[ad_1]

Why Making an attempt to Forecast Gold Costs May Spoil Your Buying and selling Account – And What to Do As a substitute

On the earth of buying and selling, there’s nothing fairly as tempting as attempting to foretell the subsequent large market transfer—particularly with gold. Whether or not it is geopolitical tensions, inflation fears, or financial downturns, gold has traditionally been a go-to protected haven. However these days, issues have gotten wild.

The issue? If you happen to’ve been following gold costs just lately, you’ve seen how unstable this market might be. Simply when it looks like costs will drop, they spike, and once you count on a rally, the value plummets. And for day merchants, this type of unpredictability might be catastrophic.

The Gold Worth Entice: Why Forecasting Is a Idiot’s Errand

Take the previous few weeks for instance. Gold costs have moved so erratically that even seasoned merchants are struggling to maintain up. What’s worse, anybody who tried to brief gold throughout a sudden rally probably noticed their positions worn out, shedding cash quick. If you’re buying and selling on leverage—and let’s face it, most merchants are—that volatility can blow up your account in a matter of hours.

Right here’s the factor: nobody can predict the market completely. Not even the so-called consultants who spend hours analyzing developments, information, and financial indicators. Gold is influenced by so many unpredictable variables that attempting to forecast its motion is like attempting to foretell the climate a month from now—certain, you’ll be able to guess, nevertheless it’s a dangerous recreation. And if a sample works properly, it will not work anymore 6 months later.

Leverage: The Double-Edged Sword

For day merchants, leverage is each a blessing and a curse. It permits you to management a big place with a small quantity of capital, nevertheless it additionally amplifies your losses. When gold costs swing violently—and so they do—it’s powerful to carry on. Chances are you’ll begin with a sound technique, however one unpredictable transfer towards your place can wipe out days, weeks, and even months of income in minutes.

It’s not unusual for merchants ready and holding brief positions in gold to seek out themselves margin-called when the market strikes towards them. They’re pressured to promote at a loss, usually watching helplessly as their accounts dwindle to zero. Forecasting gold costs, particularly in as we speak’s chaotic market, is just too dangerous for many merchants to deal with.

Enter AI + Mr. Foreign exchange EA: The Recreation Changer

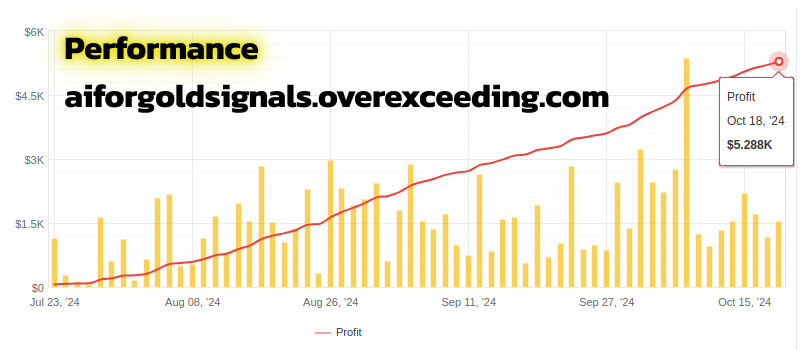

Now, think about for those who didn’t must predict gold costs in any respect. Think about for those who might earn cash buying and selling gold with out worrying in regards to the subsequent large transfer. That is the place AI + Mr. Foreign exchange EA comes into play.

AI + Mr. Foreign exchange EA isn’t about attempting to outguess the market. It’s about leveraging superior algorithms and sturdy commerce administration methods that take the guesswork out of buying and selling. This method doesn’t depend on attempting to foretell the path of gold—or another asset, for that matter. As a substitute, it routinely adapts to the market, making changes in real-time primarily based on what’s truly occurring.

Right here’s the kicker: Even when Mr.Foreign exchange, the grasp dealer who publishes the gold sign, opens a brief place in the midst of a bull run, it will possibly nonetheless handle that commerce in a means that minimizes danger and maximizes profitability. How? By superior hedging methods and dynamic danger administration, which ensures that even when the market strikes towards your place, you’re not left excessive and dry.

Loosen up and Watch Your Account Develop on Autopilot

The fantastic thing about utilizing AI + Mr. Foreign exchange EA is that you simply don’t must spend sleepless nights worrying about each tick available in the market. You don’t want to observe information occasions, attempt to interpret financial information, or agonize over when to enter or exit a place. The system does all of it for you.

Whereas different merchants are glued to their screens, frantically adjusting their positions in response to each headline or value spike, you’ll be able to loosen up, understanding that the AI + Mr. Foreign exchange EA is managing your trades within the background, working in the direction of rising your account with precision and effectivity.

It really works so properly due to these 3 danger administration methods

The EA not simply executes the trades from the Gold Sign channel. It manages them utilizing fastidiously designed and validated algorithms. These algorithms have been constructed to make revenue from random trades – regardless of how silly they is perhaps.

