[ad_1]

Time: The one most neglected part of buying and selling. But, it’s time that’s arguably an important think about figuring out whether or not a commerce finally ends up a win or a loss. A commerce that you just shut out after two hours for a loss might have ended up an enormous winner in the event you held it for 2 weeks. As people, WE are definitely the weakest hyperlink on the subject of buying and selling, as a result of most of us have little or no endurance, self-discipline and self-control, particularly on the subject of holding our trades.

Time: The one most neglected part of buying and selling. But, it’s time that’s arguably an important think about figuring out whether or not a commerce finally ends up a win or a loss. A commerce that you just shut out after two hours for a loss might have ended up an enormous winner in the event you held it for 2 weeks. As people, WE are definitely the weakest hyperlink on the subject of buying and selling, as a result of most of us have little or no endurance, self-discipline and self-control, particularly on the subject of holding our trades.

Almost the entire greatest trades I’ve personally taken or that I’ve seen our members take, took loads longer to play out than any of us initially anticipated or maybe needed. Nevertheless, the very fact of the matter is that what we would like and anticipate to occur is often not what the market has in retailer.

The bedrock of buying and selling success consists of holding trades for longer than you need usually; letting them play out with out your interference and simply accepting that the market and value take TIME to do their factor. Take a look at a chart in hindsight and you will note this for your self. Go forward and truly look, depend the times, weeks or months that a number of the most blatant commerce indicators took to play out.

All the logic of holding trades longer than you assume you need to stems from my perception that merchants ought to use the each day chart time frames and wider cease losses to keep away from being stopped out prematurely from short-term market noise. As we speak’s lesson will present you why it’s worthwhile to begin holding your trades longer if you wish to receive long-term buying and selling success…

Massively Enhance Your Buying and selling Outcomes This Yr

The New Yr is upon us and as one in all your New Yr’s buying and selling resolutions, I’m certain you wish to enhance your buying and selling outcomes. When you is likely to be pondering that’s simpler stated than carried out, right here is the one most essential factor you are able to do to enhance your buying and selling this yr: Maintain your trades for longer and meddle / take a look at them much less.

On this lesson, we’re going to take a look at a number of each day chart commerce setups to indicate how eager about time and never simply value, can vastly enhance your buying and selling outcomes. You should begin viewing time simply as essential as you view the worth of the commerce you’re in. For instance, simply because your commerce is presently destructive (however hasn’t hit your cease loss) doesn’t imply it’ll find yourself as a loss, due to TIME. Time is your good friend out there, but most merchants make it into an enemy.

When buying and selling the each day chart timeframe, I might say the common interval you need to anticipate to carry a commerce is about 1-3 weeks. I’m prepared to guess most of you studying this not often maintain your trades that lengthy. Now, that’s not meant to be offensive, it’s meant to be an eye-opener and a useful piece of knowledge. Let’s check out a number of examples on the charts…

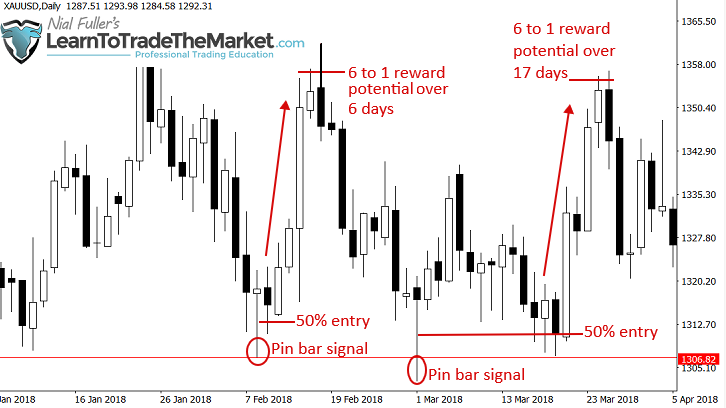

Within the each day Gold chart beneath, we will see a few very good pin bar indicators that shaped at a key assist stage. You’ll discover that the primary pin bar noticed value transfer larger pretty quick, however even that one took about 6 full days to play out in the event you needed to make a considerable revenue. The following pin bar a pair weeks later, took even longer to play out; discover this one took about 17 days to essentially internet you a pleasant revenue. Would you may have been in a position to wait that lengthy for the 50% tweak entry after which for value to maneuver larger? All of it boils all the way down to having a plan and sticking to it.

