfront.

Though it’s an non-obligatory service, a one-time payment applies when the invoice negotiation function efficiently lowers a recurring subscription like your cable or cellphone invoice.

Options

Listed here are the varied instruments that may make it easier to take higher management of your monetary life.

Account Syncing

You can begin by linking your financial institution, bank card, and funding accounts to the app. The service makes use of Plaid to attach securely. It’s doable to exclude particular accounts that you just don’t use to pay payments or don’t need the app to observe for privateness.

After connecting to your monetary establishment, the free plan updates your account balances and transactions every day. As compared, premium members have on-demand entry and may see their real-time stability all through the day.

With the ability to hyperlink your accounts at no cost is one in every of this app’s most respected options since you’ll be able to monitor each buy and know precisely the way you spend your cash.

Invoice Negotiation

The negotiation service is initially free for all customers and is a simple method to see should you qualify for reductions on costly recurring subscriptions. Then, after analyzing your spending habits, the app will immediate you when it believes it may well scale back an expense.

Contract-based cellphone plans, cable TV, and residential web have essentially the most financial savings potential as a result of current clients normally pay greater charges than new clients.

After linking your service account or importing a current month-to-month invoice, a billing skilled will see if reductions or newer plans can supply comparable companies at a decrease month-to-month value. If that’s the case, you pay a one-time success payment of 30 to 60 % of the annual financial savings.

This payment is much like different invoice negotiation companies that scale back or cancel recurring bills. Whereas it’s an expense, you spend much less cash and save time by not contacting service suppliers by yourself.

Subscription Monitoring

Free and paid customers may monitor how a lot they spend month-to-month on recurring payments like their telephone, web, or streaming companies. Tapping on a specific supplier helps you to see how a lot you spend per thirty days and is a simple method to search for billing will increase.

This instrument will help determine undesirable subscriptions it’s possible you’ll need to cancel or renegotiate for a decrease payment. For instance, there may be a streaming service you haven’t watched in a number of months and thought was already canceled.

The app gives detailed steps to cancel subscriptions at no further value. You possibly can faucet a button to name the cancellation line or go to the cancellation web page to submit your request.

Premium members can benefit from the subscription cancellation concierge, the place the app mechanically cancels a service at your request. This protects you time and allows you to keep away from a nerve-racking telephone name the place the consultant might strain you to remain.

Requesting Refunds for Charges and Outages

Rocket Cash searches for potential overdraft and late charges in your banking historical past that may be eligible for a refund. Free customers can entry a script to learn when calling an establishment to request a refund.

It’s even doable to request partial refunds throughout service outages, like when your satellite tv for pc or web service is unavailable for a number of days.

With the premium plan, the app will mechanically attempt to request refunds and credit in your behalf.

Budgeting

You possibly can create a primary price range that helps forestall you from overspending. This function is helpful for an off-the-cuff price range that requires minimal upkeep.

The free and paid budgeting instruments received’t present the in-depth insights and planning options that different premium price range software program affords. People who want hands-on assist to create a spending plan or map out monetary targets might discover Rocket Cash insufficient.

Free customers can break down their spending into 4 classes:

- Payments and utilities

- Groceries

- Charges

- Every part else

The finance app will measure your remaining revenue for the month and your projected financial savings. These instruments are ample if you wish to monitor spending, however different free budgeting software program can present extra in-depth options should you desire larger element.

Paid customers can create limitless budgeting classes and categorization guidelines. This customization could make it simpler to know precisely how a lot you’re spending on sure bills once you’re critical about saving more cash.

Automated Financial savings

Premium customers can schedule recurring deposits for financial savings targets right into a Sensible Financial savings account. You possibly can select the deposit quantity and frequency. Moreover, the app shows your financial savings progress and provides you full account management.

The cash transfers from a linked checking account right into a financial savings account at a companion financial institution that’s FDIC insured. An overdraft safety system received’t provoke transfers when it suspects there received’t be sufficient remaining funds to pay your payments.

You may make a number of accounts if you wish to save for a number of targets. As an example, you might need a trip fund and one other for a substitute car.

Observe Your Internet Price

Along with being a budgeting app, the premium plan has a web price tracker that calculates the worth of your liquid property, reminiscent of your financial savings and investments. You possibly can manually add accounts and loans and replace the stability as crucial.

It’s straightforward to allow a number of toggles to exclude sure property out of your web price complete. As an example, it’s regular to not depend the worth of your main residence, car, or checking account because you received’t promote them to take a position or pay for bills.

This function will help monitor your general monetary progress as you scale back discretionary spending, repay debt, and prioritize financial savings targets.

Credit score Rating Monitoring

All customers can view their free credit score rating and chart their rating historical past within the app. It updates month-to-month and is the VantageScore 3.0 that makes use of your Experian credit score report.

Premium subscribers can view their full credit score report, which refreshes month-to-month. Seeing your full report helps you to search for reporting errors and any destructive marks.