Which one could be your favourite? ❤️🔥

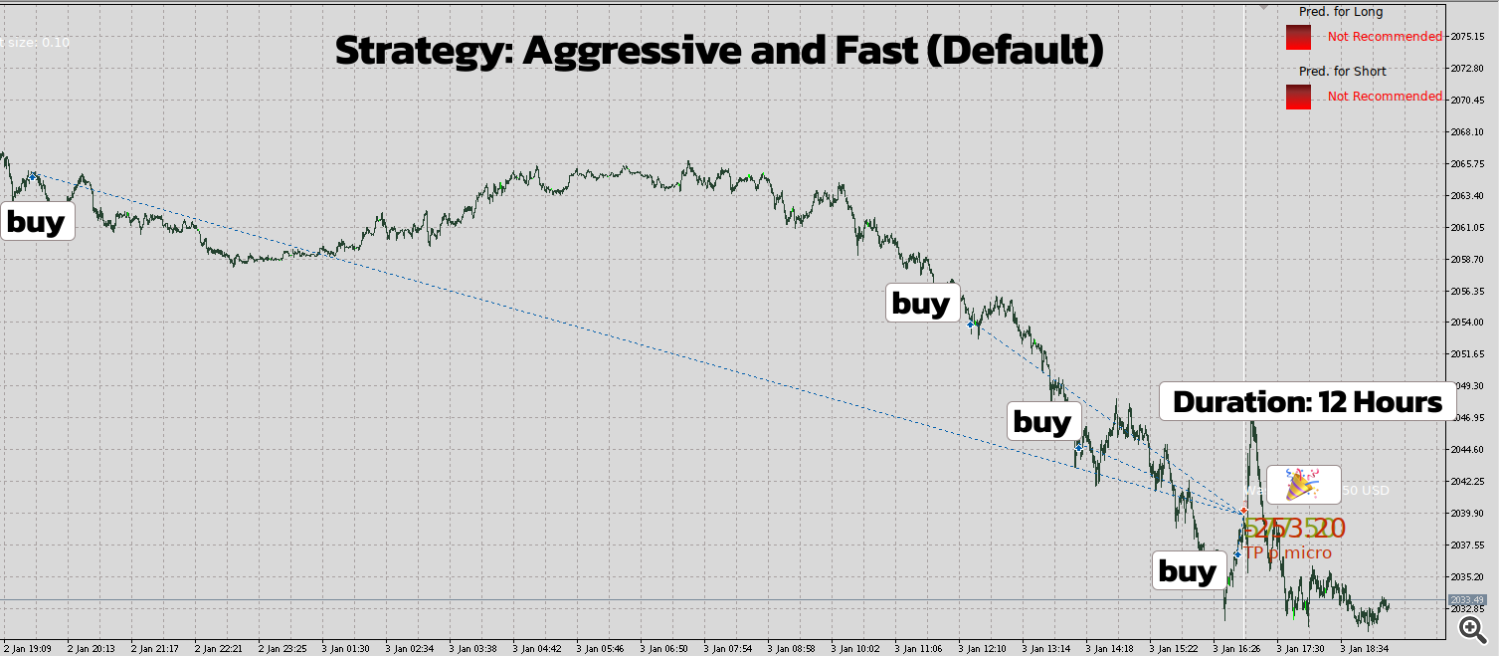

Technique 1: The Predator

This technique makes use of sample primarily based greenback value averaging system. New positions are added relying on the value motion, time and market motion pace. 99% of the trades are closed inside 24 hours.