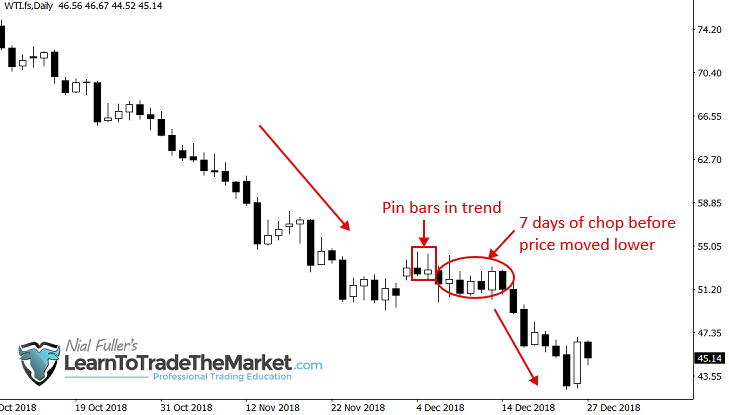

Allow us to check out one other chart now. This time it’s WTI – Crude Oil on the each day chart timeframe after all. This commerce setup shaped inside a really sturdy downtrend. We received two bearish pin bars that, while small in measurement, had the burden of an enormous development behind them, so the indicators have been superb to take. Nevertheless, you’ll discover after coming into brief the market determined to consolidate and transfer sideways for a full 7 days earlier than lastly falling decrease once more and netting you a revenue. It’s unhappy to say however most merchants would have gotten all chopped up and confused in that 7 days, turning would ought to have been an enormous winner seemingly into a number of shedding trades.

Use Wider Cease Losses and Cease Meddling with Your Trades

You may have a software in your facet to help you in giving trades the time that they require to show into large winners. That software is cease loss placement and extra particularly, contemplating using wider cease losses than what chances are you’ll be used to. Giving a commerce even one other 50 pips or so can considerably enhance the possibilities of that commerce flipping from a loser to a winner. The reason being that many trades are taken (or must be taken) at ranges of assist or resistance, maybe after a pullback inside the development, nevertheless, we can’t predict precisely how far a market will retrace. So, giving that commerce some extra “padding” or room close to that pullback space can many occasions keep away from a cease out.

Once you do improve cease loss distance you naturally improve the time you’ll need to carry that commerce as you’re inserting the cease outdoors of the each day and weekly common ranges of value motion (or a minimum of that is the objective). For instance, the EURUSD strikes, on common, 150 – 200 pips per week so in case your goal is 400 or 600 pips broad, it’s important to WAIT and there’s no means round this.

Nevertheless, keep in mind, wider stops will KEEP US IN THE GAME LONGER AND IMPROVE OUR CHANCES OF SUCCESS OVER A SERIES OF TRADES. And that’s the objective, is it not?

Right here’s an instance: The each day Crude Oil chart beneath reveals us two very good back-to-back each day bullish pin bars that shaped. Worth then creeped sideways for a number of days earlier than simply barely violating the low of these pins after which sling-shotting larger. What a merciless truth it’s that the majority merchants who entered lengthy off these pins received stopped out for a loss on the low of the bars proper earlier than value surged larger. The answer? Improve your cease distance and that loss turns into a win. Don’t be grasping by selecting the tighter cease simply so you may improve your place measurement. Bear in mind, bulls and bears become profitable however pigs get SLAUGHTERED by the market. Are you a bull, bear or pig?