How Reliable is Rocket Cash?

Rocket Cash protects your information utilizing bank-level encryption and multifactor authentication (MFA). In addition they use Plaid, which is a trusted third-party service, to sync your account and keep away from storing delicate data on the app’s servers.

These safety measures don’t make the app breach-proof, however the practices are much like different private finance platforms.

One other potential concern for people might be privateness. Your id stays nameless, however it’s possible you’ll obtain adverts and product affords from Rocket Corporations and third-party companions for loans, investments, or different monetary companies.

Professionals and Cons

Listed here are a few of the app’s strengths and weaknesses.

Professionals of Rocket Cash

- Free budgeting and expense-cutting instruments

- Syncs with financial institution accounts and bank cards

- Customizable budgets and categorizations

- Simple to make use of

Cons of Rocket Cash

- Restricted free options

- A number of instruments require a paid membership

- Budgets are too easy for critical planning

- Cell-only

If you happen to need assistance managing your cash and streamlining your bills, Rocket Cash may very well be price a attempt.

Apps Like Rocket Cash

Rocket Cash makes it straightforward to observe your spending and search for methods to chop prices. Nevertheless, sure customers would possibly discover its options missing and should profit from different platforms .

Right here’s a preview of the highest decisions:

These are the perfect options to Rocket Cash.

YNAB

You Want a Finances (YNAB) is a favourite for people who want hands-on assist making an in-depth price range. This app’s main function is that will help you cease residing paycheck to paycheck and assign every greenback you earn a job to maximise your financial savings.

This platform is accessible by pc or cell gadget. After becoming a member of, it walks you thru an intensive setup course of to allocate your month-to-month price range for widespread and fewer widespread bills.

It connects to your monetary accounts, and there are numerous colourful charts to visualise your progress.

The service is free for the primary 34 days and prices $14.99 month-to-month or $99 when paid yearly. Faculty college students take pleasure in 12 months of complimentary entry.

Tiller

Contemplate Tiller Cash should you desire spreadsheet budgets utilizing Google Sheets or Microsoft Excel. First, you hyperlink your banking accounts. Then, the app mechanically imports your transactions right into a common price range template.

Subsequent, you’ll be able to create totally different sheets to trace particular transaction sorts or pursue a number of budgeting methods. You possibly can implement auto-categorization guidelines or community-created templates to make it simpler to trace your revenue and spending.

After the primary 30 days, an annual subscription prices $79.

Empower

Empower (previously Private Capital) is a free finance app. You solely pay charges should you use its wealth administration companies for investing.

Most individuals use this platform to trace their web price, make a primary price range, and obtain a complimentary funding portfolio evaluation.

Empower helps you to create a primary price range with limitless classes and account syncing. Of the three Rocket Cash options, it has essentially the most restricted budgeting capabilities, however it’s ultimate for evaluating your month-to-month spending and revenue.

The free web price tracker is likely one of the finest since you’ll be able to effortlessly monitor liquid and bodily property. There may be additionally an entry-level retirement planner and financial savings targets to map your monetary future.

Learn our Empower evaluation to be taught extra.

Rocket Cash Overview

-

Ease of Use

-

Instruments and Sources

-

Commissions and Charges

-

Buyer Service

-

Availability

Rocket Cash Overview

Rocket Cash is a helpful private finance app that helps you handle your price range and determine companies to cancel and payments to barter to extend your financial savings.

Professionals

✔️ Free to make use of

✔️ Customizable budgets

✔️ Syncs with monetary accounts

✔️ Intuitive interface

✔️ Budgeting instruments are free

Cons

❌ Not all choices are free

❌ Cell solely

❌ It’s possible you’ll want extra superior budgeting options

Backside Line

You’ll profit essentially the most from utilizing Rocket Cash if you wish to monitor your bills by a particular transaction or search for methods to scale back spending on recurring payments.

The app’s budgeting instruments are ample for making a starter spending plan that’s straightforward to observe and ultimate for informal customers who may be intimidated by extra refined and pricier platforms.

There’s a seven-day free trial to check drive the app and resolve if the free or paid model is a greater match in your monetary targets. With no danger to provide it a attempt, it’s price testing.

What do you search for in a cash administration app?

Josh makes use of his private expertise of paying off over $130,000 in private debt and altering careers to write down about saving cash, investing, and paying off debt. He has usually written for notable shops together with Pockets Hacks, Properly Stored Pockets, and Debt Roundup.

Josh was beforehand an operations supervisor for a Fortune 500 firm for seven years. He’s married with three babies.

Associated

[ad_2]

![Rocket Cash App Overview [Is Rocket Money Safe?] Rocket Cash App Overview [Is Rocket Money Safe?]](https://i1.wp.com/www.frugalrules.com/wp-content/uploads/2023/06/FB-Is-Rocket-Money-Worth-it.jpg?w=696&resize=696,0&ssl=1)