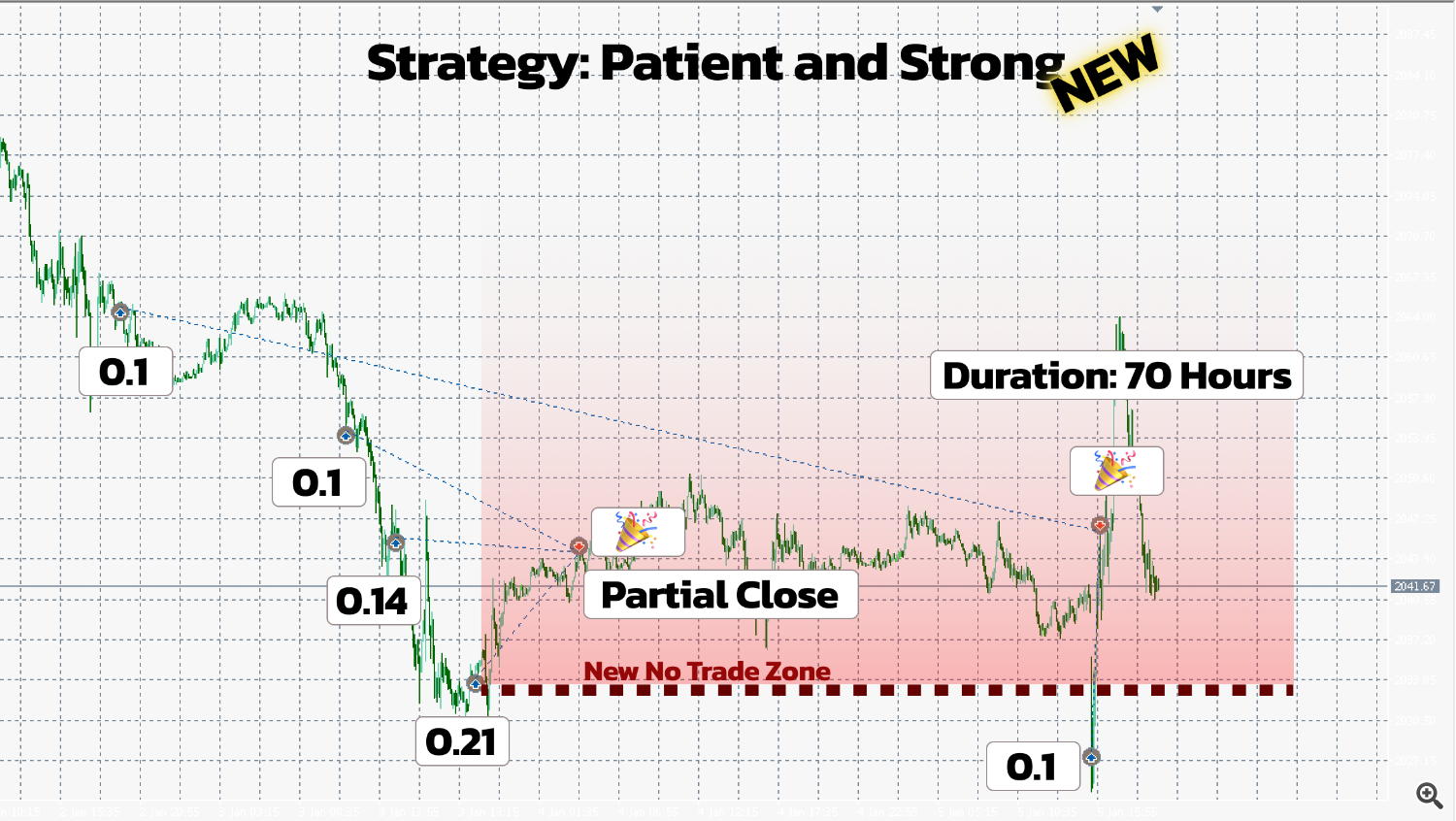

Technique 2: Affected person and Sturdy

As a way to cut back the drawdown, this technique makes use of the very efficient “Danger Cleaner” approach. It closes final largest positions and retains the publicity danger low even when the value strikes towards us.

After that cleansing step, the algorithm waits for the value to maneuver up the place it will possibly shut the remaining place.

If the value strikes under the latest (closed) place, the algorithm prompts the scaling once more however continues with the small lot sizes. After some time it closes all positions. See the picture under for an instance.

Technique 3: Development Hedger

This technique has escaped the key labs of a hedge fund. It’s nice for those who desire to attend very long time and to keep away from any dangers.

If the value retains shifting deeper and deeper, it opens SHORT positions as HEDGES. If the value continues its motion down, the brief positions make extra revenue than the unique lengthy positions and every thing might be closed with revenue.

If the value goes up once more (like within the picture under) lengthy trades are closed and the hedges are managed individually.

Remaining Ideas: Cease Forecasting, Begin Profiting

Making an attempt to foretell the subsequent transfer in gold costs is a idiot’s errand, particularly in as we speak’s unstable market. As a substitute of risking your hard-earned cash on forecasts and guesswork, why not use a system designed to take the stress out of buying and selling?

With AI + Mr. Foreign exchange EA, you don’t have to fret about being on the fallacious facet of a commerce. The system’s superior algorithms guarantee that you may revenue, even when the market doesn’t go your means.

It’s time to cease attempting to foretell the longer term and begin having fun with the advantages of automated buying and selling on autopilot. Let AI + Mr. Foreign exchange EA do the heavy lifting, whilst you sit again and watch your account develop.

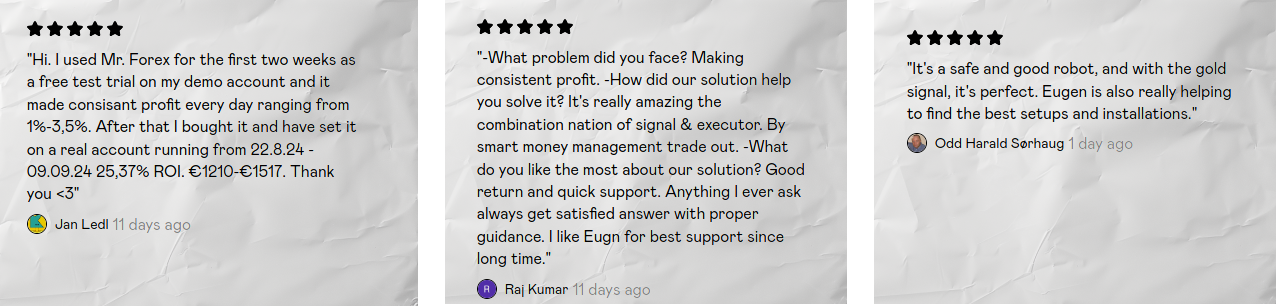

PS: That is what the customers are saying

[ad_2]