Right here’s one other prime instance of how wider stops in addition to having the endurance to present a commerce time to play out can yield a monster revenue…

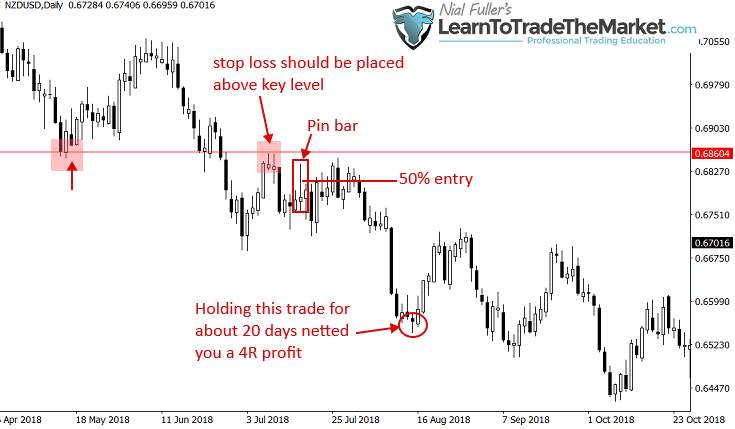

We’re wanting on the each day NZDUSD chart this time and we will see a really clear and apparent bearish pin bar promote sign shaped close to a resistance stage. Now, what’s most essential right here is the important thing resistance stage simply overhead. That you must place your cease loss simply past that stage, NOT the pin bar excessive. It actually is the distinction between a loss and win. Discover in the event you entered the commerce on a 50% tweak entry value creeped a bit of larger after that and simply violated the pin excessive (however stayed beneath the resistance stage) earlier than promoting off. Discover you needed to look ahead to 20 days to make a pleasant revenue, however in the event you simply set and overlook this commerce you’re actually doing NOTHING whereas earning money! Don’t make it more durable than it must be!

Endurance and Self-discipline – Do You Have Them?

In fact, the “glue” that makes all of this “ready” and “doing nothing” attainable is endurance and self-discipline, two issues that many individuals battle with in our age of “I need it now” mentality. It is just when a dealer chooses to stay to his plan and keep the course within the face of temptation, {that a} well-executed commerce can yield monster returns.

In my expertise, even the very best most blatant trades that come off in your course straight away, nonetheless take a couple of week, generally extra, to essentially flip into large wins. Living proof, this setup from the AUDUSD each day chart earlier this yr. The development was general down and value had swung again as much as a key resistance space and shaped a really apparent bearish pin bar promote sign. Worth moved decrease the very subsequent day however many merchants in all probability settled for a small revenue after simply that in the future as an alternative of holding it for six days and ready for value to hit that subsequent assist space, netting a a lot bigger revenue…

Conclusion

What I need you to remove from this lesson is that it’s worthwhile to begin eager about TIME as a essential part to buying and selling success, not simply as an afterthought. Each time you enter a commerce it’s worthwhile to be ready to present it the house and time it must doubtlessly flip right into a winner, or else you can be enduring many pointless losses.

Don’t be in a rush to become profitable as a result of that is merely greed and as you recognize, grasping folks find yourself shedding out there. That you must not get too hooked up to your trades and buying and selling, and the primary means you do that is by controlling your threat and never over-leveraging your buying and selling account, but in addition, by not being in a rush and over-trading.

The merchants who become profitable and find yourself within the notorious “10% of merchants who’re profitable” are those who’re courageous sufficient to carry trades and who’ve the endurance to not get shaken out by each little fluctuation out there. You don’t wish to be reactionary like an animal within the wild, you wish to be expert and affected person, like an clever human being who’s utilizing their frontal lobe to manage their impulses.

If you wish to be taught extra about how I commerce with easy value motion patterns like those in immediately’s lesson in addition to how I handle my feelings and cash out there, take a look at my freshly up to date value motion buying and selling course for extra in-depth training and coaching.

Please Go away A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.

[ad_2]